GBP/EUR FORECAST UPDATE: The British £ to Euro exchange rate remained confined to a narrow range into Friday's session with Sterling last seen trading at €1.13250, down a shade form the daily open.

With Brexit remaining at the fore, data-releases remain secondary market drivers. Nevertheless, Friday's German and Italian CPI releases could provide some short-term volatility. Given the enduring persistence of the range however and the overarching Brexit issue, the releases are unlikely to have much impact beyond the short-term.

Expectations for progress on the Brexit front remain limited as UK lawmakers appear to be focusing on anything but Brexit. First EU elections took precedence, now the Tory leadership contest - meaning since the collapse of cross-party talks there's been absolutely nil progress Brexit-wise.

Moving forward, this isn't likely to change in the coming weeks. "The UK political process has slipped into neutral while the Tory leadership campaign unfolds. Next week’s Cabinet meeting has been cancelled, reflecting the fact that the business of running the country and trying to resolve things like, oh I don’t know, Brexit have been put on hold while the Conservatives sort themselves out," wrote Scotiabank analysts.

Such political paralysis is likely to keep investors side-lined as they await the outcome and the ramifications for Brexit, limiting GBP upside.

Meanwhile, the Euro doesn't look much more appealing with a drop in CPI forecast and rising political unease within the bloc.

"Lower CPI in Germany would point to lower inflation in the eurozone in May, which is unlikely to bode well for the euro," wrote ING economist, Petr Krpata, adding "Italian Deputy Prime Minister Matteo Salvini’s threat that he is prepared to end the coalition government unless his coalition partner supports his tax plan is also a negative for the EUR."

With bilateral negative pressure, the range-bound forecast appears to be supported for now which is likely to persist in lieu of a major Brexit breakthrough.

The British pound to Euro exchange rate languished close to three-month lows during Thursday's session with the cross confined to a narrowing range following two weeks of dramatic Brexit-spurred losses.

At the time of writing, Sterling was last seen trading at €1.13356, down a shade from the session open but failing to extend Euro gains against the UK£.

The GBP enjoyed a solid first quarter (2019) against the single currency as Brexit-related optimism buoyed the £ while persistently weak Euro zone economic data releases and the European Central Bank removing all prospects of 2019 rate hikes saw the EUR soften.

Despite the considerable upside potential, the looming March 29th Brexit deadline prompted Sterling bulls to take a breather as market fears of a no-deal by default scenario weighed on sentiment. The subsequent EU council decision to grant an extension until October 31st was met with short-term cheers, spurring the GBP higher but failing to push through important technical resistance levels.

March and April saw the Pound-to-Euro range-bound before rising Brexit uncertainty - following the breakdown of cross party talks, PM May’s resignation and the start of the Conservative Party leadership contest - prompted a substantial Sterling sell-off in May with the GBP on track to post its largest monthly losses in over a year.

While political uncertainty has been abundant, the UK has remained on a reasonably stable economic footing with fundamentals reflecting a high degree of resilience - largely thanks to robust consumer spending.

In light of the underlying fiscal footing, Bank of England (BoE) policymakers - while holding off on adjusting interest rates amid uncertainty relating to the UK's future relationship with the European Union - have persistently reaffirmed their intent to increase UK interest rates to keep inflation in check.

For the Euro, economic releases have continued to underwhelm into Q2 - pushing back expectations of a 2019 rebound in the bloc. Since the turn of the year, momentum has continued to slow with sentiment in the doldrums and PMIs dipping in and out of contraction (sub 50) territory. The manufacturing sector has been particularly downtrodden - first attributed to transient factors but now also facing deteriorating global demand.

While not implicit in the US-China trade spat, global trade tensions have also contributed to the Euro-negative outlook, weighing on exports. Furthermore, President Trump looks set to put the bloc in his cross-hairs for his next round of trade re-negotiations.

Interest Rate Outlook Favours GBP but Brexit Uncertainty to Cap Upside

In their latest quarterly exchange rate review, strategists from Lloyds Bank's Commercial Banking branch (LBCB) see bilaterally negative factors at play in the Pound-to-Euro currency pair with these forces expected to leave GBP/EUR range-bound over the forecast horizon.

On a positive note for the British £, LBCB strategists expect the respective stances of the Bank of England (BoE, on hold but hawkish) and the European Central Bank (ECB, firmly on hold) to weigh in favour o the GBP as policy rates widen.

