Things felt like they were finally turning around for Aaron Woodrum in March 2015 after several months of unemployment. The 38-year-old had fallen behind on bills, causing his credit score to slip. But, thankfully, he’d secured a new job, bolstering his prospects. He just needed a car.

Living in Plainfield, Indiana, population 31,000, a vehicle is almost always necessary to get—and keep—a job. One day, he found a solution: an online ad for an auto dealer that offered financing to consumers with low credit scores. Woodrum said he filled out a form and, shortly after, the dealership gave him a call.

When he arrived, Woodrum found a 2009 Dodge Ram 1500 that seemed perfect. He had a decent chunk of savings, $4,000, as a down payment. The dealer said that was more than enough.

“I didn’t think I’d get one because of my credit,” he said. “But they worked it out somehow.”

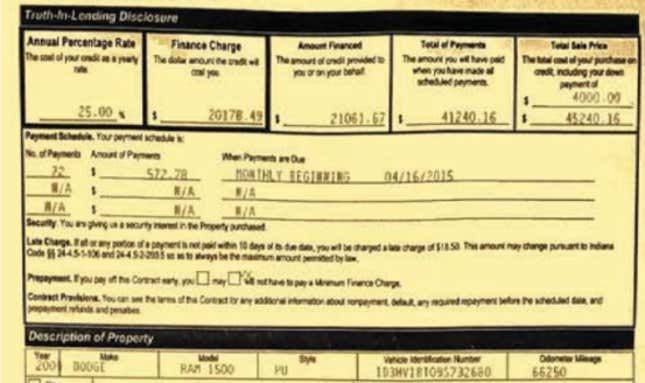

The sales price of his truck was about $21,000. Woodrum purchased a service contract for $2,500, and the dealer worked out a loan that carried an annual percentage rate of 25 percent. The terms required him to pay $573 per month for the next six years.

“At the time I got it, I did some numbers in my head, and I thought I could make it work,” he said. “I thought it was a little high... but right now it’s the only place that’s willing to give me a chance to get a car. So I said, ‘I’ll make it work.’”

Woodrum put his $4,000 down that day. But in the end, thanks to the double-digit interest rate, the loan agreement called for him to pay a total price of roughly $45,000, more than double the car’s original price, for a seven-year-old Dodge Ram with 66,000 miles.

A new 2017 Dodge Ram Rebel retails at $45,095.

Woodrum had the truck for less than two years. By late 2016, the nearly $600 monthly payments to Santander Consumer USA, the holder of his loan, proved too difficult to maintain. Woodrum said he kept in touch with Santander, working out arrangements to catch up, but in mid-December, the financial institution repossessed his vehicle.

“It was the payments,” he said. “I was paying so much on insurance, because it was a financed car. All in all, if you add in that, and the insurance, I was paying $750 a month.”

It may seem easy to write Woodrum off as ignorant of finance, or budgeting, or the car buying process. In reality, he’s one of thousands of people in recent years who have been ensnared in high-interest “subprime” car loans aimed at buyers with bad credit, often with no attempts to verify their income—loans that have led to multiple repossessions of the same vehicle and an endless cycle of repossession fees to get their cars back.

And Woodrum’s lender in particular, Santander Consumer USA, has been singled out by regulators and authorities as one of the most problematic companies for subprime car loans. But few protections exist for car buyers, especially those in bad economic situations to begin with and who need a vehicle no matter what so they can stay employed.

Cars and jobs lost. Credit scores, once just low, have been permanently ruined. State attorneys general have launched lawsuits and investigations.

It is the ugly underside to the cheery narrative about the auto industry’s sales resurgence after the recession, achieved on the backs of some of the more desperate people in the country. It’s a system that primarily targets poor people, set up to make them fail over and over again, while financial institutions make a lot of money.

Now, like the housing market a decade ago, the question is this: when does it all explode?

The Bubble

The question of whether a subprime auto loan bubble exists—and, if so, when it’ll pop—has come up time and again in recent years.

Following the near-total collapse of the global economy in 2008, spurred by a crush of bogus subprime mortgages, and the resonance of 2015's The Big Short, a film adaptation of the seminal book on the housing meltdown, that concern makes sense. After banks emerged from the financial crisis virtually unscathed, investors turned their eye back to auto lending as the next subprime craze.

As car buying skyrocketed after the recession to record heights, more Americans with bad credit started obtaining auto loans—oftentimes with interest rates as high as 29 percent, exploiting consumers who lacked education, financial acumen or were simply desperate to get a vehicle so they could get to work.

