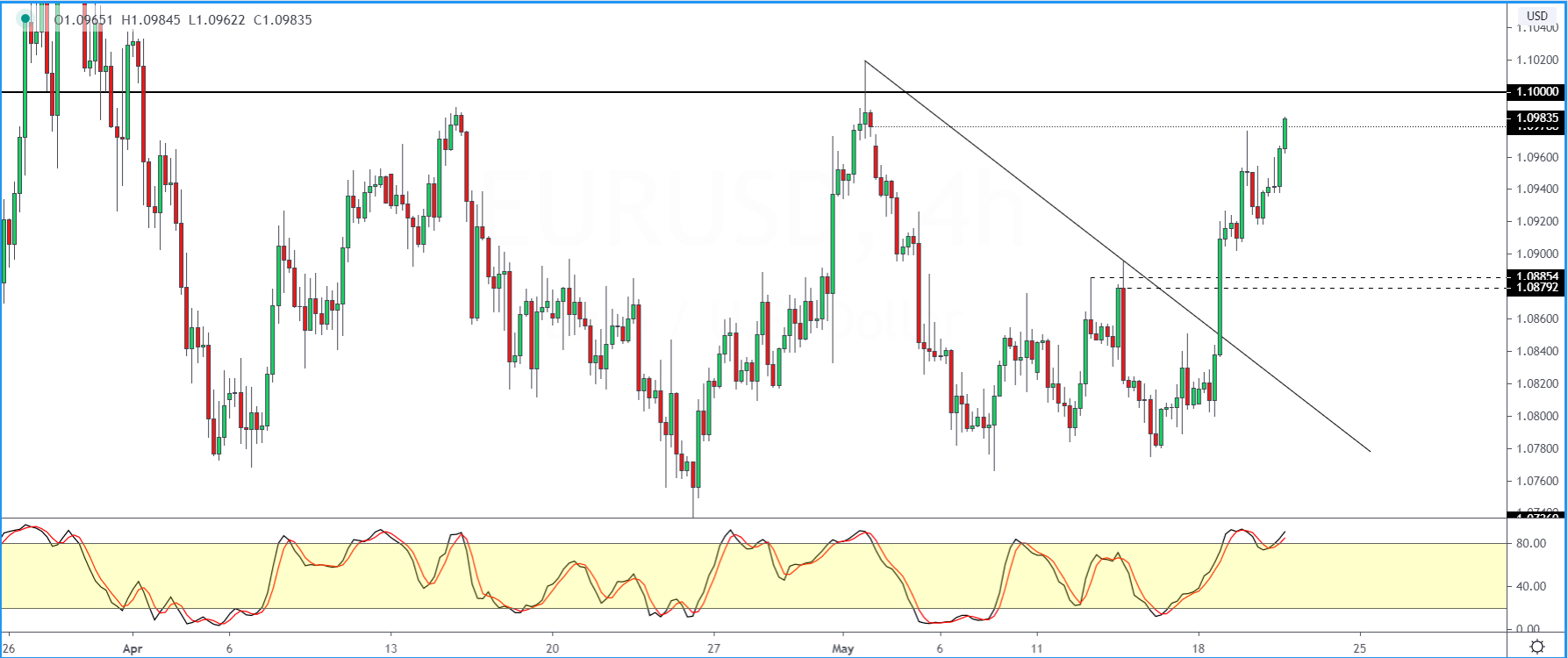

EUR/USD at Risk Of A Correction As The Rally Continues

The euro currency is rising steadily, with a boost from a weaker US dollar.

Price action is, however, indicative that a correction could come in the near term.

At the time of writing, EURUSD is seen filling the gap from May 1 st , 2020. The Stochastics oscillator is pointing to a hidden divergence.

This, along with the fact that the price level near 1.0885 – 1.0879 is not yet tested for support suggests a move lower.

A breakdown in the rally could see this level being tested once again. This is as long as EURUSD does not break past the 1.1000 level.

