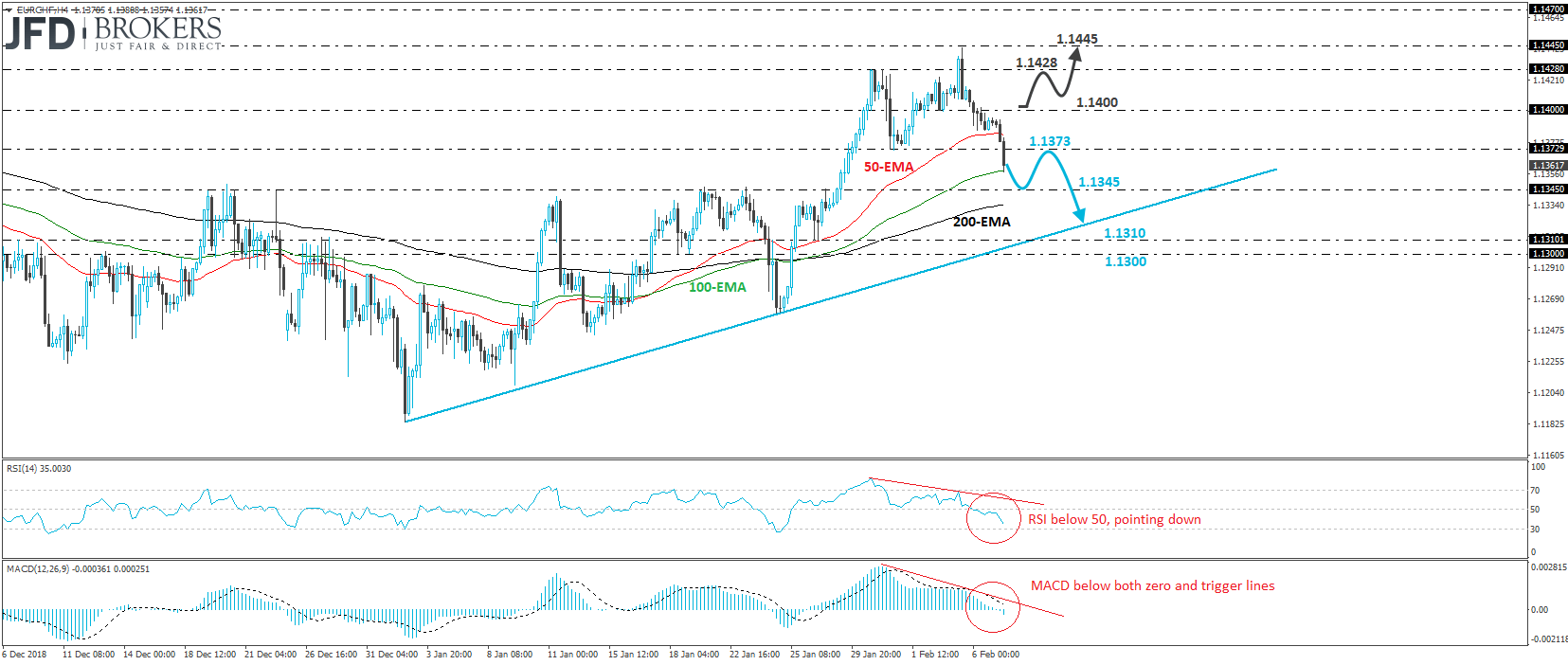

EUR/CHF traded lower during the European morning Thursday, breaking below the key support zone of 1.1373, marked by the low of January 31st, that way confirming a forthcoming lower low on the 4-hour chart. Although the rate continues to trade above the tentative upside support line drawn from the low of January 2nd, today’s slide suggests that there is room for some further declines, perhaps towards that line.

We believe that the dip below 1.1373 may have initially opened the way for the 1.1345 key support zone, which proved to be a strong resistance from the beginning of December until January 29th, when it was broken to the upside. We could see a rebound from that zone, but if the rate fails to move back above the 1.1373 barrier, we see a decent chance for another slide and another test near 1.1345. It that area fails to support the pair this time, then we may experience downside extensions towards the aforementioned upside line, or the 1.1310 area, defined by the low of January 28th.

Shifting attention to our short-term oscillators, we see that the RSI lies below 50 and looks to be heading towards 30, while the MACD lies below both its zero and trigger lines, pointing down as well. Both indicators detect negative momentum and support the notion for this exchange rate to continue correcting lower for a while more.

On the upside, we would like to see a clear break above 1.1400 before we start examining whether the setback is over earlier, and whether the bulls are back in the driver’s seat. Such a break could initially aim for the 1.1428 zone, the break of which could carry extensions towards the high of February 5th, which fell just shy of the 1.1445 hurdle.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.