Banks and financial institutions say there are enough safeguards in place that allow them to provide financing for people who otherwise couldn’t purchase a car. But the influx of investor cash enabled lenders to loosen underwriting standards, increasing the number of risky loans in the market that carry high rates and questionable terms.

And Wall Street has performed the same dance with auto loans that turned the explosion of subprime mortgages into an economic catastrophe: thousands of auto loans for subprime consumers—generally defined as having a credit score of 620 or less—are packaged into complex bonds.

The bonds are sold as securities to investors, like mutual funds and insurance companies, feeding a vampiric appetite for profit.

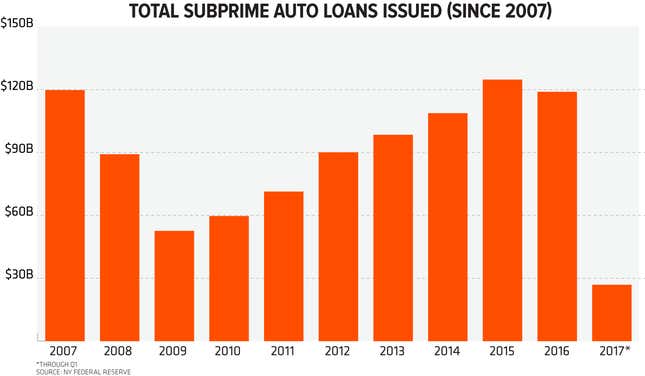

But, if there was a warning to respond to a few years back, no one heeded the call. New car loans lasting 73, 84, sometimes 96 months have soared. Between 2009 and 2016, loans issued to people with bad credit jumped from $52.6 billion to $119 billion, an increase of more than 126 percent.

It’s More Common Than You Think

About one in five auto loans last year went to consumers considered subprime.

Over the last several years, the total number of auto-loan securities packed with “deep” subprime loans—those with lenders that have credit scores below 550—increased from 5.1 percent to 32.5 percent, according to Bloomberg, leading to more delinquencies and concerns from financial analysts who say that auto loan performance “continues to deteriorate.” Auto loan fraud is at a level that hasn’t been seen since the mid-2000s, right before the economy fell into shambles.

Lenders could be forced to tighten standards, a potentially troubling development for an industry already in a precarious position. Financial institutions have slightly pulled back this year on issuing loans to subprime borrowers, but it may been too little to late.

To be sure, the auto lending boom almost certainly won’t crater the economy the way housing did in the 2000s. Auto loans currently comprise $1.17 trillion of outstanding debt in the U.S., whereas mortgages account for $9.09 trillion.

That’s why comparing subprime auto loans to mortgages misses the point: it’s not an economy-busting crisis in-waiting. It’s a personal crisis instead.

Access to a car or reliable transportation is known to be a necessity for low-income people trying to escape poverty, or just survive, and wide swaths of the country have felt stretched to the limit to meet their monthly bills, a sentiment that was made abundantly clear in the recent presidential election.

Those who default on a car loan can fall into a nasty, cyclical trap: their credit gets shot, they lose their vehicle, they struggle to make arrangements to gather money to get their car back, fall behind on their bills, lose their car again. Rinse and repeat. Meanwhile, they’ve lost the ability to gain access to financing in the future without onerous terms.

Auto lenders themselves forecast gloom on the horizon; this month, for instance, Wells Fargo announced it was overhauling its auto lending business, in light of growing trouble in the market. The move is expected to result in hundreds of job losses.

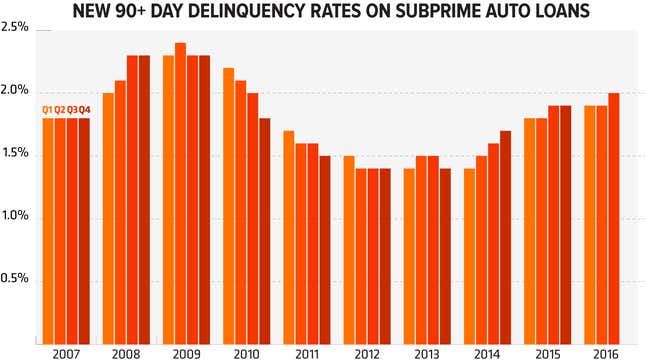

And with delinquencies for subprime auto loans still on the rise—last fall, 90 day delinquencies hit a six-year high of 2 percent, returning to post-crisis levels; total 90 day auto loan delinquencies are now up to 3.82 percent—the situation may prove to be an unchecked catastrophe on a personal-level, saddling people with insurmountable debt.