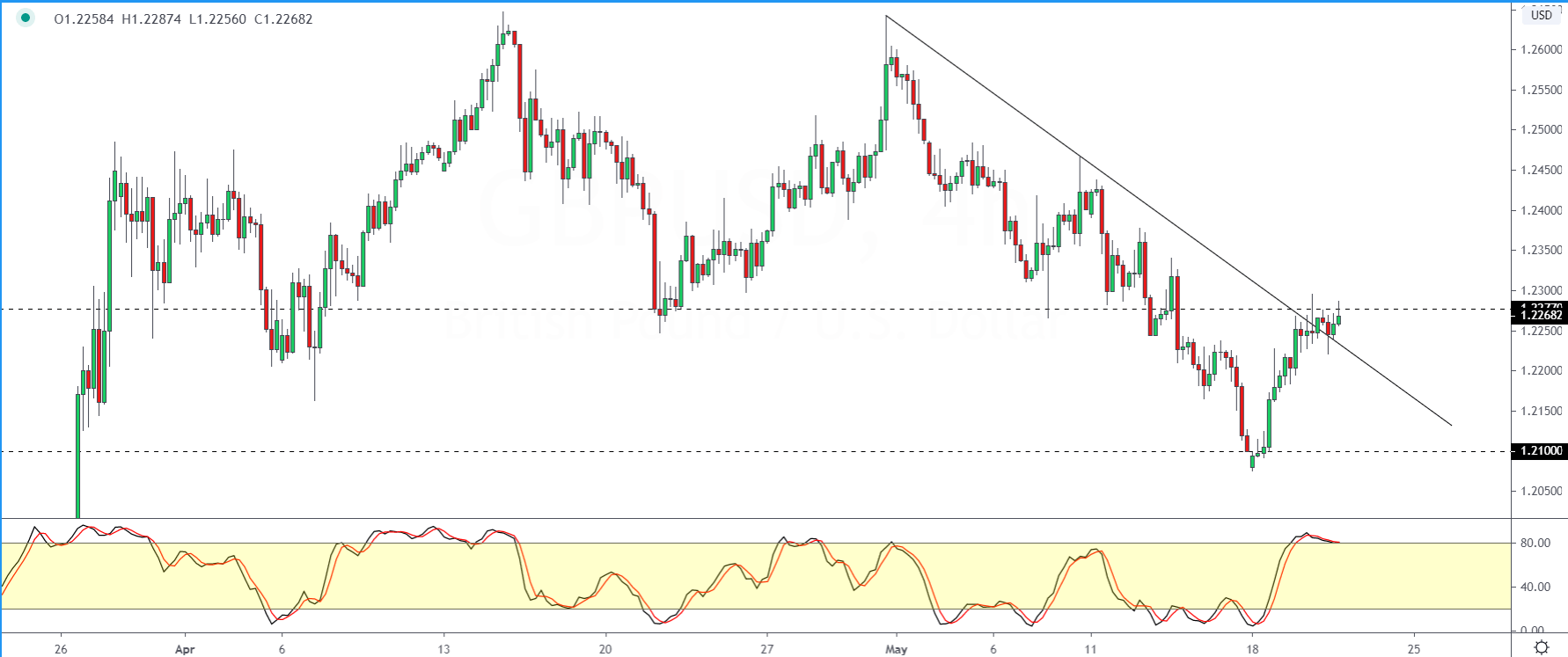

GBPUSD Could Struggle To Breakout Above 1.2271

GBPUSD is maintaining a steady pace as the recent rally has pushed price to the technical resistance area of 1.2271.

The strong hidden divergence on the Stochastics points to a possible correction lower.

Given that GBPUSD has formed a bottom near 1.2100, this could be the downside in the currency pair.

But, we expect price action to remain range-bound within 1.2271 and 1.2100 in the short term.

Any breakout above 1.2271 will, of course, need to see a higher low forming above this level to validate any further upside gains.