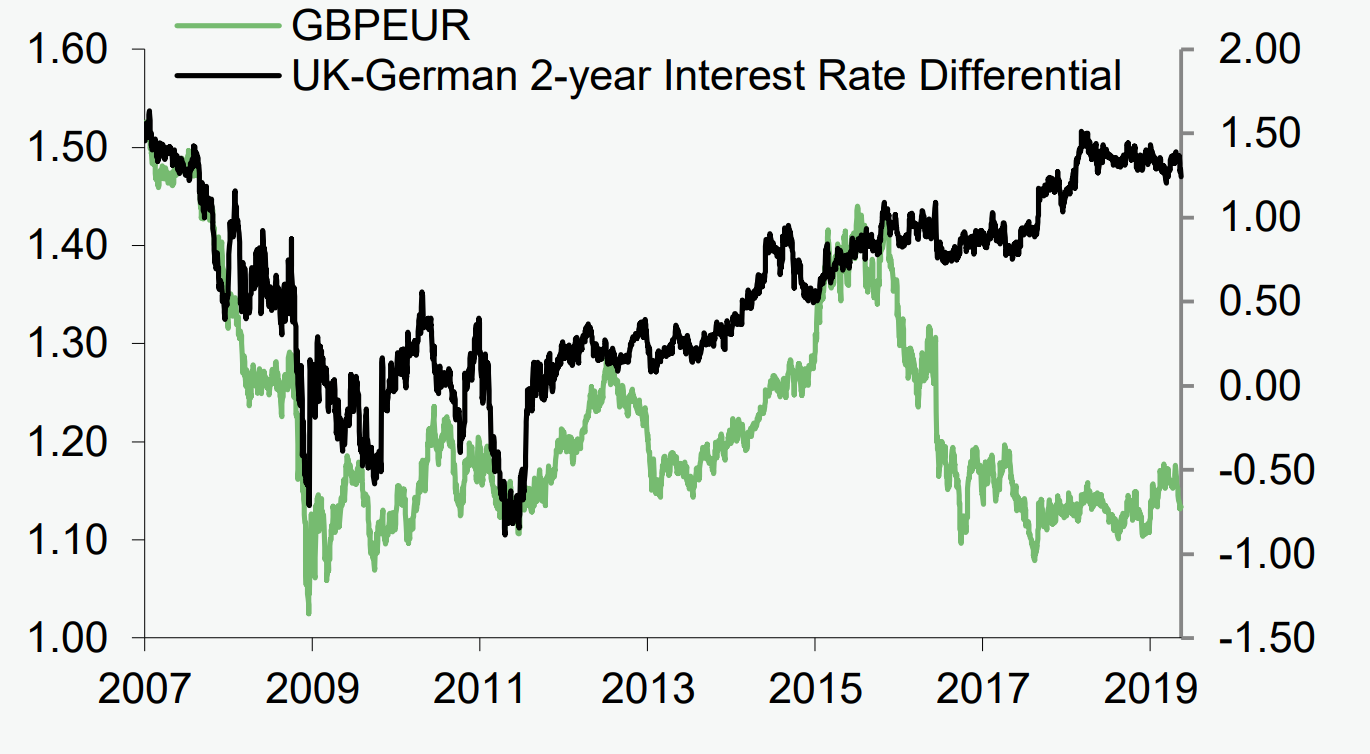

Above: LBCB GBP/EUR and UK-German 2-year Interest Rate Differential

"Our respective views on BoE and ECB policy rates imply a further widening in UK versus European (German) interest rate differentials. We have the UK-German 2-year and 10- year interest rate spreads widening by a 20bps (to 1.5% and 1.4% respectively) over the next 12 months," wrote strategist Gajan Mahadevan, adding "This would put the 2-year differential at its widest (in favour of the UK) since early 2007. At the margin, such price action may push GBP/EUR higher (as, by historical standards, it’s at a depressed level given the relative interest rate dynamics)."

While disparate outlooks from the respective central banks looks set to favour a stronger Pound, rising political risks are driving the currency pair in the opposite direction as investors ramp up their no-deal Brexit probabilities.

For evidence, look no further than the record-breaking losing streak which saw the Pound to Euro rate fall for fourteen consecutive sessions in May. While uncertainty has been apparent in market pricing since the EU referendum in 2016, concerns have intensified over recent weeks following the breakdown of cross-party talks, PM May's announced resignation and a growing number of pro-Brexit Tory candidates emphasising that in lieu of better terms from the EU, the UK will withdraw without a deal on October 31st.

