Beverages

Anheuser-Busch InBev

- Est. sales growth: 1%

- Est. EPS Growth: 20.9%

- Total assets: $237.40b

- 12–month sales: $56.43b

- 1–year total return: -37.3%

- Female board membership 13.3%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 1% | 20.9% | $237.40b | $56.43b | -37.3% | 13.3% |

AB InBev has grown via dealmaking for years, accumulating $108 billion in net debt along the way. It will use cash flow to cut that burden in half over the next four years and probably abstain from acquisitions. Meanwhile, rivals will continue to consolidate the beer industry as new markets open up in Asia. Don’t be shocked if ABI puts its nonalcoholic assets up for sale.

Health Care

The American health insurer, under first-year CEO Gail Boudreaux, finds itself playing catch-up following the recently approved acquisition of Aetna by CVS and the pending Cigna/Express Scripts deal. But it rolls out its own pharmacy benefit manager in 2019 and is likely looking to bulk up with an acquisition.

Banking

Barclays CEO Jes Staley is still standing after a period of layoffs, legal challenges, and a $2 billion settlement with the U.S. Department of Justice. The bank’s recent return to profitability may persuade investors to take another look. After all, based on price-earnings ratios, it’s one of Europe’s very cheapest banks.

Pharma

The drugmaker formerly known as Valeant has a shot at making 2019 a banner year. Lucrative dermatology products are nearing Food and Drug Administration approval, debt concerns are fading, and there’s significant sales growth among its gastrointestinal products, led by irritable bowel syndrome drug Xifaxan.

Real Estate

Boston Properties

- Est. sales growth: 4.9%

- Est. EPS Growth: 9.3%

- Total assets: $19.96b

- 12–month sales: $2.64b

- 1–year total return: 2.4%

- Female board membership 27.3%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 4.9% | 9.3% | $19.96b | $2.64b | 2.4% | 27.3% |

Boston Properties will see cash flow soar as tenants move into its skyline-dominating and almost fully leased Salesforce Tower in San Francisco. It should rise further as vacant Midtown Manhattan office spaces welcome new occupants in the coming year. One possible hurdle could be competition from Hudson Yards, a development being built by Related and Oxford Properties on New York City’s West Side. *Note: Estimated FFOPS growth (USD) rather than EPS growth

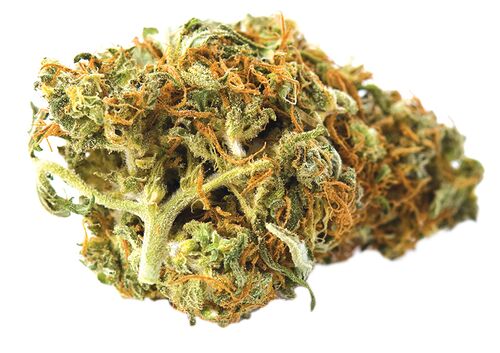

Cannabis

Canopy Growth

- Est. sales growth: 556.7%

- Est. EPS Growth: 87.3%

- Total assets: $1.61b

- 12–month sales: $69.21m

- 1–year total return: 193.4%

- Female board membership 14.3%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 556.7% | 87.3% | $1.61b | $69.21m | 193.4% | 14.3% |

The world’s largest cannabis producer benefits from fast-emerging global demand for legal cannabis-based products for both medical and recreational use. The Canadian company, which operates in 11 countries, is expanding in Germany and may enter other markets, including Spain, Denmark, and Australia. Its partnership with alcoholic beverage company Constellation Brands gives it an advantage over rivals.

▷ High Times

Investors are excited about Canadian cannabis companies such as Tilray, Canopy Growth, and Aurora Cannabis now that their home turf has fully legalized recreational pot. The companies have had no trouble raising capital to fund deals and expand operations. But Canada restricts marijuana marketing and most branding. Even with the federal legislation, it will be several months before Canadian consumers will be able to buy cannabis edibles, drinks, and vape pens.

