SOUTHFIELD, Mich.--(BUSINESS WIRE)--With nearly 2.7 billion smartphones in the hands of global consumers today, and more than 5.5 billion projected by 2018, it’s no surprise that consumers are increasingly more aware of and opportunistic about them integrating seamlessly in their vehicles, according to recent research from IHS Automotive, a global provider of critical information and insight to the automotive industry and part of IHS, Inc. (NYSE: IHS).

A new report, Apps in the Car 2015, includes highlights from a recent consumer study conducted by IHS Automotive. More than 4,000 vehicle owners intent on purchasing a new vehicle within the next 36 months were surveyed, representing four key automotive markets – the U.S., China, Germany and the United Kingdom. While results varied by region, key findings shed light on consumer preferences that manufacturers and apps developers can use to best address market needs as they develop new products for the global marketplace.

The report covers a number of categories, including vehicle purchase intentions, respondent profiles, Apple CarPlay/AndroidAuto/MirrorLink research, smartphone, mobile carrier and data plan information, apps, navigation and music.

“Among new car intenders, nearly 90 percent of those surveyed currently own a smartphone,” said Colin Bird, senior analyst, automotive software, apps and services at IHS Automotive. “Not surprisingly, these devices have wide implications for consumer behavior while driving and influence consumer expectations on how vehicles and apps should integrate with them.”

Mobile Apps offer Continued Growth Opportunities

In 2014, approximately 132 billion mobile apps were downloaded worldwide, with revenue of more than $25 billion, according to IHS research. iOS developers brought in more than $10 billion alone. Approximately 90 percent of the revenue is generated through in-app purchases or subscriptions, while the remaining 10 percent is attributed to consumers who bought apps for personal, social or business use.

The majority of responders (93 percent) indicated they had downloaded apps to their device, and 53 percent reported having paid for apps in the past. Price points for apps varied by region, with most respondents having spent an average of $12 to $22 USD on their most expensive app. These findings represent the ongoing need and demand for continued development and identify significant revenue opportunity for developers and OEMs in the future.

| Country of Response | Highest Price Paid for an App | ||

| US | $22 USD | ||

| Germany | 11€/ $12 USD | ||

| UK | £9/$14 USD | ||

| China | ¥119/$19 USD | ||

Continued Growth Expected for Apple CarPlay and Android Auto

In the coming years, IHS expects significant growth by vehicle manufacturers to integrate apps into their vehicles for various consumer connectivity as well as increased partnerships among OEMs and apps integrators. IHS Automotive forecasts for the three primary systems for 2015 and beyond are as follows:

| IHS Automotive forecast for screen projection mode features - annual sales units | ||||

| Brand | 2015 Forecast* | 2020 Forecast* | ||

| Android Auto | 643K | 31 million | ||

| Apple CarPlay | 861K | 37 million | ||

| MirrorLink | 1.1 million | 17 million | ||

*Figures are rounded

Source: IHS Auto Tech Software, Apps &

Services Forecast, (March, 2015).

When asked about familiarity with the various integrators, and those consumers interested in having them on their next new vehicle, results varied widely by region.

Most Widely Used Apps in Vehicles

Nearly 45 percent of respondents agree that they would use in-vehicle apps if they helped enhance the driving experience, with 35 percent of them reporting they’d be most willing to use them if they were similar to those on their smartphone. In addition, nearly 75 percent of respondents across the regions indicated they would also be willing to pay for updates to an app, paving the way for continued growth.

The top five categories that consumers identified as a favorite for use in their vehicles are, in order: navigation (53 percent), weather (40 percent), music (38 percent), news (33 percent) and social networking (29 percent).

Least likely to be mentioned as favorites for use in the vehicle include apps for points of interest/local, books, health and fitness, business/productivity, education and podcasts, with less than 15 percent use rates among respondents.

Interest and Desire for Technology/Features Evolve, with Regional Trends

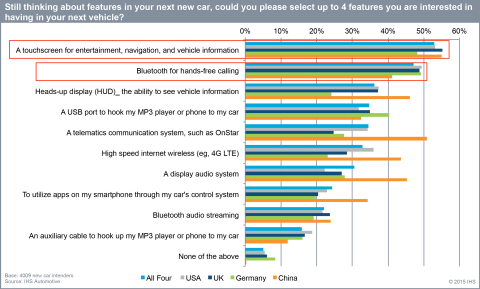

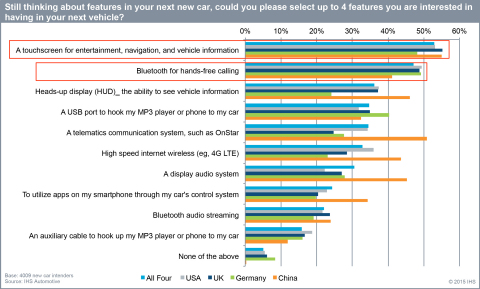

When it comes to infotainment, top features desired by respondents across the regions were varied. The following chart demonstrates various infotainment options and how often they were mentioned among audiences in each country surveyed.

In-Car Music is Evolving

The majority of consumers (nearly 70 percent) surveyed indicated a strong desire for continued listening of music via AM/FM radio and CD options in their vehicle. However, a similar number of respondents prefer listening to music stored on their mobile devices, and internet/streaming radio, satellite radio options and a desire for music stored on an in-vehicle hard drive also were listed as options. In China, however, streaming music from a mobile device is overwhelmingly preferred.

Additional regional findings from the report will forthcoming in future releases. The full comprehensive report is available for purchase here.

About IHS Automotive (www.ihs.com/automotive)

IHS Automotive, part of IHS Inc. (NYSE: IHS), offers clients the most comprehensive content and deepest expertise and insight on the automotive industry available anywhere in the world today. With the 2013 addition of Polk, IHS Automotive now provides expertise and predictive insight across the entire automotive value chain from product inception—across design and production—to the sales and marketing efforts used to maximize potential in the marketplace. No other source provides a more complete picture of the global automotive industry. IHS is the leading source of information, insight and analytics in critical areas that shape today’s business landscape. IHS has been in business since 1959 and became a publicly traded company on the New York Stock Exchange in 2005. Headquartered in Englewood, Colorado, USA, IHS is committed to sustainable, profitable growth and employs about 8,800 people in 32 countries around the world.

IHS is a registered trademark of IHS Inc. All other company and product names may be trademarks of their respective owners. © 2015 IHS Inc. All rights reserved.