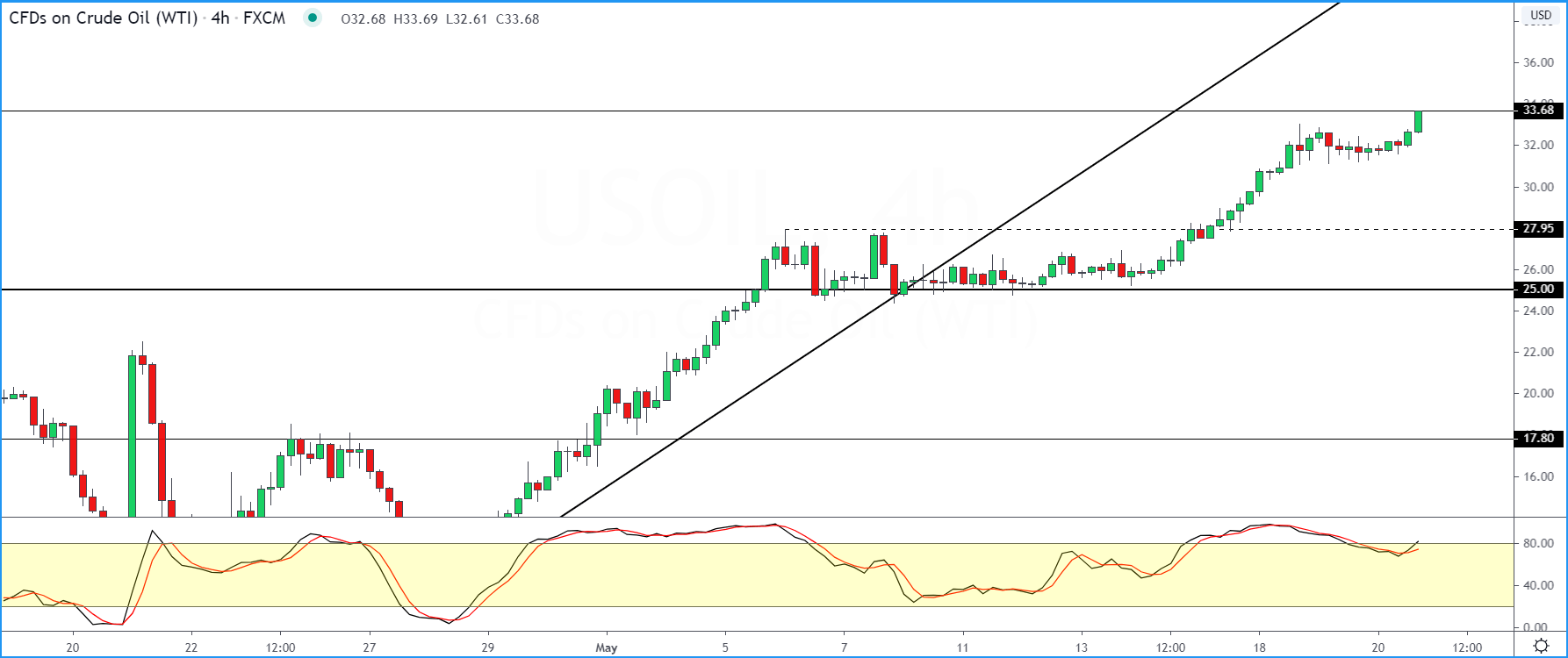

WTI Crude Oil Rallies To Resistance Level

The rally in oil prices saw the commodity finally hitting the technical resistance level at 33.59.

This comes as the commodity rose over 5% intraday on Wednesday.

But with the Stochastics oscillator indicating a possible divergence, we could see a correction.

Of course, if oil prices rise convincingly above the 33.59 resistance level, this downside view will be invalidated.

To the downside, oil prices could test the lower price area near 27.95 if the correction gets underway and oil starts to drift lower.