Despite Canada’s first-mover advantage, the legal recreational market in the U.S. is already much bigger, with sales expected to hit roughly $5.4 billion this year. In recent years, 10 states have legalized recreational cannabis for adults—the latest was Michigan, following a Nov. 6 ballot measure. With densely populated East Coast states such as New Jersey and New York considering similar measures, expansion in the U.S. is expected to spread, with the domestic market projected to be worth $75 billion by 2030. That’s good news for MedMen, Curaleaf, Acreage Holdings, and other American companies. With Democrats in control of the House of Representatives, there’s increasing optimism that the government will ease federal weed regulations. That could mean finally opening the banking system and domestic stock exchanges to cannabis companies. –by Craig Giammona

Media

The exit of CEO Les Moonves and a settlement with controlling shareholder National Amusements Inc. (NAI) raises the prospects of a sale for the network. While NAI won’t initiate merger talks, a deal with Viacom Inc. is not off the table. CBS has had success in its streaming efforts and is poised to build more momentum in 2019, in part from gains in retransmission and content licensing.

Utilities

The British electric and gas utility continues to lose market share and will take a hit from caps on home energy bills set to go into effect in England, Scotland, and Wales in late 2018. The company’s future hinges on its bets on “connected homes” and alternative energy. In the short term, a dividend cut and asset sales look likely.

Energy

Cheniere Energy

- Est. sales growth: 21.3%

- Est. EPS Growth: 226.7%

- Total assets: $30.33b

- 12–month sales: $6.93b

- 1–year total return: 29.2%

- Female board membership 9.1%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 21.3% | 226.7% | $30.33b | $6.93b | 29.2% | 9.1% |

With liquefied natural gas shipping terminals in Louisiana and Texas, Cheniere Energy finds itself in a sweet spot as rising demand, particularly in Asia, keeps LNG prices aloft, even in the offseason. It’s even somewhat insulated against China’s threat of retaliatory tariffs by long-term contracts that safeguard its cash flow.

Financials

CK Asset Holdings

- Est. sales growth: 55.5%

- Est. EPS Growth: 12.6%

- Total assets: $58.45b

- 12–month sales: $5.81b

- 1–year total return: -18.9%

- Female board membership 26.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 55.5% | 12.6% | $58.45b | $5.81b | -18.9% | 26.7% |

Victor Li, son of Li Ka-shing, Hong Kong’s richest man, has been steering CK Asset in a new direction since taking over from his father in May. To lower the property developer’s exposure to a correction in Hong Kong, he’s expanded overseas, paying $1.3 billion for UBS’s London headquarters and bidding $9.5 billion for Australian gas pipeline giant APA Group. Core profit jumped 20 percent when CK reported earnings in August.

Media

With its purchase of Sky Plc, the largest U.S. cable operator is on the cusp of transforming itself into a global distributor with more than 50 million subscribers. While the acquisition is a gamble, it opens up the possibility of launching a global streaming platform to rival Netflix Inc.’s. Comcast is well-positioned to withstand wireless’s 5G broadband rollout thanks to its own ultrahigh-speed offerings. Still, pressure remains to report strong internet gains over the next few quarters.

Technology

Dell Technologies

- Est. sales growth: N/M%

- Est. EPS Growth: N/M%

- Total assets: $123.38b

- 12–month sales: $85.84b

- 1–year total return: N/A%

- Female board membership 16.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| N/M% | N/M% | $123.38b | $85.84b | N/A% | 16.7% |

Dell is looking to simplify its capital structure and return to being a publicly listed stock, possibly by the end of the year. Doing so means buying up the tracking stock for its VMware unit, which will set off an avalanche of arguments as investors try to drive up the final price.

Banking

Deutsche Bank must execute on a revamp that aims to focus on core strengths and boost profitability. The key challenge is stabilizing trading, which accounts for a significant share of its revenue, while scaling back its global investment banking ambitions.

▷ If You Stream It, Will They Watch?

Comcast’s Sky deal is part of the global war for streaming dominance. That field of battle will grow more crowded next year when both Walt Disney Co. and AT&T Inc.’s WarnerMedia launch new online video services. These media giants will not only be competing on price, they’ll also be vying for the top creative talent and spending millions to create more original shows.