“If even one borrower one person is getting victimized by a predatory auto loan, that’s one victim too many for me and my office,” Maura Healey, the Massachusetts Attorney General, told Jalopnik in an interview. “Because that has a consequence for that person, for that family, for their livelihood.”

Whatever The Lenders Want

New York resident Franklyn Garcia knows what that’s like. In 2015, he brought a suit against Chrysler Capital—the partnership between FCA and Santander—alleging it relies on local dealerships to skirt laws that prohibit excessively high interest rates.

It’s a loophole, more or less: The dealers are free to set terms with whatever interest rate they want, before immediately passing along the loan to financial institutions like Santander, which otherwise would have to abide by the usury laws.

According to Garcia’s complaint, he purchased a used 2011 Dodge Durango for $26,000 with a loan that carried an interest rate of 23.67 percent. By the end of the 72-month loan, Garcia would’ve paid more than double for the vehicle.

But a federal judge agreed with Santander, saying New York state law allows dealers to charge whatever interest rate they want. The judge’s opinion reads as if he believed his hands were tied.

“Although the alleged conduct permits the inference that Santander exerted influence over the credit charge rate ultimately provided by B&Z Auto—such as by providing a buy rate and maximum markup on the buy rate—there are no allegations that anyone other than B&Z Auto and Plaintiff agreed to the credit charge rate, or that B&Z Auto was under any obligation to align the credit charge rate with the terms provided by Santander,” the judge, Edgardo Ramos, wrote.

“Yet the MVRISA’s silence also indicates that there is no statutory basis for Plaintiff’s claim that the alleged conduct was improper,” Ramos added.

Some consumers could see relief soon. In March, Massachusetts’ Healey announced a $22 million settlement with Santander, which she said had funded “unfair and unaffordable auto loans” to more than 2,000 Massachusetts residents through abusive practices. (Santander neither admitted nor denied the allegations as part of the settlement.)

“We don’t want cars to be a vehicle for [financial institutions] profiting through predatory practices,” Healey said.

In short, the situation means it’s not a question of what could happen if subprime auto lending isn’t reined in. It’s a matter of what is going to happen.

‘A Microcosm Of The Industry’

If there’s one company that most illustrates the recent rise of subprime auto lending in the U.S., it’s Santander Consumer USA, the American arm of Spanish financial institution Grupo Santander.

“They’re a microcosm of the industry,” said Mark Williams, a former bank examiner with the Federal Reserve and current finance professor at the Boston University Questrom School of Business.

Santander has been the largest issuer of bonds that are backed by subprime auto loans, according to Bloomberg, selling $50 billion of securities in the last decade.

Since 2013, Santander has enjoyed a larger presence in the subprime auto loan market, following the launch of a partnership with Fiat Chrysler to create a full-service financier for low credit consumers. Santander took the company public in 2014, and last year, it posted a roughly $760 million profit. Santander pulled back on auto lending in 2016, reportedly because subprime loans weren’t performing as well as expected.

“In 2016 we made some changes, where we looked at pockets where we weren’t getting paid for the risks we were taking,” CEO Jason Kulas said in February. “We ended up booking less nonprime business.”

Since taking the company public, those risks—while netting the company a profit—have consumed Santander with persistent scrutiny from U.S. regulators.

In 2014, it received subpoenas and civil investigation demands from at least 28 state attorneys generals over its lending practices, according to Securities and Exchange records. In 2015, the company paid a near-$10 million settlement for illegally repossessing more than 1,100 cars that belonged to military service members, in violation of the Servicemembers Civil Relief Act.

In March, as part of the deal Healey announced, the company agreed to pay $26 million to settle allegations from Massachusetts and Delaware.

Santander neither admitted nor denied wrongdoing, but documents from the settlement—which covers loans from 2009-2014—outline a pattern of alleged abuse that mirrors the actions of banks that funded the subprime mortgage explosion a decade ago.

“What I’m concerned about is I’m seeing practices—predatory practices—that are almost identical to what we saw in the mortgage industry that led to the global economic collapse,” Healey said.

In the settlement, Santander also implicated car dealers.

“[Santander Consumer] employees suspected that many of these dealers were engaging in fraud against SC by submitting loan applications reflecting inflated borrower income, thereby inducing SC to purchase loans it might not otherwise have purchased,” the settlement document reads.

‘Something’s Not Right. Something’s Up’

The issues found in Massachusetts weren’t surprising to former Santander employees who spoke with Jalopnik.