Compounding this negative view, the EU's chief negotiator, Michel Barnier reasserted the EU's position on the withdrawal agreement, i.e., it isn't open for re-negotiations.

"If the UK wants to leave in an orderly manner, this treaty is the only option. If the choice is to leave without a deal—fine. If the choice is to stay in the EU—also fine," said Barnier, adding "But if the choice is still to leave the EU in an orderly manner, this treaty is the only option. This is all that our legal constraints allow."7

While the risks of a no-deal outcome have clearly risen over recent weeks, the upside risks surrounding a potential second EU referendum or snap general election have also climbed over recent sessions.

Initially refusing to be drawn, Labour Party leader Jeremy Corbyn appears to have made a u-turn on his position regarding fresh public votes to break the Brexit impasse.

Speaking to Sky News, Corbyn said "Faced with the threat of no deal and a prime minister with no mandate, the only way out of the Brexit crisis ripping our country apart is now to go back to the people. Let the people decide the country's future, either in a general election or through a public vote on any deal agreed by parliament."

Faced with such polarised potential outcomes, Sterling speculators are faced with a distinctly binary proposition based on the likelihood of the UK withdrawing from the EU with or without a deal - or perhaps not leaving at all. Unsurprisingly, volatility in the GBP has tumbled and remains subdued.

"The risk of a no deal and no Brexit have both increased and that’s why volatility remains low,” wrote senior Mizuho economist, Colin Asher, adding "The problem is both extremes have become likely and you don’t want to bet the farm on either.”

Summarising the Brexit outlook and the implications for the Pound to Euro rate, Lloyds' Mahadevan wrote "Should we see little progress going into October and the risk of ‘no deal’ rise further, GBP/EUR is likely to fall. Alternatively, an agreement passing through Parliament would, in contrast, alleviate some of the near-term uncertainty."

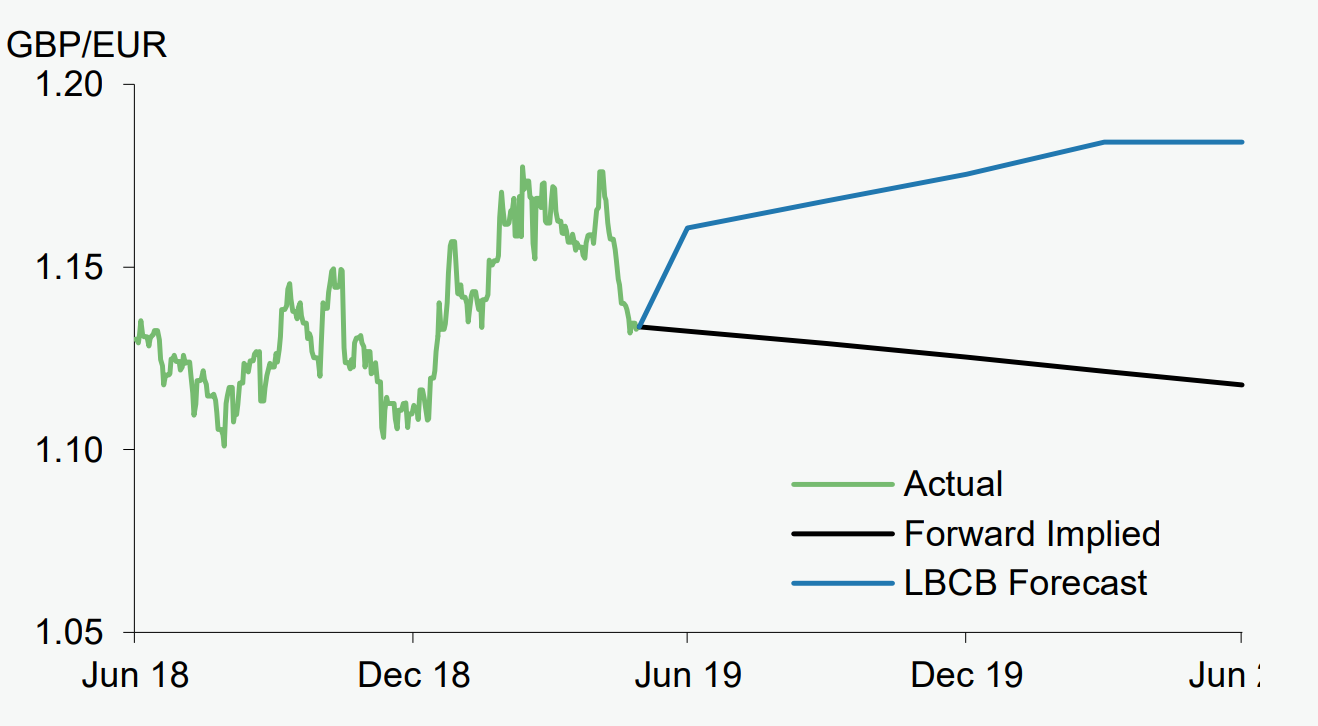

Overall, with bilateral pressures acting on the cross, LBCB's latest GBP/EUR forecasts expect the cross to remain range-bound over the forecast horizon, targeting the upper bound of the current range by year-end and remaining around that level throughout 2020.