HBO’s new owner, AT&T, has signaled that it wants the premium channel to increase its programming to get subscribers tuning in more often—an hour every day, rather than just one or two hours on Sunday nights.

That still might not be enough to match Netflix Inc. With more than 130 million customers around the world, the company is burning cash to create original series in local languages, knowing that what’s popular in one country might not appeal in another. Comcast may be forced to create original shows for Sky if AT&T decides to stop licensing HBO and Warner Bros. shows and movies and instead keeps them for its new streaming service. –by Gerry Smith

Energy

It was a question of when, not if. By uniting Energy Transfer Partners with Energy Transfer Equity in August, founder Kelcy Warren has made the natural gas and propane company a far more formidable player. The change lowers capital costs and boosts project returns, setting Energy Transfer up for what’s likely to be a year of aggressive expansion.

Financials

Fannie Mae/Freddie Mac

- Est. sales growth: N/M%

- Est. EPS Growth: N/M%

- Total assets: $5.30t

- 12–month sales: $195.00b

- 1–year total return: -58.5%

- Female board membership 25%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| N/M% | N/M% | $5.30t | $195.00b | -58.5% | 25% |

Key court rulings are expected in 2019 concerning the constitutionality of directing Fannie’s and Freddie Mac’s profits to the Department of the Treasury, as well as the structure of the Federal Housing Finance Agency. The companies’ post-financial crisis reforms, including risk transfers to private investors, smaller balance sheets, and a new uniform mortgage-backed security, may give the Trump administration the ammunition to argue for returning the companies to private ownership. A downturn in housing markets would test the resilience of the government-sponsored enterprises and disrupt the push for privatization. *Note: Total assets and 12-month sales data are combined Fannie/Freddie figures; 1-year total return is an average of the two.

Apparel

The Japanese company is ramping up overseas expansion in a bid to overtake Inditex and H&M as the world’s biggest apparel retailer by revenue. Its push abroad means Uniqlo’s international operations should account for a majority of Fast Retailing’s sales and operating profit within the next one to two years.

Autos

Ford Motor

- Est. sales growth: -0.5%

- Est. EPS Growth: -9.3%

- Total assets: $258.08b

- 12–month sales: $147.02b

- 1–year total return: -16.5%

- Female board membership 21.4%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| -0.5% | -9.3% | $258.08b | $147.02b | -16.5% | 21.4% |

There’s a massive restructuring ahead as the company abandons mainstream sedans in favor of pickups and SUVs and comes to grips with Japan’s rising global market share and North American production capacity. It also has to gain ground in autonomous vehicles. The coming year will be critical to turning the business around. Management has been short on specifics as the sense of urgency has deepened.

Industrials

General Electric

- Est. sales growth: -1.2%

- Est. EPS Growth: 11%

- Total assets: $342.77b

- 12–month sales: $123.64b

- 1–year total return: -48.2%

- Female board membership 18.2%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| -1.2% | 11% | $342.77b | $123.64b | -48.2% | 18.2% |

GE’s recent CEO swap-out gave its beleaguered stock a bump, but the road to recovery will be long. After making a badly timed bet on demand for power generation equipment—and paying a heavy price—the conglomerate appears intent on accelerating asset sales from GE Capital and narrowing its overall focus.

Pharma

Gilead Sciences

- Est. sales growth: -7.7%

- Est. EPS Growth: -11.3%

- Total assets: $65.36b

- 12–month sales: $23.20b

- 1–year total return: -6.3%

- Female board membership 30%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| -7.7% | -11.3% | $65.36b | $23.20b | -6.3% | 30% |

The drugmaker helped turn once-fatal HIV into a manageable chronic ailment and developed a cure for hepatitis C, becoming a $100 billion company along the way. Even though Gilead’s drug pipeline won’t deliver again until 2020 and its revenue has slipped, a pending leadership change and bursting coffers put near-term growth within reach.

