Sempra takes a big step to establish an LNG beachhead in Mexico

Sempra Energy’s plans to construct a liquefied natural gas export facility near Ensenada, Mexico, to serve customers in Asia moved closer to becoming reality Wednesday as the San Diego-based company announced agreements with three international firms.

French energy giant Total and Japanese companies Mitsui and Tokyo Gas each signed what is called Heads of Agreements with Sempra subsidiaries that, together, would take the entire LNG capacity in the first phase of a proposed export facility at the Energía Costa Azul facility in Baja, California.

The agreements reflect a significant investment in the LNG sector by Sempra as part of its overall corporate strategy under CEO Jeff Martin.

“We’ve raised our ambitions,” Martin said in a conference call Wednesday with energy and utility analysts. “And when you think of our strategic goals to become North America’s premier energy infrastructure company, we also want to be North America’s premier infrastructure company in the LNG space.”

Sempra’s other LNG projects

In addition to its plans in Mexico, Sempra heads a partnership in a $10 billion facility already under construction in Hackberry, Louisiana, called Cameron LNG and is looking to open another Gulf Coast project near Port Arthur, Texas.

LNG processing units are called “trains” and the initial phase of Cameron will consist of three trains. The facility is expected to open next year.

The Energía Costa Azul facility already has the ability to import LNG but Sempra and its subsidiary in Mexico, IEnova, see a lucrative opportunity by adding liquefaction and export components to the site. A final decision to expand the facility has not been made but the agreements with Total, Mitsui and Tokyo Gas represent 20-year commitments if the additions go forward.

“There’s a very, very high probability that these projects are going to come now,” said Matthew Hong, director of research for power and gas at Morningstar Commodities Research. “I’d definitely say they (Sempra) are going all in” on LNG.

Phase 1 of the proposed export component at Energía Costa Azul consists of one train and is expected to produce about 2.4 million tons per annum (Mtpa) of LNG to global markets. Total, Mitsui and Tokyo Gas would each potentially purchase 0.8 Mtpa of LNG.

An ultimate decision on expanding Energía Costa Azul is expected in late 2019, with potential first deliveries in 2023.

An export facility on the West Coast of Mexico is considered enticing because it would be geographically closer to markets in Asia than LNG projects in the Gulf Coast and less expensive since ships carrying the cargoes would not have to go through the Panama Canal.

Japan is one of the world’s major importers of LNG and China is expected to take over as the No. 1 importer of LNG by next year.

Analysts see another reason why LNG exports from Costa Azul are attractive: The Chinese government in September responded to tariffs imposed on its goods by the Trump administration by slapping a 10 percent tariff on LNG from the U.S.

But since Costa Azul is located in Mexico — not in the U.S. — the tariff may be avoided.

A Sempra spokeswoman did not directly address the tariff issue, saying in an email to the Union-Tribune that “trade issues are evolving and we continue to monitor them as they develop.”

Wednesday’s announcement comes just two days after Sempra signed a memorandum of understanding with Total to potentially contract for up to 9 million Mtpa in the second phase at Cameron. Total may also acquire an equity stake in the anticipated LNG export facility at Costa Azul.

“The interest for our Port Arthur facility also is very robust,” said Sempra Chief Operating Officer Joseph Householder, who just came back from spending two weeks in Asia talking to potential LNG off-takers. “We have a lot of interest in all of our projects.”

Through the liquefaction process, natural gas is cooled to minus-260 degrees Fahrenheit and turned into liquid. The gas can then be transported in containers and once at its destination, the LNG is warmed and regasified so it can be used just like existing natural gas.

Quarterly earnings released

Sempra also released its third-quarter report Wednesday.

The company reported earnings of $274 million, up from $57 million in the third quarter of 2017.

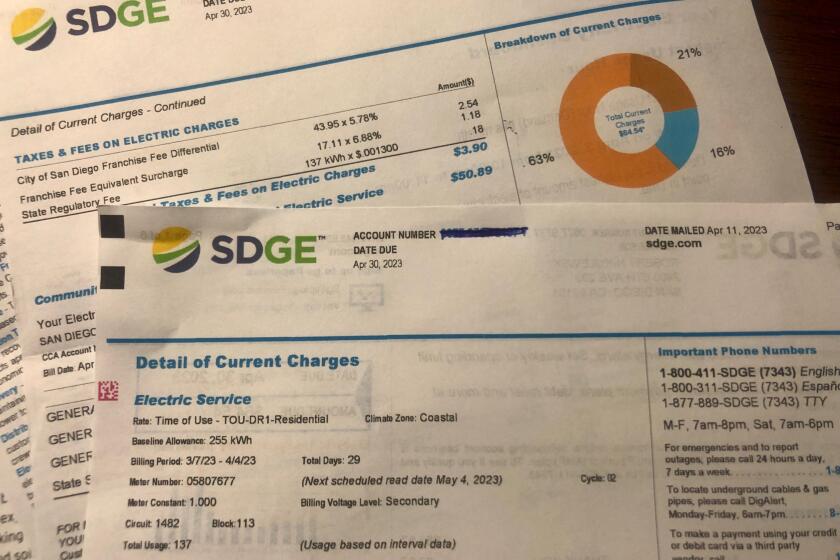

The company attributed the improved numbers largely to $154 million of earnings from Oncor, the Texas utility Sempra acquired 80 percent of earlier this year, and $39 million of higher earnings at San Diego Gas & Electric due to electric transmission operations.

The quarterly report was the first since Sempra management hammered out a truce with a group of activist investors who controlled 4.9 percent of the company.

Earlier this year, investors headed by Elliott Management Corporation and Bluescape Energy Partners criticized elements of Sempra’s corporate strategy but in September the two sides reached a “cooperation agreement” that included adding two members to Sempra’s board of directors.

Sempra stock closed the trading day up 3.85 percent, at $117.56 a share.

Business

rob.nikolewski@sduniontribune.com

(619) 293-1251 Twitter: @robnikolewski

Get U-T Business in your inbox on Mondays

Get ready for your week with the week’s top business stories from San Diego and California, in your inbox Monday mornings.

You may occasionally receive promotional content from the San Diego Union-Tribune.