Above: Lloyds Bank Commercial Banking GBP/EUR Forecast

"We expect GBP/EUR to be broadly unchanged over our 2-year forecast horizon," wrote Mahadevan, "While the UK economy is currently outperforming the Eurozone and the BoE looks more likely to raise interest rates than the ECB, political turbulence in Westminster seems to be dampening optimism and confidence in parts of the UK economy. This uncertainty looks likely to persist in the near term, as many Brexit options are still on the table and there doesn’t appear to be a clear or generally favoured path. All considered, we forecast GBP/EUR at 1.18 at end-2019 and end-2020."

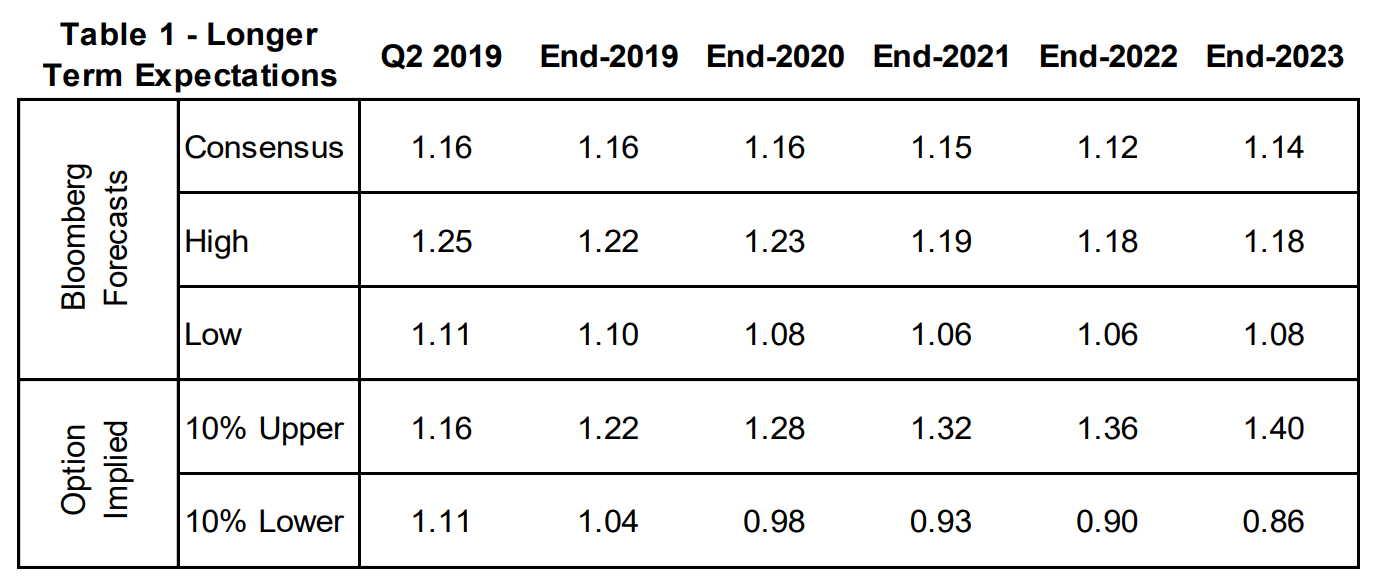

Relative to consensus forecasts of institutional investors compiled by Bloomberg, LBCB retain a slightly more bullish outlook on the Sterling with median forecasts projecting the cross to trade around the €1.16 level until the end of 2020 before drifting lower.

Above: Consensus GBPEUR Exchange Rate Forecasts Compiled by Bloomberg

With the political environment the core driver for the GBP moving forward and reflecting the binary outcomes on the table coupled with an abundance of uncertainty, GBPEUR rate forecasts are unsurprisingly of the low-conviction variety with any interim changes in the political landscape and outlook for Brexit holding the potential to drastically impact Sterling markets.