Financials

Hammerson

- Est. sales growth: -5.9%

- Est. EPS Growth: -4.2%

- Total assets: $12.78b

- 12–month sales: $491.27m

- 1–year total return: -14.9%

- Female board membership 20%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| -5.9% | -4.2% | $12.78b | $491.27m | -14.9% | 20% |

The British retail property REIT has been battered by the growth of e-commerce. It’s fighting back, reducing costs and debt while focusing investment on premium outlets and revamping malls to enhance the shopping experience. Those efforts should help as retail real estate values stabilize. *Note: The figure titled 12-month sales reflects Hammerson’s 12-month net rental income.

Autos

Spurred by trade tension and the threat of additional tariffs, Harley is adding production outside the U.S., bringing it closer to the emerging markets it’s targeting. The problem: It has no experience designing and building the smaller, lightweight bikes favored throughout Asia. An Asian manufacturing partner could make all the difference.

Aerospace

InterGlobe Aviation

- Est. sales growth: 34.5%

- Est. EPS Growth: -16.2%

- Total assets: $3.24b

- 12–month sales: $3.49b

- 1–year total return: -37.4%

- Female board membership 16.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 34.5% | -16.2% | $3.24b | $3.49b | -37.4% | 16.7% |

InterGlobe, aka IndiGo, is India’s dominant carrier, with a 42 percent share in one of the world’s fastest-growing aviation markets. And it plans to stay on top: With more than 430 planes on order, it has a clear path to capturing much of the growth in Indian air travel.

Health Care

Iqvia Holdings

- Est. sales growth: 15.6%

- Est. EPS Growth: 15.9%

- Total assets: $22.63b

- 12–month sales: $9.31b

- 1–year total return: 13.7%

- Female board membership 9.1%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 15.6% | 15.9% | $22.63b | $9.31b | 13.7% | 9.1% |

Formed in 2016 through the merger of clinical trial contractor Quintiles and data and technology company IMS Health, Iqvia may show its full potential in 2019. Although it already leads the contract health research market, the recent acquisition of new clients and a widening range of services are setting it up for a year of serious organic growth.

Media

All eyes will be on CEO Dame Carolyn McCall as she fights to win viewers back from Amazon.com and Netflix. The U.K. broadcaster’s “More than TV” strategy aims to counter a squeeze on traditional advertising revenue with investments in ad- and subscription-based online platforms, a bigger position in the global market for content production, and better monetization of spinoff products and services. Failure could lead to a buyout or breakup.

Industrials

Johnson Controls International

- Est. sales growth: 4%

- Est. EPS Growth: 10.4%

- Total assets: $49.41b

- 12–month sales: $31.17b

- 1–year total return: -20.5%

- Female board membership 25%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 4% | 10.4% | $49.41b | $31.17b | -20.5% | 25% |

Since the 2016 merger with Tyco, conglomerate Johnson Controls’ stock has dramatically underperformed its industrial peer group. It’s looking for a big cash boost from the pending sale of its power unit, which makes batteries for vehicles and brings in 24 percent of revenue. Activists are sure to push for further action if 2019 doesn’t bring better results in its core HVAC and building systems businesses.

Luxury

After a knockout 2017 performance, Kering has more in store for the year ahead. Growth at Gucci in 2018 is unabated, stemming from new designs and store concepts, targeted marketing, and e-commerce projects. Its second brand by size, Yves Saint Laurent, and smaller brands such as Balenciaga and Alexander McQueen are also on a roll.

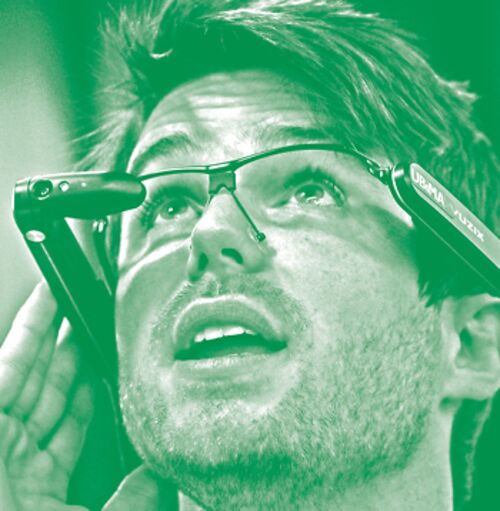

▷ 5G’s Delayed Entrance

Is the dawn of fifth-generation mobile networks, which will move greater volumes of data more quickly, finally here? For several years, carriers and tech companies have talked about the great 5G possibilities involving augmented reality and the internet of things—including factories that adapt automatically to demand and self-driving cars that talk to each other. The reality is likely to be a lot more mundane, for now at least.

