The GBP dipped against a basket of peers, losing a third of a percent against both the Euro and US Dollar.

The slump comes in the wake of comments from European Commission President, jean-Claude Juncker, who said "My impression is … that this week at the European council there will be no decision, but that we will probably have to meet again next week... Mrs May doesn’t have agreement to anything, either in her cabinet or in parliament.”

While after almost 3 years of negotiation, a few days delay seems inconsequential, given that a no-deal outcome at the end of the month remains a technical possibility, a delayed verdict until next week means that should the EU fail to vote unanimously to back an extension, the UK could still crash out of the EU without a deal.

- ING Further to their longer-term forecast, ING's chief EMEA Foreign exchange and interest rates strategist, Petr Krpata added the bank's near term expectations for the Sterling given it now seems likely the UK will request a short (around 3 months) delay.

Krapata wrote that for the GBP, "The focus remains on Brexit and the EU Council meeting on Thursday and Friday, with growing expectations that Prime Minister Theresa May will ask for an Article 50 extension / Brexit delay."

Looking at the possible outcomes, Krpata added "The latest reports suggest that only a short extension will be requested by the UK. This would, in our view, limit GBP upside vs more sterling strength in the case of longer extension, given that the economic uncertainty would remain and the Bank of England would not be able to hike."

- UBS

Amid confirmed reports that the PM has sent a letter to EU Council President Donald Tusk to request a Brexit delay, UBS strategists remain cautious in terms of directional bets on the Sterling in the near-term given continued uncertainty.

In a note to clients, UBS strategists wrote "Until some clarity emerges, we do not advocate taking directional views on sterling and advise hedging downside risks, but we note that sterling has tended to react positively to events that point to a substantial delay."

- Rabobank

In a note to clients, Rabobank strategists remained upbeat on the British Pound. Based on the logic that a no-deal scenario remains off the radar for the time being, the bank sees the potential to strategically secure GBP longs. They wrote "The predominant notion adopted by the market is that, as long as the worst case scenario of hard Brexit is avoided by delaying Brexit, the pound is a buy on dips."

- Hantec Markets

Following Bercow's torpedoing of Prime Minister May's plans for MV3, Hantec Market's Richard Perry sees focus shifting to the upcoming EU Council summit and Brexit extension verdict.

Perry wrote that Bercow's ruling "puts a pin into the plans for May’s Meaningful Vote 3 (MV3), for this week at least. So it is now over to the EU Council to decide on whether to extend Article 50 this week." In terms of the market reaction to the latest developments, Perry wrote "For their part, UK Gilts and sterling remained remarkably steady at Bercow’s decision, with the feeling that the risk of a no deal Brexit remains limited." Looking ahead, Perry expects the fate of the Sterling to remain Brexit-driven with markets currently in "limbo". He wrote "There is no getting away from the fact that Brexit newsflow is the main driver of sterling and subsequently a big fact in Cable right now. The state of limbo seemingly now (at least until the EU-27 decide on an Article 50 extension) is being reflected now on the charts."

- Lloyds Bank Commercial Banking

Despite a busy week on the hard economic data front, Lloyds analysts anticipate Brexit developments to remain in the proverbial driver’s seat.

They wrote “Domestically, we have a busy key data week, including the latest employment, inflation and consumer spending figures.

However, markets wise this is likely to remain overshadowed by the Brexit process.”

Senior economist Hann-Ju Ho added further colour, writing “The pound could endure another volatile week as the government tries to garner sufficient support for the EU Withdrawal Agreement deal in a third meaningful vote,” adding “Sterling firmed last week, as markets assessed a reduced likelihood of a ‘no deal’ Brexit scenario.

However, uncertainty would be expected to remain should the deal be rejected again. “

- Danske Bank

Danske Bank senior analyst, Mikael Olai Milhøj, expects continued Brexit uncertainty alongside a “slowdown in the rest of Europe” to weigh on the UK economy, and by proxy the British £, in the near-term with the Euro-to-Pound (EURGBP) exchange rate expected to remain range-bound for now.

Further out, over both medium and longer-term forecast horizons, Milhøj expects the Sterling to pick up against the single currency, with a number of factors driving the rally.

Not least, Milhøj anticipates a benign Brexit outcome to bolster the GBP, alongside “continued recovery in foreign investors’ appetite for UK assets,” which “supports the case for a stronger GBP over the medium term.”

