Breaks above MA cluster and races higher today

The USDCHF consolidated over the last 4 days with the 100 day MA (at 0.9790 today) stalling the upside, and a floor at 0.97347 acting as support. Today, the pair moved above the 100 day MA and that triggered buying.

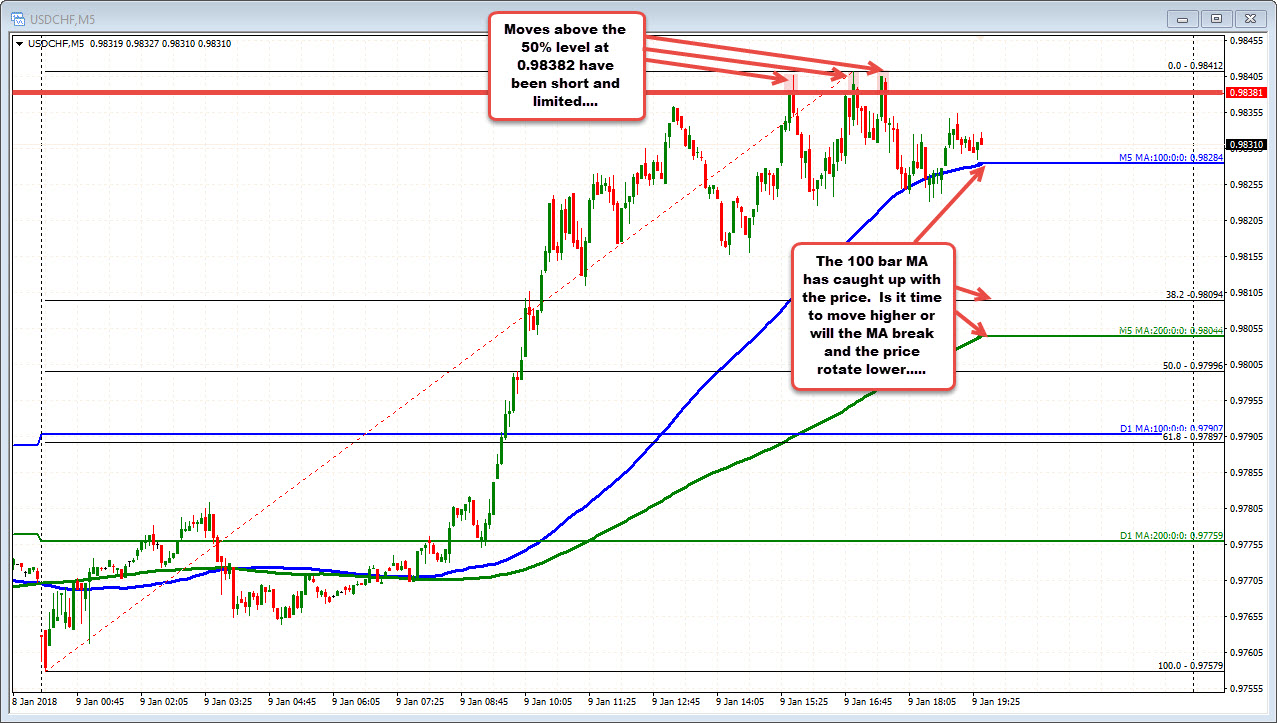

The buying has pushed the price toward the 50% of the move down from the December 8 high at the 0.98382 level. Also in that area are swing levels from December in the 0.9833 to 0.9838 area. The high today extended just above that area to 0.98412 and stalled.

What now?

Get above the 0.98382 level keeps the buyers engaged and tilts the trading more to the upper half of the range since December. A topside trend line cuts across at 0.9862. The 61.8% retracement is at 0.9871.

Drilling to the 5-minute chart, the consolidation near the 50% retracement level has allowed for the 100 bar MA to catch up with the price. The price is trading around the MA line and traders are likely looking for either a bounce and break higher, or a further corrective move lower with the 0.9809 as the 38.2% of the day's range and the rising 200 bar MA at 0.98044 would be targets. Watch the 0.9838 above or for more selling below the 100 bar MA at 0.9828.