For Jerry Robinson, there were noticeably problematic practices in the company’s debt collections unit, up until when he retired August 2016. Robinson’s job entailed working with auto dealers to make sure Santander was repaid for loan fraud—say, for instance, if he found a repossessed car didn’t have a sunroof or wheels, contrary to what a dealer stated in the agreement for Santander to purchase the loan.

But he discovered that Santander tried to return a consumer’s car to them, even if it was evidently clear they couldn’t afford the loan. It worked out to be a lucrative arrangement for Santander; not only would the consumer pay what was past-due, they’d owe repo fees on top.

“That makes Santander look good, because they say this is business on the books,” said Robinson, who now works as a member of the Committee for Better Banks, a group that’s working to unionize Santander employees. Time and again, he found the same consumers getting the same car repossessed by Santander.

“I’ve seen people get repoed three or four times,” he said. “There was pressure there, even when I was working in the reinstatement department, the key there was... how many customers we could get back in the car. That’s how we’d make our bonus.”

Santander spokesperson Laurie Kight disputed Robinson’s allegations, and said the company is “committed to a work environment in which associates are compensated for helping customers improve their account status and return them to their vehicles, as appropriate.” Kight said Santander believed Robinson’s remarks were an attempt by the pro-union group to “unfairly and inappropriately discredit” the company.

But Robinson’s experience inside Santander’s dealer operations department echoed the findings of the Massachusetts and Delaware AGs.

“At Santander’s end, they were not actually doing any type of verification,” he said. “What I saw in dealer authorization is the customer would have the car two or three months, and when I’d go back and do the research to figure out why would this customer have this type of car with this type of payment… well, we weren’t doing any verification.”

Shaneca Gay-Evans, a former worker in Santander’s collections department who’s also with Robinson’s group, said she had a hardened perception of consumers behind on their loan from her prior work experience as a debt collector.

That quickly changed within months of starting at Santander, as calls continued to mount from consumers who claimed their income had been inflated. She said that, at least once a week during her call, she’d meet a consumer with allegedly inflated income.

“When it started happening weekly,” she said, “that’s when I’m like, ‘You know what? Something’s not right. Something’s up.’”

‘Santander Drives The Market’

If you’re wondering why a consumer’s income could be inflated, it’s a common thread from the subprime mortgage boom: stated-income loans—also known by their pejorative, “liar” loans—allow for financial institutions to give money to someone, without verifying the stated income on their form is accurate.

The former Santander employees interviewed by Jalopnik said they often came across consumers who believed their income had been fraudulently inflated. Unlike mortgages, there’s no regulatory oversight of stated-income loans in the auto world.

“What you got to understand is, not only were dealerships looking to Santander to finance loans that other banks probably wouldn’t finance... because of the FICO score,” Robinson said. And again, “At Santander’s end they were not actually doing any type of verification.”

That fits with internal audits conducted by Santander, according to the Massachusetts settlement document. In May 2013, Santander reviewed 11 loans from a dealer in the state and found only one had correct income, while seven were wildly inflated.

“The smallest income overstatement in the verified inflated loans in the review was $45,324/year,” the document said.

A Santander vice president of sales later said, in a November 2013 email, that the high rate of early payment defaults on loans from the group of “fraud dealers” was “likely the result of dealer efforts to inflate borrower income.”

Healey, the Massachusetts AG who secured the settlement, worked for her predecessor in the office during the subprime mortgage collapse, and her past experience is part of the reason why she immediately took interest to the auto lending world.

The AG’s staff launched an investigation after receiving a torrent of complaints from affected consumers, and the settlement—thought to be the first of its kind in the U.S.—is part of an industry-wide investigation by Healey’s office into subprime auto lending and securitization.

“This is just one bank, Santander,” she said. “We got $22 million back for Massachusetts customers; that’s 2,000 car buyers who were given unaffordable loans.

“Think about the ripple effect on the economy,” she continued. “Somebody can’t get to work, loses their job.”

Healey’s investigation found Santander allegedly funded loans without having a “reasonable basis” to believe that borrowers could afford them, the AG’s office said in March.

Santander recognized a high rate of Massachusetts consumers had loan applications that contained inflated incomes, but still continued to fund the loans, according to the settlement document. Santander estimated that 42 percent of subprime loans created in Massachusetts between 2009-2014 have already defaulted or will end in default, the document says.