Furthermore, Lloyds Bank continue to view the Sterling as substantially undervalued. Milhøj wrote “GBP remains fundamentally undervalued: our G10 MEVA model puts EUR/GBP at 0.78 but our Brexit-corrected MEVA estimate for the cross is around 0.83. Our PPP estimate is 0.78.”

In light of the positives and anticipated Brexit resolution, Lloyds project the EURGBP cross to hit 0.83 in three months and target 0.82 by the six-month mark.

Milhøj wrote “We lower our targets to 0.83 (previously 0.84) in 3M and 0.82 (previously 0.83) in 6M on the back of the ECB’s dovish policy shift. If no deal is reached by then, we expect a long extension, which should also strengthen the GBP. In this scenario, we expect EUR/GBP to trade in the range 0.84-0.86.”

- Commerzbank

Commerzbank currency strategist, Ulrich Leuchtmann, outlined his view that the act of confirming a third meaningful vote on the EU withdrawal agreement could support the Sterling with the ‘go-ahead’ on the vote anticipated to be indicative of majority support for the deal, given reports that the government wont carry through with the vote unless they feel they have sufficient backing.

Leuchtmann wrote “Should May hold another vote tomorrow that would constitute a signal that she considers it possible that her deal will be accepted,” adding that “It should no doubt have a moderately positive effect on the British currency.”

- DNB Markets

DNB Markets economist, Magne Østnor, expects the Pound-to-Dollar exchange rate (currently trading at $1.31880) to dip to remain around the $1.31 level over the coming month before edging back to $1.32 over a 3 month horizon and extending GBP gains to $1.36 by the twelve-month mark with the bank slightly more upbeat than median projections from the latest Reuter’s poll which put the cross at $1.35 in 12m.

Commenting on the current context, Østnor wrote “While volatility unsurprisingly has been haunting the GBP over the last week, neither parliamentary vote have been a game-changer in terms of levels. We are sticking to our call of a delayed Brexit,” adding “Another parliamentary vote is coming up ahead of the EU meeting late this week, expectations are for it to be held Tuesday or Wednesday. Anyway, this week’s BoE meeting will play second fiddle to Brexit, as it makes very little sense adjusting policy with the lingering uncertainty.”

