In 2008, in an advertisement for a three-day, $1,495 Trump University workshop, the future president was quoted as saying, “I’ve always made a FORTUNE in foreclosures, and you will too.”

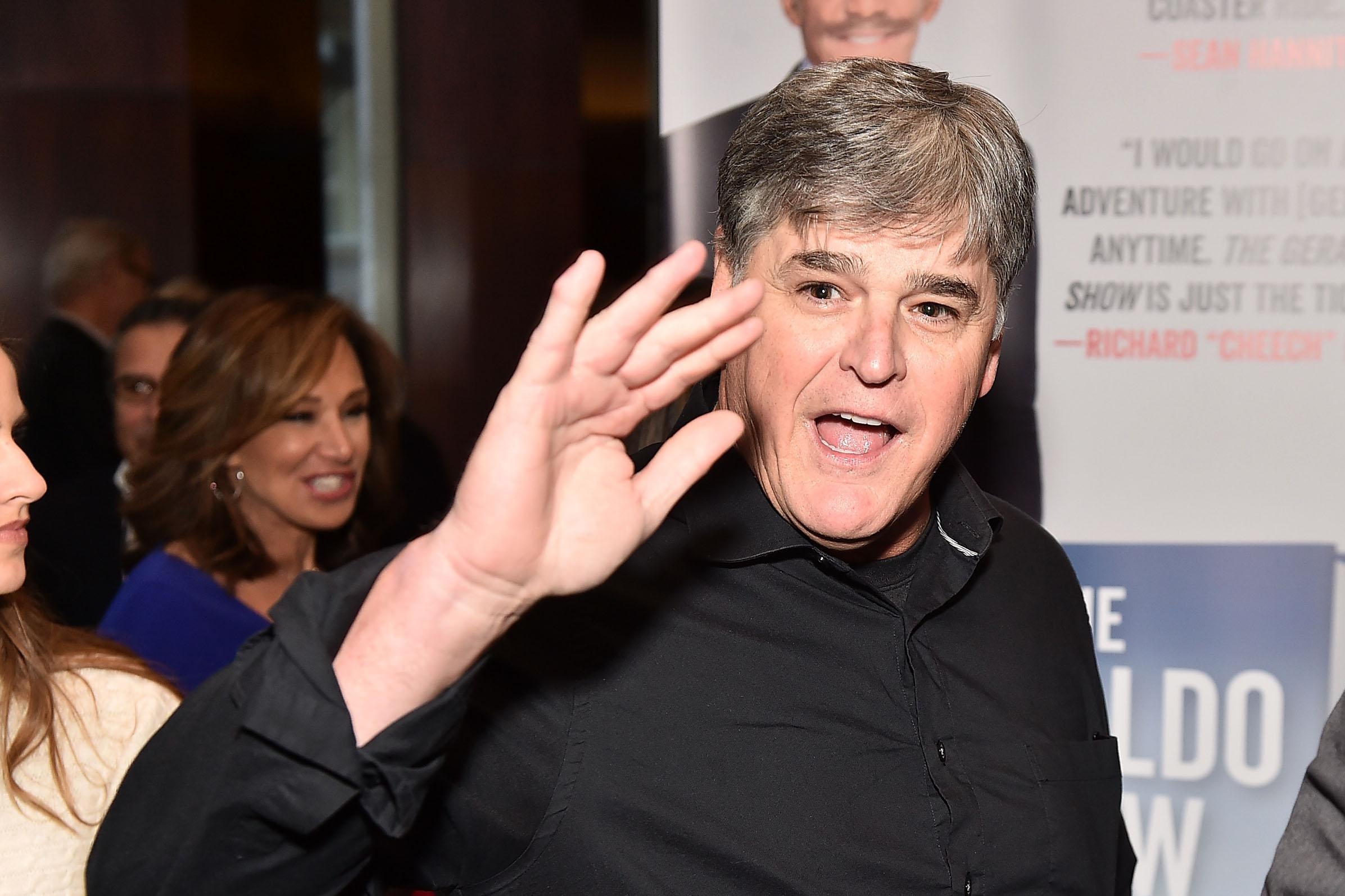

It appears the president’s most ardent televised defender, Sean Hannity, took his advice. On Sunday, the Guardian uncovered public records suggesting that the Fox News host is behind or affiliated with shell companies that, over the past decade, have spent more than $90 million on 870 homes in seven states, including dozens of foreclosed houses. It also offers an explanation why Hannity said last week that he had consulted Michael Cohen, Donald Trump’s personal lawyer who is under criminal investigation, to ask some questions about real estate.

The newspaper notes that several of the properties were obtained with mortgages backed by the Department of Housing and Urban Development, a fact that Hannity did not disclose while interviewing or praising HUD Secretary Ben Carson. This is not, in fact, suspicious: Under the National Housing Act, which insures mortgage loans for multifamily rental housing, HUD covers about 70,000 units a year for a sum of $4.5 billion. Millions of Americans have mortgages backed by the Federal Housing Administration, which is within HUD, which gives a whole lot of us a similar rudimentary relationship with Carson’s department.

Of course, Hannity is a hypocrite for positioning himself as a downhome populist when he is in fact an anonymous multistate landlord to hundreds of tenants. And he’s a hypocrite for slamming the Obama administration for the declining homeownership rate while he snapped up properties in foreclosure auctions. But what else is new?

The real significance is somewhat less bombastic: Hannity represents the rise of the corporate landlord. The housing crisis flooded the market with millions of foreclosed or low-cost homes, which were scooped up by private equity and real estate firms, aided by banks and big investors like pension funds. Between 2007 and 2009, nearly 3 million single-family homes were converted to rentals.

Mom-and-pop landlords were responsible for most of those conversions, as they had historically been. But in many of the worst-hit Sun Belt cities, institutional investors—a designation that here means everyone from nonprofits to real estate corporations—took over the market. By 2014, the private equity firm Blackstone had spent billions to become the largest rental landlord in America, and when Blackstone merged with Starwood Capital Group last year, its stock grew to include 82,000 homes. There’s a whole new multibillion-dollar market for bonds backed by these rent rolls. (Here’s a deep dive into the sector.)

In addition to public or well-known companies, you also have hard-to-track LLCs like the ones Hannity set up. Technology has made managing a far-flung portfolio a lot easier than it used to be, in real estate as in other things. An ongoing building shortage has given investors confidence that rental demand isn’t going away.

According to a 2017 Harvard Joint Center for Housing Studies report, individual investors’ share of all rental buildings fell from nearly 82 percent in 2001 to under 75 percent in 2015. In some ways, that undersells the change, because their share really plummeted in multifamily buildings, and those properties contain more units. For example, in buildings with between five and 24 units, the share of individual owners fell from 65 percent in 2001 to 53 percent in 2012 to 38 percent in 2015. (Then again, some mom-and-pop landlords may have developed LLCs to protect their identities or save money on taxes.)

Proponents of this change argue companies stepped in to rehabilitate properties that would otherwise have grown dilapidated, which is true. They also say Landlord Inc. can be more consistent and dependable than the old man down the street, which is probably true too. But, according to a 2016 paper from the Atlanta Federal Reserve, large rental owners—in this case, those with more than 15 single-family rental homes in Fulton County, home of Atlanta—are 8 percent more likely than their mom-and-pop peers to file eviction notices. This was true after controlling for property values and neighborhood characteristics.

In any case, the trend is clear: You’re more likely than ever to be cutting rent to a faceless corporation or obscure LLC, behind which may lie the very man who has been yelling about the injustice of foreclosures at you on the television.