- The BTC/USD had an exciting week, recovering nicely and making a nice U-turn.

- Interest from Morgan Stanley pushed prices higher and so did Mike Novogratz's comments.

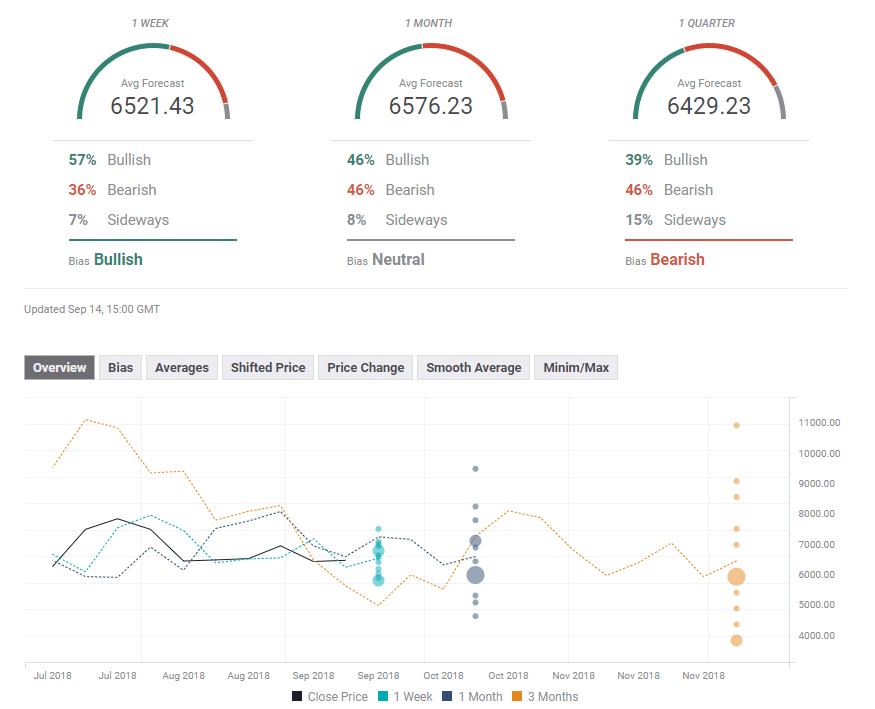

- The technical picture is mixed for the digital coin. The expert poll shows a bullish bias in the short-term and a bearish one afterward.

The price of Bitcoin made an impressive recovery, advancing from enjoying a bounce of over $400 and topping $6,500. Morgan Stanley is reportedly venturing into Bitcoin trading, responding to demand from clients. The report from Bloomberg on the topic may have been the trigger, but other reports suggest significant short-covering after a sharp sell-off beforehand.

Citigroup, another financial behemoth, is also showing interest in digital coins. Goldman Sachs vehemently denied new that it is abandoning its plans for a crypto trading desk. An ex-Goldman Sachs banker and ex-hedge fund manager, Mike Novogratz, said that Bitcoin has bottomed out. He is heavily involved in the blockchain world as a crypto fund manager.

The focus now turns to the next deadline for approving a Bitcoin Exchange Traded Fund (ETF). The Securities and Exchange Commission (SEC) has set September 21st as the new deadline for approving or disapproving five Bitcoin ETF's. These are Direxion Daily Bitcoin Bear 1X Shares, Direxion Daily Bitcoin 1.25X Bull Shares, Direxion Daily Bitcoin 1.5X Bull Shares, Direxion Daily Bitcoin 2X Bull Shares, and Direxion Daily Bitcoin 2X Bear Shares.

The deadline for the Direxion requests precedes a September 30th deadline for other significant ETF contenders. ETF's are critical for Bitcoin as they provide a gateway for mainstream traders and investors to enter the world of digital currencies. Speculation about ETF's has been a crucial mover for crypto prices.

To understand more about ETF's see: Bitcoin ETF explained: 9 questions and answers about the critical crypto catalyst

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

What's next for Bitcoin?

BTC/USD Technical Analysis - A few bullish signs

The recent downturn did not reach the lows below $6,000, and this is a bullish sign. However, other indicators are more nuanced. The BTC/USD is still trading below the 50 and 200 Simple Moving Averages. Momentum and the Relative Strength Index are not going anywhere fast.

$6,630 capped the pair in August and looms over prices at the time of writing. $6,870 was a swing high in mid-August and then a temporary low later in the month. $7,145 capped the pair in early August and served as support in early September. Close by, $7,200 cushioned the BTC/USD price just before the most recent drop. $7,400 was the peak early in September.

Looking down, $6,200 was a support line in August and also helped the pair stabilize this week. It is closely followed by $6,110 which was the low point of the downturn. Below the round level of $6,000, we find $5,891 as the August low before the 2018 trough of $5,770.

The Forecast Poll of experts shows a bullish bias in the short term and a bearish one in the long term. Forecasts have been bumped up higher in the past week.

More: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: last breath or rebirth for Ethereum?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

CAKE price bottoms out as PancakeSwap announces $25 million burn

PancakeSwap’s price increased nearly 3% on Monday after the decentralized exchange platform on the Binance Smart Chain announced a token burn of more than 8.9 million CAKE tokens, collected from trading fees across Automated Market Makers Version 2 and 3 of the platform.

Ripple lawsuit to see SEC response on Monday, XRP nears 4.5 million mark in liquidity pools

Ripple closed above $0.52 on Sunday and resumed its climb on Monday, May 6. Sentiment among market participants is positive as traders await Securities and Exchange Commission response filing and XRP locked in Automated Market Maker liquidity pools crosses 4.31 million.

Crypto AI tokens post near double-digit gains amidst launches from NVIDIA, OpenAI and Amazon

AI-based cryptocurrencies have experienced nearly double-digit or higher gains on Monday, well above the price increases seen among the main crypto assets, likely fuelled by recent announcements of new developments from AI and tech giants in the US.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin’s consolidation crosses the two-month mark but shows no signs of a breakout or a directional move. Investors waiting with bated breath for a volatile move remain confused about whether to buy the dips or keep some cash reserves for a rainy day.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

-636725176863982964.png)