- ING

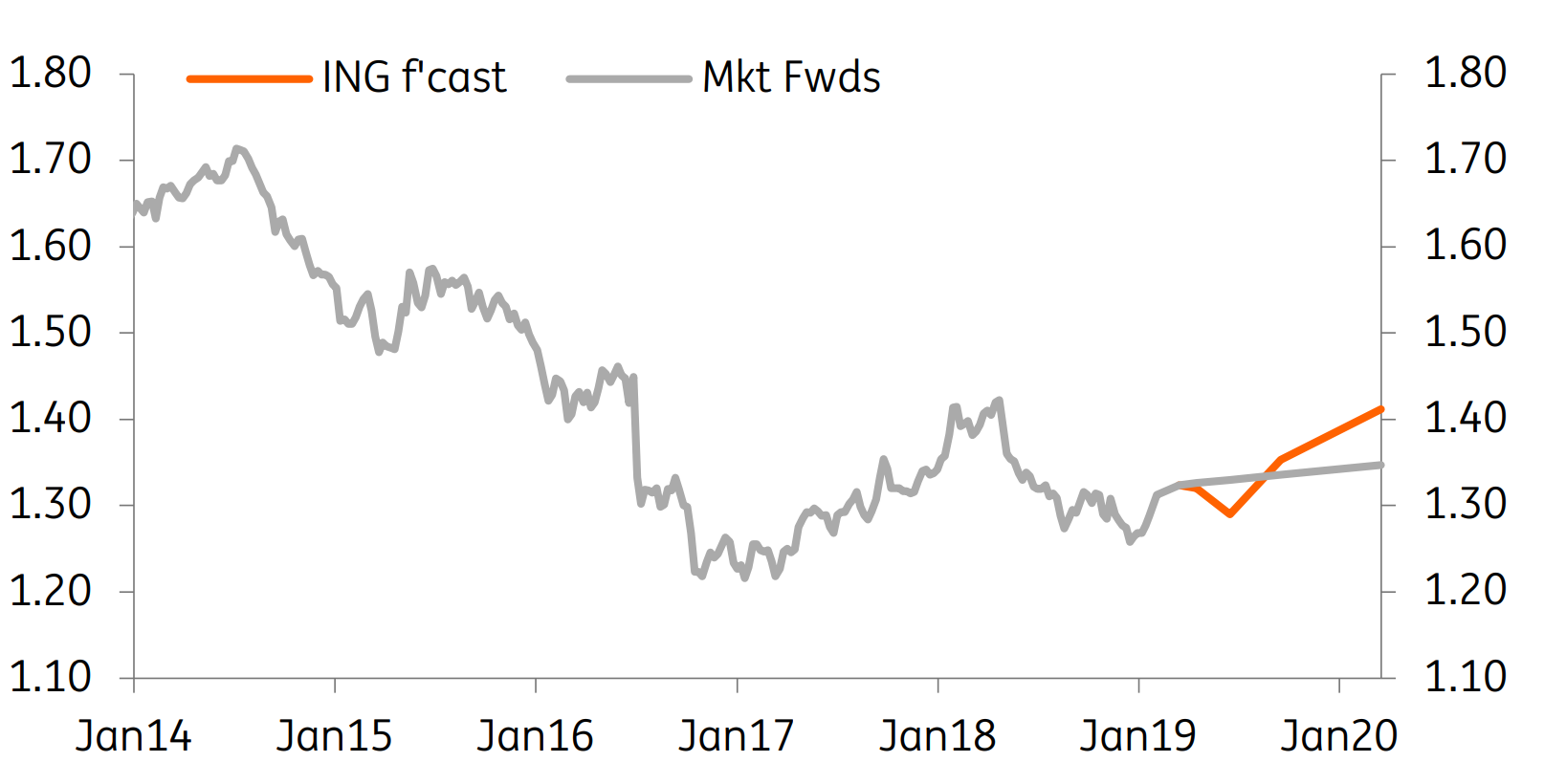

ING’s head of FX strategy, Chris Turner, and chief EMEA FX and IR strategist, Petr Krpata, expect the Sterling to dip against the Greenback over the three month horizon with the pound-to-Dollar rate targeting $1.29 before reverting to the upside to reach $1.41 by 12 months out.

Above: ING Pound-to-Dollar Exchange Rate Forecast

Commenting on the Cable, ING analysts wrote “We really are at crunch time for the Brexit story. Event risk, as priced by the option market, is huge in the final two weeks of March,” as markets await a potential third meaningful vote and the EU Council’s Brexit extensions decision.

They added “The paths are starting to look a little more GBP constructive.

For example, approval of May’s deal would buy a bit of certainty until end-2020, while a rejection would see a coalition start to build around a softer Brexit.”

Against the single currency, they anticipate the EURGBP cross to range around the £0.85 level throughout the coming year.

ING analysts wrote “We’ve generally been constructive on GBP over the last year, expecting EUR/GBP to gravitate to 0.85 as London and Brussels thrash out a deal,” adding however that they “do see a scenario for 0.83 out there, eg, should a long transition deal or long delay emerge, but upcoming events will probably determine this new path.”

- Saxo Bank

Saxo Bank head of FX strategy, John Hardy, sees two potential outcomes for the Sterling in the days ahead with one being positive for the GBP and the other lacking clarity.

On the one hand, should Prime Minister May somehow manage to push her deal through the House of Commons, Hardy expects the GBP to climb.

Hardy wrote “If PM May can deliver Brexit over the next couple of days, it should provide sterling with an immediate and large boost as this clears away the majority of near-term uncertainty, even if the Labour opposition may try to move to call for a referendum on the deal.” On the other hand, should the deal fail and EU grant a long extension the outlook is less clear for the British £.

Hardy wrote “The alternative of May’s deal not passing will likely lead to a long day and protracted further uncertainty that doesn’t provide a clear signal for sterling,” adding “Certainly, May’s days are numbered if she fails to deliver this week.”

Overall the coming days could prove critical for the Pound Sterling’s direction with Brexit-related developments expected to be the key drivers of price action.

Nevertheless, out-with a rejection from the EU council with respect to a Brexit delay, the alternatives, that is PM May’s deal and a short extension or no deal and a longer extension are both rather benign outcomes relative to no-deal Brexit.