The first 5G networks are coming online in 2019, and 5G-enabled smartphones are expected in the second half of the year. While network-builder Ericsson AB estimates that the number of internet-of-things device connections will jump more than threefold by 2023, most of that increase will come from fixed network connections, not cellular ones. The main hurdle to 5G investment is the lack of a clear business case, given low demand for fast data, according to a Moody’s survey of European telecommunications companies.

A rapid 5G rollout is unlikely, particularly in Europe, where 4G adoption is still relatively low. Carriers such as Vodafone Group Plc will more gradually add 5G capabilities over the next five years. The main motivation: cost reduction. Meeting data demands with 4G networks through 2025 would be about twice as expensive as with 5G, the Boston Consulting Group estimates. For all the technological promise, the real driver of 5G in the short term will be the bottom line, not growth. –by Alex Webb

Trucking

Knight-Swift Transportation Holdings

- Est. sales growth: 25.3%

- Est. EPS Growth: 45.8%

- Total assets: $7.75b

- 12–month sales: $4.48b

- 1–year total return: -22.3%

- Female board membership 16.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 25.3% | 45.8% | $7.75b | $4.48b | -22.3% | 16.7% |

Trucking giant Knight-Swift is poised for revenue and earnings growth that’s likely to outpace those of its peers through 2019. Gains will be driven by two factors: management’s ability to find operating efficiencies and limited truck driver availability. Greater demand for trucking is rapidly pushing up revenue per mile.

Food

Kroger is seeing some positive results from a plan unveiled a year ago to adopt technological and data-driven efforts to connect with customers and reduce investments in new stores. Partnerships with U.K. online grocer Ocado, Alibaba’s Tmall, and other sellers have paved the way for the next wave of growth.

Apparel

Will L Brands turn business around in 2019? Returning to its historical sales peak is unlikely at Victoria’s Secret, but watch for moves to improve the product lines and marketing at Body By Victoria and Pink. Moving to fix merchandising issues—the product mix isn’t right—would be a positive sign and a first step toward recovery.

Construction

Lennar’s acquisition of CalAtlantic Group Inc., the largest ever in the U.S. homebuilding industry, strengthened its position as the No. 2 U.S. homebuilder (behind D.R. Horton) and increased its market share in 24 of the top 30 markets. Across the sector, share prices have been hurt by rising home prices and interest rates. Demand and Lennar’s “Everything Included” program, which features digital-ready, green luxury homes, should support sales.

Financials

Manulife Financial

- Est. sales growth: -3.9%

- Est. EPS Growth: 10%

- Total assets: $572.25b

- 12–month sales: $43.84b

- 1–year total return: -18.9%

- Female board membership 35.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| -3.9% | 10% | $572.25b | $43.84b | -18.9% | 35.7% |

Next year will be critical for Manulife and new CEO Roy Gori. The insurer in June announced a big cost-reduction program, and it’s in the process of streamlining its legacy businesses in the U.S. and Canada. The company’s strong presence in Asia, which provides most of its growth, is a huge advantage as the region’s middle class surges.

Energy

Marathon Petroleum

- Est. sales growth: 17.3%

- Est. EPS Growth: 26.4%

- Total assets: $51.74b

- 12–month sales: $82.05b

- 1–year total return: 20.9%

- Female board membership 16.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 17.3% | 26.4% | $51.74b | $82.05b | 20.9% | 16.7% |

The $23 billion acquisition of Andeavor will make Marathon the largest American refiner and second-largest fuel retailer. Buying a premium asset near the top of the refining cycle is definitely a risk. And Marathon’s previous major acquisition, the $15.7 billion MarkWest Energy Partners LP deal in 2015, set back its stock for more than a year. But there are strong tailwinds for U.S. refiners right now, including access to cheap shale crude and natural gas. The combined company boasts geographical and equipment advantages.