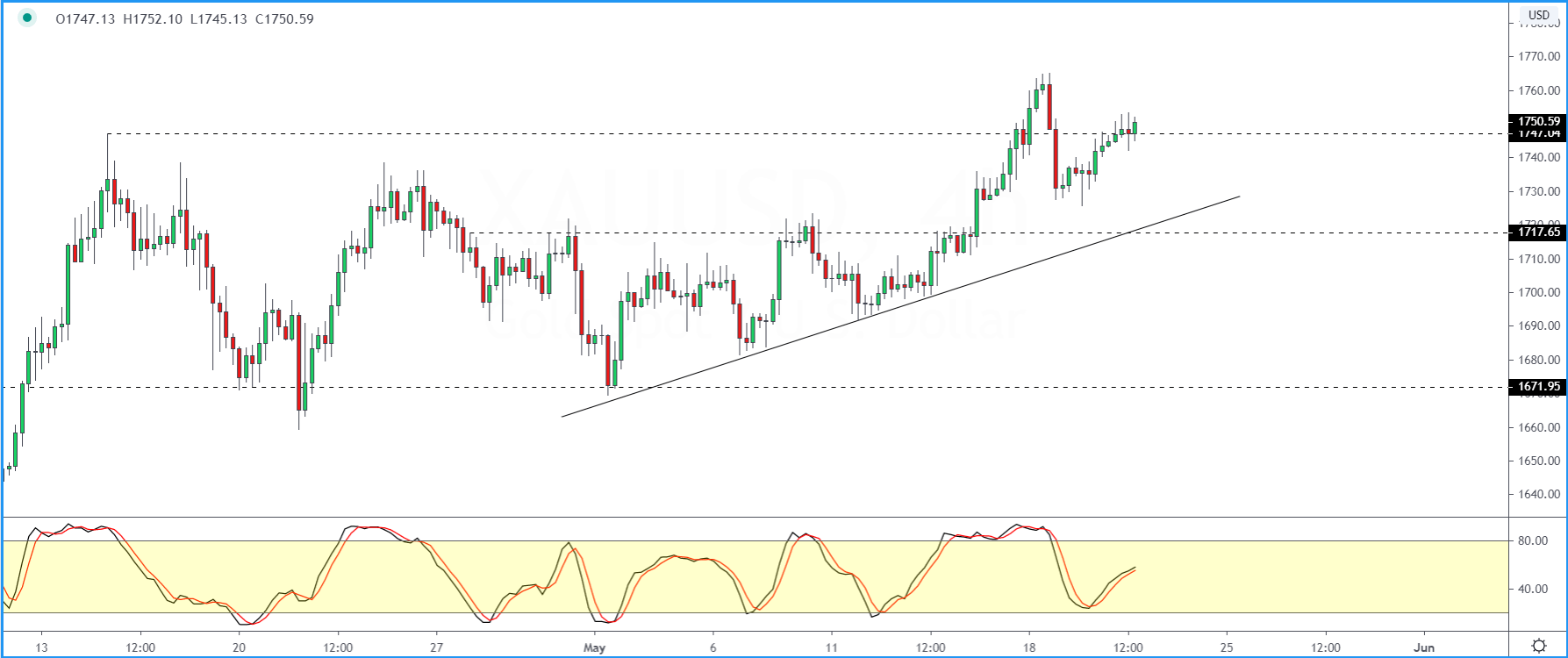

XAU/USD Attempts To Pare Losses

The precious metal is posting a recovery rally following the sell-off from the previous sessions.

Price action is back trading near the 1750 handle after slipping to lows of 1731 earlier.

But with the previous high at 1764.90 level, the upside could be capped.

This is, of course, unless price action breaks past this level to post new highs. If a lower high forms as a result, then expect a move lower.

The previous lows at 1731 will be the initial target followed by a move toward the 1717.65 level which could be tested for support.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD turns negative near 1.0760

The sudden bout of strength in the Greenback sponsored the resurgence of the selling pressure in the risk complex, dragging EUR/USD to the area of daily lows near 1.0760.

GBP/USD comes under pressure and challenges 1.2500

GBP/USD now rapidly loses momentum and gives away initial gains, returning to the 1.2500 region on the back of the strong comeback of the US Dollar.

Gold retreats from highs on stronger Dollar, yields

XAU/USD trims part of its initial advance in response to the jump in the Dollar's buying interest and the re-emergence of the upside pressure in US yields.

XRP tests support at $0.50 as Ripple joins alliance to work on blockchain recovery

XRP trades around $0.5174 early on Friday, wiping out gains from earlier in the week, as Ripple announced it has joined an alliance to support digital asset recovery alongside Hedera and the Algorand Foundation.

Week ahead – US inflation numbers to shake Fed rate cut bets

Fed rate-cut speculators rest hopes on US inflation data. After dovish BoE, pound traders turn to UK job numbers. Will a strong labor market convince the RBA to hike? More Chinese data on tap amid signs of slow Q2 start.