“Legally the deal is between the dealership and the consumer, said Robert Duff, an attorney who represents Woodrum in an ongoing federal lawsuit against Santander. But the deals are consummated, he continued, “only because [the dealers] believe Santander—or whatever finance company they’re working with—has agreed to purchase the contract.”

“Santander drives the market,” Duff said. “They absolutely drive the market.”

Santander declined to make someone available for an interview and said it doesn’t comment on “active legal matters.” Since 2015, Kight said the company has terminated 800 dealers for “performance-related issues” since 2015. The spokesperson said Santander has a “robust dealer oversight program and zero tolerance for fraud.”

Nevertheless, Santander has maintained what appears to be one the lowest rates of income verification in the industry. In May, analysts from Moody’s said the company verified income on only 8 percent of borrowers for loans that were later bundled into a $1 billion security and sold to investors.

Ally Financial, by comparison, verified incomes on nearly 65 percent of subprime car loans.

The Moody’s analysts said the decision to not verify stated income on an application “creates more uncertainty around whether borrowers will be able to afford their monthly payments, which becomes particularly important if they have poor credit records and risky loan terms.”

Santander disputed the idea that a low rate of income verification translates to flawed standards.

“Our approach to credit underwriting has always included a strong focus on a customer’s ability to repay the loan,” spokesperson Kight said.

‘Borrowers Are Struggling To Keep Up With Payments’

Asked if Santander believes there’s a prolonged role for subprime auto loans in the industry, Kight said its services are far superior to consumers with few options.

“For more than 20 years, we have enabled our customers to access quality, reliable vehicles to help our customers travel to work, school and wherever life takes them,” the spokesperson, said. “We believe that our services provide a better alternative for customers who might otherwise turn to buy-here pay-here businesses, or other unregulated lenders, to obtain a vehicle.”

Lenders have been slightly slowing down on the issuance of subprime auto loans and securities backed by the risky deals. Nonetheless, with the number of loan defaults increasing, there’s concerns abound.

“Underwriting appears to be quite lax last year in subprime auto lending,” the Federal Reserve Governor, Lael Brainard, said in June. “Delinquencies rates suggest some borrowers are struggling to keep up with payments.”

So is there a bubble so massive that it could tank the economy? Depends on who you ask.

For one thing, the current size of the subprime auto loan market is dwarfed by mortgages during the housing boom of mid-2000s, said Lawrence White, an economics professor at New York University. And this time around, he said, financial institutions holding subprime auto loans, or securities backed by them, are in a “better position to absorb the losses.”

“It’s nowhere near the magnitude of what we were seeing a decade ago in terms of the subprime residential mortgage problem,” White said in an interview.

But the personal hardships—a blemished credit score that’s further stained—can be devastating for a borrower who’s unable to repay the loan, he said.

“The standard stories are going to be true, and that’s important, but that’s not an economy threatening phenomenon,” he said. “It’s very personalized, very important. But personalized is not an economy-wide issue.”

Williams, the former Federal reserve bank examiner and current Boston University finance professor, disagreed.

“These are loans to individuals that need cars to be able to, basically, go to work,” he said. “As there’s foreclosures on these cars, and as these folks are then unable to go to work, this puts extra economic pressure on them.”

The growing level of income inequality in the U.S. has continued to rise since the economic crisis of the mid-2000s, a reality that helped shape the uptick in subprime auto-lending. People need a car to get around, and with shoddy credit, there’s few places to turn but a dealer offering steep interest rates on a loan. That reality illustrates why it isn’t so simple to place equal blame on the lender and subprime consumer who defaults.

“If one car breaks down your choices are very limited,” said Catherine Lutz, a professor at Brown University who wrote the book Carjacked, which focuses on the relevance of the automobile in everyday life. “You’ve got to go to a lot the same day, and get a loan, and get a car. Get a used car so you don’t just lose your job.”

The impact on the auto industry isn’t entirely clear, but if the inevitable response to deteriorating subprime loan performance is that lending standards tighten, the outcome seems obvious.

“The main thing is... if these people are going to default, they’re not about to turn around and go into the new car market,” Lutz said, “and no it’s not going to be good for anybody.”

Robinson, the former Santander employee, said he was routinely troubled while working for the financial institution, knowing a customer couldn’t afford a car, but yet his job still entailed seeing what they could do to be reinstated.

“It puts you in a tough situation for this reason, and it’s because, I’m sitting here, and—no offense to the customer—but I know the customer can’t afford the car,” he said. “I know the customer needs the car, so the customer’s in a Catch 22, because the customer’s gonna try to feed their family before they pay their car.”