Energy

McDermott International

- Est. sales growth: 127.7%

- Est. EPS Growth: -9.4%

- Total assets: $11.43b

- 12–month sales: $4.02b

- 1–year total return: -61.1%

- Female board membership 18.2%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 127.7% | -9.4% | $11.43b | $4.02b | -61.1% | 18.2% |

The energy infrastructure company doubled in size and broadened its skill set in May with the acquisition of Chicago Bridge & Iron Co., which adds onshore oil and gas infrastructure know-how to McDermott’s offshore expertise. Tenuous U.S. relations with Saudi Arabia are the wild card, as the company has a slate of projects under way for Aramco. McDermott is highly leveraged, but its strong track record under CEO David Dickson is reassuring.

Apparel

The global leader in athletic apparel and footwear is looking to use its social media links with fans to build a stronger connection between its e-commerce and physical retail presence. Nike continues to invest in demand sensing, a technology that sweeps up signals from across the digital world to guide manufacturing and distribution. The ultimate goal is to know when and where to send inventory to maximize full-price sales and profitability.

Chips

NXP Semiconductors

- Est. sales growth: 4%

- Est. EPS Growth: 13.7%

- Total assets: $22.64b

- 12–month sales: $9.40b

- 1–year total return: -35.8%

- Female board membership 16.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 4% | 13.7% | $22.64b | $9.40b | -35.8% | 16.7% |

After a year of drama, including the failed Qualcomm Inc. deal, NXP is eager to reignite growth. Underperformance may be short-lived—a $5 billion share buyback could boost earnings. Autos and industrials, underpenetrated markets with a need for chips, present an opportunity.

Lighting

Leaving behind a shaky 2018, when its stock had fallen 50 percent by the end of June, the company is expected to rebound in early 2019. Once the world’s No. 2 seller of lightbulbs, Osram is now focused on specialty lighting for autos, entertainment, and the health-care sector. These businesses are promising, delivering $2.3 billion in sales in fiscal 2017. It announced in August that it’s shedding the loss-making Lighting Solutions and Systems unit.

Energy

Petrobras

- Est. sales growth: -1.5%

- Est. EPS Growth: 86.9%

- Total assets: $220.09b

- 12–month sales: $92.66b

- 1–year total return: 45.4%

- Female board membership 30%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| -1.5% | 86.9% | $220.09b | $92.66b | 45.4% | 30% |

Brazil’s national oil company has undergone a major transformation, from the most indebted oil company in the world to a growing, profitable one, over the past 18 months. The election of Jair Bolsonaro as president could set it back. He’s pledged greater independence for Petrobras and divestment from other government enterprises but as recently as May supported fuel price controls, which have been crippling in the past. The market approves of him so far, though it remains to be seen if he’ll keep his hands off Petrobras.

Financials

Prudential

- Est. sales growth: 28%

- Est. EPS Growth: -5.1%

- Total assets: $661.24b

- 12–month sales: $72.42b

- 1–year total return: -16.3%

- Female board membership 12.5%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 28% | -5.1% | $661.24b | $72.42b | -16.3% | 12.5% |

Prudential is composed of three separately regulated and managed businesses in the U.K., the U.S., and Asia. It announced in March that it would spin off its U.K. business by 2020, signaling the breakup of the company. Group management is based in London, and there will be even less of a rationale for this once the U.K. business breaks free. The closer the uncoupling comes, the more investors are likely to value the U.S. and Asian operations separately.

