3 Growth Stocks to Buy and Hold for 25 Years

Day traders think long-term investing means holding a stock over the weekend. Many investors would stretch that definition to a few months and others to several years.

But here at The Motley Fool, we tend to believe in truly long-term investing. Buy great stocks at reasonable prices, and then watch them grow for decades.

That means finding companies that will not only stick around for the long haul. They should also deliver strong business growth and healthy stock returns for many years to come.

If that sounds like your investment style, we rounded up a few great long-term ideas from your fellow investors here at the Fool. Read on to see how they came up with open-source software veteran Red Hat (NYSE: RHT), casino giant Wynn Resorts (NASDAQ: WYNN), and transportation services stalwart XPO Logistics (NYSE: XPO).

Image source: Getty Images.

Betting on a booming gaming industry

Travis Hoium (Wynn Resorts): If there's one macro trend that I think will continue for the next 25 years, it's people who spend an increasing amount of their money on travel and entertainment. According to the Bureau of Economic Analysis, entertainment, recreation, hotel, and food service spending has been growing about 50% faster than the overall economy over the past two decades. That's a major tailwind for a company like Wynn Resorts.

What Wynn has in its favor is that it controls some of the most profitable resorts in the best gaming markets in the world. In Las Vegas, Wynn's property is the most profitable of all the resorts on the Las Vegas Strip, and Steve Wynn developed the second most profitable property, Bellagio, which MGM Resorts now owns. In Macau, Wynn Macau and Wynn Palace combined could generate over $1.5 billion in EBITDA in 2018, a proxy for cash flow from a resort, and if the region keeps growing at a double-digit rate, $2.0 billion in EBITDA annually isn't out of the question.

WYNN Revenue (TTM) data by YCharts

What investors should really like about Wynn Resorts is that its growth days aren't over. Wynn Boston Harbor near downtown Boston is under construction, and the golf course behind Wynn Las Vegas will soon be torn up to make way for a new hotel tower, convention space, and a lagoon for entertainment. If all goes well, the company could even win a bid to build a casino in Japan, a highly sought-after prize that may be decided in 2018.

The gaming market is highly regulated, and that means there are a limited number of key players that can build megaresorts like Wynn in highly coveted markets. If spending on travel and entertainment rises, the company will continue to out-grow the economy overall. Those are trends in investing that I want to ride for the next 25 years.

The picks-and-shovels way to play e-commerce

Jeremy Bowman (XPO Logistics): It's been said about the gold rush that the people who got rich weren't the propsectors, but the ones selling the picks and shovels.

E-commerce is shaping up to be the gold rush of this era, with consistent annual growth around 15% as it takes share from the massive retail market, but as companies such as Amazon.com duke it out with traditional retailers building out their own e-commerce infrastructure, a surefire winner in the picks-and-shovels sense looks like XPO Logistics.

The supply chain and logistics company specializes in last-mile delivery of heavy goods such as furniture and appliances, and it's now the large provider of such services in North America. It's the one to whom retail giants such as Ikea, Amazon, and Home Depot turn to support their burgeoning online sales of such goods.

XPO stock has already been a success story, with shares up 664% since September 2011, when Brad Jacobs became CEO. Jacobs brought his expertise as a "roll-up" specialist to XPO, where he's made slew of acquisitions of logistics providers and freight companies to make XPO one of the biggest providers of transportation and logistics services in the world. The stock's 112% gains last year were prompted by Jacobs' saying the company would again look into acquisitions after taking a break to absorb recent ones, and the stock popped at the end of the year on a surprising report that Home Depot had considered making a buyout play for XPO, in part to keep it out of the hands of Amazon.

Such a takeover would bring an end to the XPO stock story, but it underscores the unique value the company provides in e-commerce. Whether in public or private hands, XPO should see booming growth over the next 25 years.

No red flags or old hat in Red Hat

Anders Bylund (Red Hat): Open-source software veteran Red Hat has been around for two decades so far. In another 20 or 30 years, the company should really start to hit its stride.

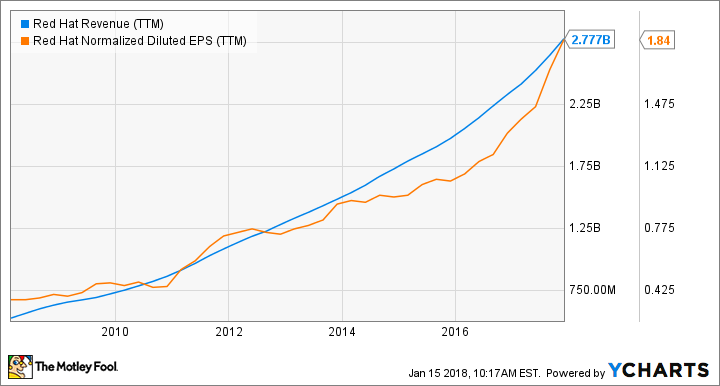

If you were impressed by Red Hat's growth in 2017, you could be forgiven for thinking of it as a hungry little start-up. Share prices rose 72% last year, fueled by three earnings surprises and four revenue beats. In the recently reported third quarter of Red Hat's fiscal year 2018, earnings rose 20% year over year on 22% higher sales. And the growth is only accelerating on both the top and bottom lines:

RHT Revenue (TTM) data by YCharts

Typical high-growth gadfly stuff, right?

But after 19 years on the public market and 25 years of software development operations, Red Hat sports a $22 billion market cap and $2.8 billion in trailing revenue. The balance sheet is rock solid, with nearly twice as much cash as long-term debt on the books.

These days, Red Hat has expanded beyond its traditional stronghold market of enterprise-grade operating systems. The company's products touch every stage of the Internet of Things data pipeline, Red Hat's OpenStack and OpenShift solutions have become the gold standard for modern cloud computing platforms, and advanced tools for application development form the core of Red Hat's highest-growth operations.

In short, Red Hat is already a well-respected and important member of the enterprise software industry, but the company is only getting started.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anders Bylund owns shares of Amazon and Red Hat. Jeremy Bowman has no position in any of the stocks mentioned. Travis Hoium owns shares of Wynn Resorts. The Motley Fool owns shares of and recommends Amazon. The Motley Fool has the following options: short May 2018 $175 calls on Home Depot and long January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot and XPO Logistics. The Motley Fool has a disclosure policy.