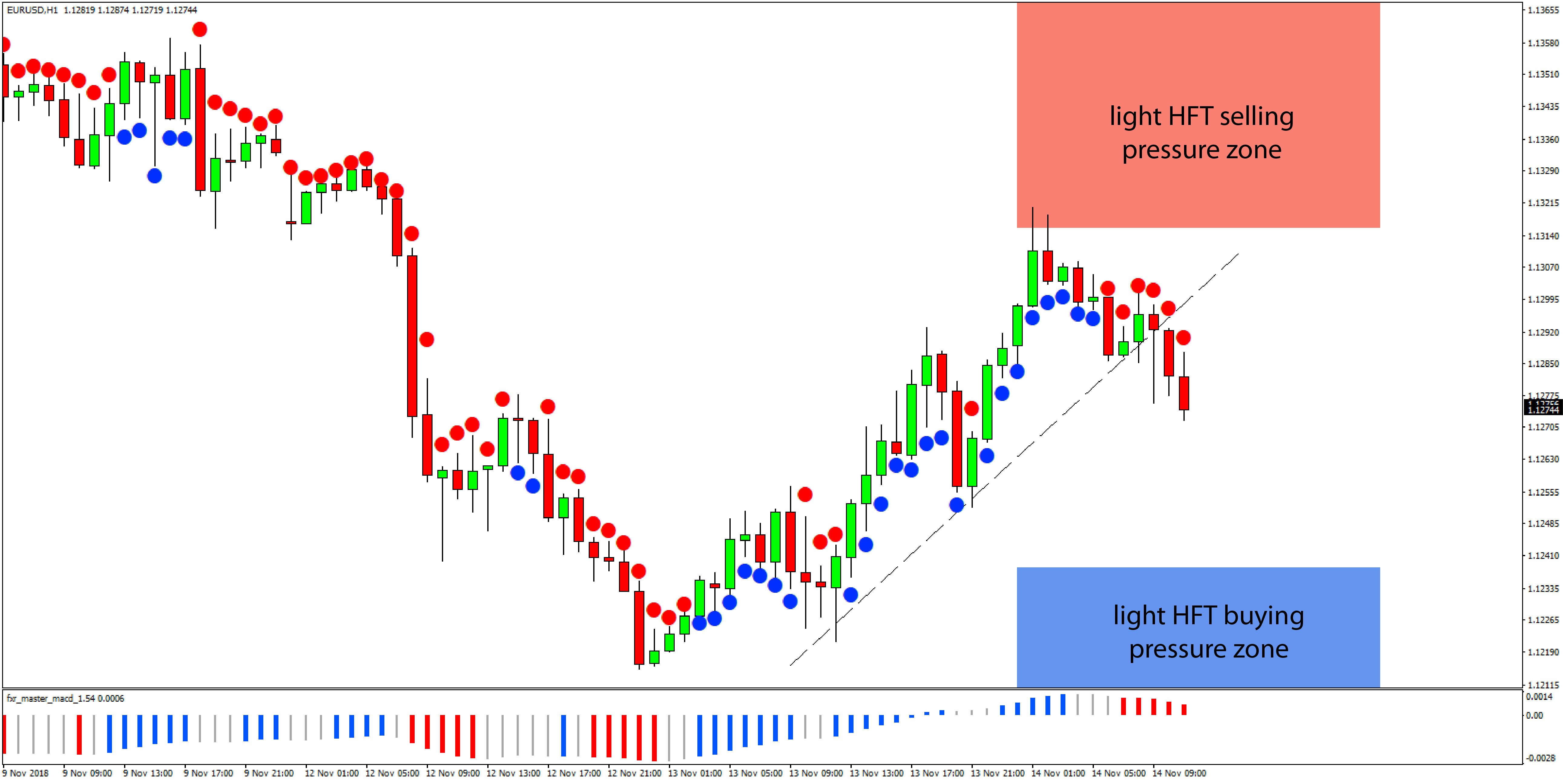

We are analyzing the trading activity on HFT algorithms this morning and have noticed that the EURUSD currency pair has already reached the light HFT selling pressure zone that is today noted at 1.1316 and above.

Bearish pressures remain strong on the pair due to the bearish momentum on larger timeframes and that is likely to keep a bearish bias on EURUSD even on intraday timeframes.

Today we can see on the charts that trend indicators such as the Master MACD and the FxTR CCI are both bearish on the 1-hour timeframe at the moment and EURUSD has also broken a rising retracement trendline. This should provide bearish continuation today with the light HFT buying pressure zone that is noted at 1.1238 and below looking like the probable area to be reached as a result.

EURUSD Current Trading Positions

High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

ADVISORY WARNING: Any news, opinions, research, data, or other information is provided as general market commentary and does not constitute investment or trading advice. FXTradingRevolution.com expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.