Tobacco

Pyxus International

- Est. sales growth: N/M%

- Est. EPS Growth: N/M%

- Total assets: $2.13b

- 12–month sales: $1.86b

- 1–year total return: 121.9%

- Female board membership 12.5%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| N/M% | N/M% | $2.13b | $1.86b | 121.9% | 12.5% |

The world’s second-largest independent tobacco leaf dealer has been busy buying stakes in companies and forming joint ventures in emerging markets. The strategy is to sprinkle its expertise in agronomy over these businesses while expanding into such areas as liquids for vaping and Canadian cannabis.

Energy

Range Resources

- Est. sales growth: 19.2%

- Est. EPS Growth: 7.4%

- Total assets: $11.83b

- 12–month sales: $2.75b

- 1–year total return: -12%

- Female board membership 11.1%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 19.2% | 7.4% | $11.83b | $2.75b | -12% | 11.1% |

Investors have lost their enthusiasm for Range Resources, an oil and natural gas exploration and production company, since its 2016 purchase of Memorial Resources. Range’s share price has fallen from a high of $46.45 in June 2016 to $17.16 on Oct. 18. Management’s commitment to spending its cash more efficiently, boosting productivity, and shedding some assets to cut debt may renew optimism.

▷ CEOs To Watch

Anthem Chief Executive Officer Gail Boudreaux has been on a tear since becoming head of the second-largest U.S. insurer in November 2017. She’s been trying to expand Anthem’s partnerships with Blue Cross Blue Shield to gain clients, create Anthem’s own pharmacy benefit manager—expected to launch in early 2020—and improve digital capabilities.

Nick Read, who became Vodafone CEO in October, has been closing deals in Australia and India. He’s also been meeting with the European Commission as it reviews Vodafone’s acquisitions of cable assets in Germany and Central and Eastern Europe. “It was a very active summer, which is why I have zero tan,” Read said at a September conference.

General Electric CEO Larry Culp, whose surprise appointment was announced on Oct. 1, is knee-deep in asset sales and other efforts to revive the company. He’s also dealing with investigations by the U.S. Securities and Exchange Commission and the Department of Justice into GE’s accounting practices.

After Twenty-First Century Fox Inc. completes the sale of most of its assets to Walt Disney Co., Lachlan Murdoch, Rupert Murdoch’s oldest son, will serve as CEO of the new Fox. The Murdochs are counting on live news and sports to withstand the threat of on-demand streaming. –by Nick Leiber and Anousha Sakoui

Energy

Prospects for continued high oil prices and Rosneft’s capacity to raise production—it pumped 5.7 million barrels a day in the second quarter—bode well for the Russian oil giant. A lean cost structure, weak ruble, and steady output will allow the company to reduce debt and reassure investors, who will also embrace the $2 billion share buyback program. Expanded U.S. sanctions remain a risk.

Conglomerate

SoftBank Group

- Est. sales growth: 1.4%

- Est. EPS Growth: -14.8%

- Total assets: $291.28b

- 12–month sales: $83.82b

- 1–year total return: -8.1%

- Female board membership 0%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 1.4% | -14.8% | $291.28b | $83.82b | -8.1% | 0% |

SoftBank’s $100 billion tech fund may slow the pace of its investments. An impending test will be whether Chairman Masayoshi Son can pull off a 3 trillion yen ($26.3 billion) mobile IPO to help finance the tech fund. The merger of subsidiary Sprint Corp. with T-Mobile is another pending deal that may save SoftBank from taking on more debt.

Financials

Synchrony Financial

- Est. sales growth: 9.4%

- Est. EPS Growth: 29.5%

- Total assets: $99.12b

- 12–month sales: $12.69b

- 1–year total return: -9.7%

- Female board membership 33.3%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| 9.4% | 29.5% | $99.12b | $12.69b | -9.7% | 33.3% |

Losing Walmart usually isn’t a good thing, and Synchrony will lose the Walmart store-card program next year. Its expanded deal with PayPal—which includes the recent purchase of almost $8 billion worth of consumer loans— and growth in its Amazon.com card business will help soften the blow. The company may also lose its deal with Walmart’s Sam’s Club. It recently renewed contracts with Lowe’s Cos. and J.C. Penney Co.

