Did You Participate In Any Of AstraZeneca's (LON:AZN) Fantastic 126% Return ?

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term AstraZeneca PLC (LON:AZN) shareholders have enjoyed a 86% share price rise over the last half decade, well in excess of the market decline of around 8.6% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 17% in the last year , including dividends .

View our latest analysis for AstraZeneca

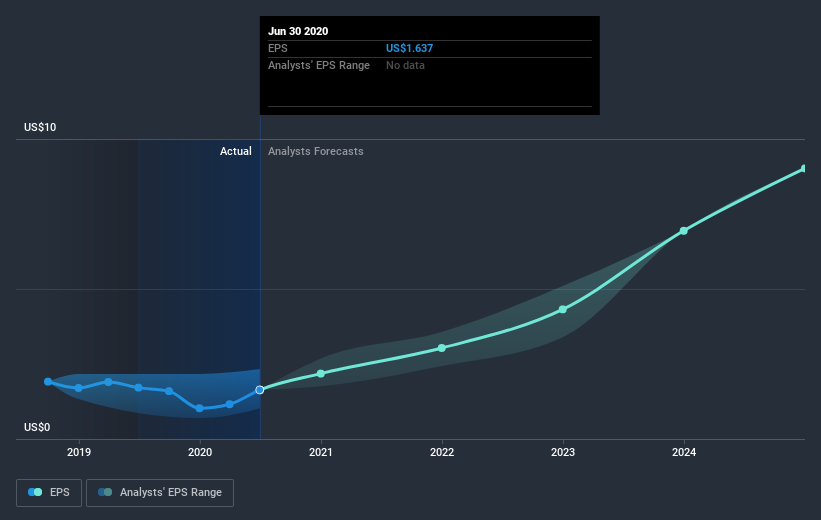

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, AstraZeneca achieved compound earnings per share (EPS) growth of 12% per year. So the EPS growth rate is rather close to the annualized share price gain of 13% per year. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Rather, the share price has approximately tracked EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on AstraZeneca's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for AstraZeneca the TSR over the last 5 years was 126%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that AstraZeneca has rewarded shareholders with a total shareholder return of 17% in the last twelve months. And that does include the dividend. Having said that, the five-year TSR of 18% a year, is even better. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for AstraZeneca you should be aware of, and 1 of them doesn't sit too well with us.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Sport

Yahoo Sport