SPDR Gold Shares (HK:2840) (NYSE:GLD) – on buy signal.

iShares Silver (NYSE:SLV) – on buy signal.

VanEck Vectors Gold Miners (NYSE:GDX) – on buy signal.

iShares S&P/TSX Global Gold (TO:XGD) – on buy signal.

Sprott Physical Gold and Silver Trust (NYSE:CEF) – on buy signal.

VanEck Vectors Junior Gold Miners (NYSE:GDXJ) – on buy signal.

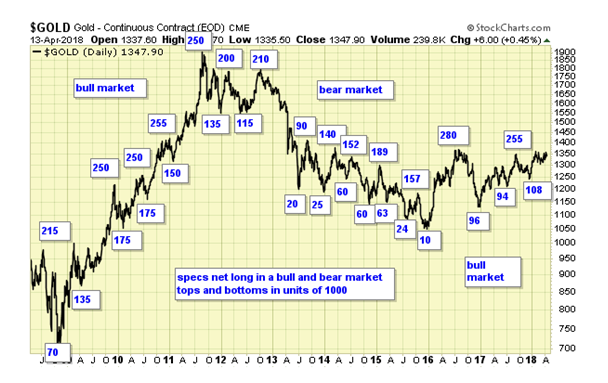

Gold – Speculation is in bull market values.

Silver – Speculation remains near recent new low and yet prices are holding firm.

This is a massive bottoming pattern four years in the making, with prices currently testing resistance.

Zooming in, it clearly shows a cup with handle pattern in progress within the larger bottoming pattern.

Summary

Long term – on major buy signal.

Short term – on buy signals.

Gold sector cycle is up.

COT data is supportive for overall higher metal prices.

We are holding long term positions.

Disclosure : We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.

We also provide coverage to the major indexes and oil sector.