Software

Tableau, known for its chart applications and analytics dashboards, is broadening its product line to include data cleanup and machine learning tools, enabling it to compete in the wider data-warehousing and reporting market. That’s sure to boost sales. Demand for the company’s established products will remain strong.

Autos

CEO Elon Musk can’t tweet away Tesla’s problems. The fix-it list is long. Tesla must address operational, capacity, and liquidity needs, rebuild a credible management team, and wean itself off its reliance on income statement and balance-sheet maneuvers, all while facing a lower price-to-sales mix as it produces more of the cheaper Model 3.

Pharma

Teva Pharmaceutical Industries

- Est. sales growth: -12.1%

- Est. EPS Growth: -22.4%

- Total assets: $67.03b

- 12–month sales: $20.84b

- 1–year total return: 47%

- Female board membership 26.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| -12.1% | -22.4% | $67.03b | $20.84b | 47% | 26.7% |

Teva has a drug pipeline full of growth opportunities starting in 2019. Austedo, a possible treatment for Tourette’s syndrome for which trial data may come in the first half of next year, represents a potential $1 billion-plus opportunity. Ajovy is one of the most significant migraine advances in decades. These launches may help offset the loss—worth about $2 billion—of exclusivity for Teva’s best-selling Copaxone, a drug for multiple sclerosis.

Telecom

Vodafone Group

- Est. sales growth: -2.5%

- Est. EPS Growth: 1.5%

- Total assets: $179.49b

- 12–month sales: $54.91b

- 1–year total return: -29.6%

- Female board membership 41.7%

| Est. sales growth | Est. EPS growth | Total assets | 12–month sales | 1–year total return | Female board membership |

|---|---|---|---|---|---|

| -2.5% | 1.5% | $179.49b | $54.91b | -29.6% | 41.7% |

Vodafone is set to become the largest fixed/mobile carrier in Europe if its deal with Liberty Global is approved. The company will have to cope with rising competition and weakening revenue growth. A new CEO—Nick Read succeeded Vittorio Colao in October—also complicates the picture. Nevertheless, patience may pay off as Vodafone commands strong mobile network quality and has already developed significant capabilities to bundle its services.

Industrials

The rail transport equipment company—formed in 1999 through the merger of Westinghouse Air Brake Co. and MotivePower Industries Inc.—will double in size in 2019, once its acquisition of GE Transportation closes. The merger, plus a recovering freight transport sector and technological innovations, positions Wabtec for growth.

Media

Lagging revenue growth, major account losses, and cuts in client spending are adding up to trouble for the advertising giant’s new CEO Mark Read. WPP needs to revamp its business model to catch up with main rivals Omnicom, Interpublic, and Publicis, and to repel competition from technology consulting firms like Accenture and Deloitte. Getting a good price for its Kantar data unit is essential to reduce debt and provide funds for targeted acquisitions.

Engineering

After a streak of acquisitions, Xylem has become a tech-driven leader in equipment and services for water and wastewater utilities. The stock price has underperformed in the past year, after doubling in the four years prior. Margins may improve materially in 2019 as robust order intake converts to sales and incremental investment ends. A large federal infrastructure spending bill could provide further upside.

Methodology: Figures were compiled or calculated by Bloomberg’s Global Data division from the most recent company and/or broker reports as of Sept. 15, except 1-year total return, which was calculated as of Oct. 31. Estimated sales growth: the percentage change in sales for the next 12 months vs. the previous 12 months, based on Bloomberg surveys of analysts. Estimated EPS growth: the percentage change in earnings per share for the next 12 months vs. the previous 12 months, based on Bloomberg surveys of analysts. Figures are in U.S. dollars. N/M = not meaningful.

Female board membership, added to this year’s list to highlight the environmental, social, and governance (ESG) efforts and sustainable metrics that companies are increasingly focused on, is the number of women on a company’s board of directors, as a percentage. Figures were compiled by Bloomberg’s Global Data division.

- Credits

- Edited by Dimitra Kessenides

- Design by Alexander Shoukas

- Charts by Dorothy Gambrell

- Data Analysis by David Russell

- Development by James Singleton