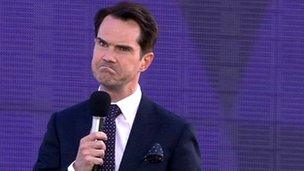

Comedian Jimmy Carr: I've made terrible error over tax

- Published

- comments

Comedian Jimmy Carr says he has "made a terrible error of judgement" over using a tax avoidance scheme.

In a statement on his Twitter account, Mr Carr said he was no longer involved in the K2 tax shelter.

Prime Minister David Cameron on Wednesday called Mr Carr's use of the scheme "morally wrong".

But the PM refused to comment on Take That star Gary Barlow's tax affairs - saying it was a different case - after Labour called for his OBE to removed.

The K2 tax scheme used by Mr Carr is a way of lowering the amount of tax paid. It is legal and Mr Carr made clear in his statement it was fully disclosed to HMRC.

In a series of messages on Twitter Mr Carr said: "I appreciate as a comedian, people will expect me to 'make light' of this situation, but I'm not going to in this statement.

"As this is obviously a serious matter. I met with a financial advisor and he said to me 'Do you want to pay less tax? It's totally legal'. I said 'Yes'."

"I now realise I've made a terrible error of judgement.

"Although I've been advised the K2 Tax scheme is entirely legal, and has been fully disclosed to HMRC (Her Majesty's Revenue and Customs).

"I'm no longer involved in it and will in future conduct my financial affairs much more responsibly. Apologies to everyone. Jimmy Carr."

More than 1,000 people, including Mr Carr, are thought to be using the Jersey-based K2 scheme, which is said to be sheltering £168m a year from the Treasury.

Under the K2 scheme, an individual resigns from their company and any salary they subsequently receive is paid to an offshore trust.

Downing Street welcomed Mr Carr's apology.

A spokeswoman said: "HMRC are working hard to investigate the sort of scheme that Jimmy Carr had been reported to be involved in to ensure that they are not aggressively avoiding tax, and, if they are, they are closed down."

She defended Mr Cameron's decision to speak out about an individual's tax affairs - in contravention of normal government practice.

"The prime minister was expressing what probably lots of people felt after reading the coverage," she said.

Business Secretary Vince Cable also backed the prime minister, telling BBC Radio Sheffield he was not prepared to go "through a hit-list of our celebrities" but adding: "We just want people to pay their dues."

The Lib Dem minister said he did not use tax avoidance schemes himself and that, as far he knows, no members of the cabinet did either, saying: "We observe the law... but also try to set an example."

'Unfair'

According to The Times newspaper, which first published details of Mr Carr's tax arrangements, the K2 scheme enables members to pay income tax rates as low as 1%.

The prime minister was asked about Mr Carr's arrangement on Wednesday during a visit to Mexico for the G20 summit.

He told ITV News the comedian's tax affairs were "straightforward tax avoidance" and it was unfair on the people who pay to watch the comic perform that he was not paying his taxes in the same way that they did.

"I think some of these schemes - and I think particularly of the Jimmy Carr scheme - I have had time to read about and I just think this is completely wrong.

"People work hard, they pay their taxes, they save up to go to one of his shows. They buy the tickets. He is taking the money from those tickets and he, as far as I can see, is putting all of that into some very dodgy tax avoiding schemes.

"That is wrong. There is nothing wrong with people planning their tax affairs to invest in their pension and plan for their retirement - that sort of tax management is fine.

"But some of these schemes we have seen are quite frankly morally wrong. The government is acting by looking at a general anti-avoidance law but we do need to make progress on this.

"It is not fair on hard working people who do the right thing and pay their taxes to see these sorts of scams taking place."

'Take That'

Labour leader Ed Miliband opted not to join in with the chorus of criticism of the 8 Out of 10 Cats star's tax affairs.

Accountant Ronnie Ludwig: We do not sit in judgement of our clients' moral values

He said: "I'm not in favour of tax avoidance obviously, but I don't think it is for politicians to lecture people about morality.

"I think what the politicians need to do is - if the wrong thing is happening - change the law to prevent that tax avoidance happening."

Shadow leader of the House of Commons Angela Eagle turned her fire on Take That star Gary Barlow, who with two bandmates, is facing questions about £26m they are alleged to have invested in a scheme that is facing a legal challenge from HMRC.

The Labour MP said: "The prime minister rushed to the TV studios to condemn the tax avoidance scheme used by Jimmy Carr but he did not take the opportunity to condemn as morally repugnant the tax avoidance scheme used by Conservative supporter Gary Barlow, who's given a whole new meaning to the phrase 'Take That'.

"If it's all so morally repugnant, why has he just been given an OBE in the birthday honours list?

"Why is the prime minister's view of what's dodgy in the tax system so partial? Sir Philip Green has interesting tax arrangements but far from being labelled morally repugnant in a Mexico TV studio, he's got a government review to head up."

Retail magnate Sir Philip has firmly denied avoiding hundreds of millions of pounds in tax by transferring ownership of his Arcadia business, saying that Arcadia was bought by his wife, Lady Green, in 2002 and because she has not lived in the UK for 15 years no tax was due on any dividends that were paid to her.

During a joint press conference with Burmese opposition leader Aung San Suu Kyi Mr Cameron declined to comment on Mr Barlow's tax affairs.

He said he was not "going to give a running commentary on different people's tax affairs", and said he had made "an exception yesterday... it was a particularly egregious example".

Mr Carr, who has satirised "fat cat" bankers, is reported to protect £3.3m a year from tax by channelling cash through the K2 scheme, which is under investigation by HMRC.

The comedian is thought to be one of more than 1,000 beneficiaries who shelter some £168m from the taxman each year using the company.

- Published21 June 2012

- Published21 June 2012

- Published20 June 2012

- Published21 June 2012

- Published14 June 2012

- Published24 May 2012

- Published28 March 2012