USD IMPLIED VOLATILITY – TALKING POINTS

- USD currency volatility could ramp up tomorrow considering the serious event risk posed by the Federal Reserve’s FOMC and Chair Powell

- Although overnight implied volatility has risen across some major USD currency pairs, forex option traders are generally estimating relatively tame price movements

- Learn more on how the FOMC impacts the US Dollar and the effects of interest rate expectations on currency markets

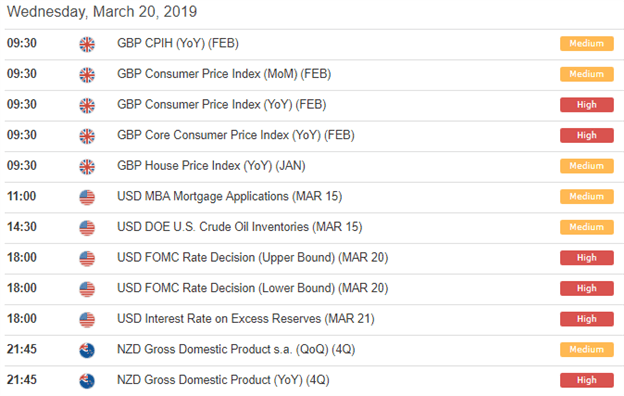

The Fed is set to take the spotlight tomorrow with the FOMC expected to announce its latest interest rate decision at 18:00 GMT. While it’s largely expected that the US central bank will keep its target policy rate range unchanged at 2.25-2.50 percent, USD currency traders will likely focus their attention on Chair Jerome Powell’s follow-up commentary.

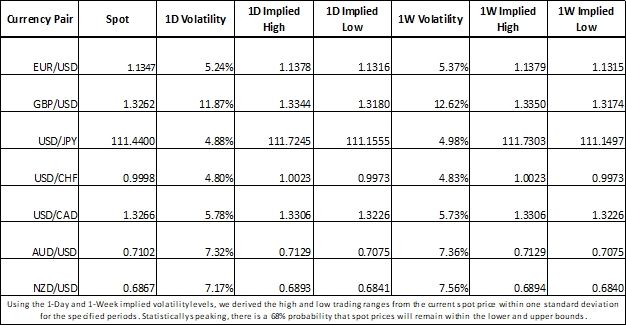

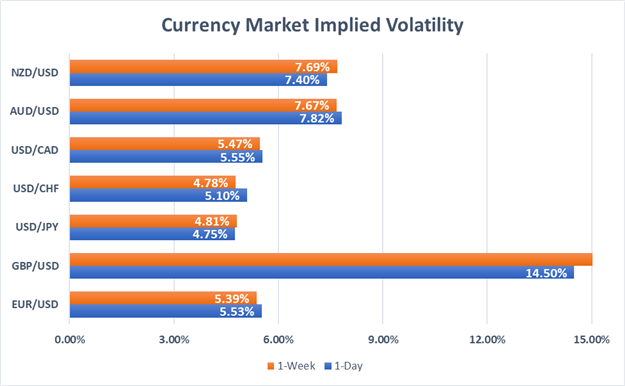

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

Although overnight implied volatility has ticked higher across major USD currency pairs as option traders prepare for tomorrow’s Fed announcement, anticipation of significant price swings remain particularly low. Yet, that in turn may set the stage for significant volatility should any unexpected updates be made. This may be the case in particular if the Fed disappoints markets with a position that’s less dovish than what many market participants have hoped for. If the Fed does come out less dovish than anticipated, the greenback could very well jump higher and recover ground from its recent selloff – particularly against the Euro.

Check out these possible US Dollar Price Action Setups ahead of tomorrow’s FOMC meeting.

FOREX ECONOMIC CALENDAR

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

Meanwhile, the Pound Sterling should remain on every currency trader’s radar despite the fall in GBPUSD implied volatility. Headlines with the latest Brexit developments could send spot markets gyrating as great uncertainty surrounding the UK’s departure from the European Union remains. Additionally, pressure in inflation statistics could add fuel to the fire that may force the Bank of England to consider raising interest rates – especially with other economic indicators surprising to the upside.

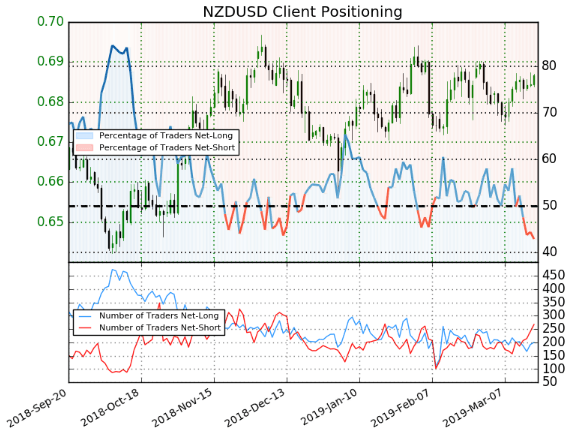

NZDUSD may experience larger than expected price swings in particular as it faces confluence of a Fed policy update followed shortly by New Zealand GDP data. If NZ economic growth comes in materially above or below consensus, NZDUSD could be prompted to break free from its tight trading range. According to real-time IG client positioning data, NZDUSD trader sentiment shows a bearish bias headed into tomorrow’s session. Specifically, the data shows that 42.8 percent of traders are net-long with the ratio of traders short to long at -1.33 to 1.

NZDUSD TRADER CLIENT SENTIMENT

Check out IG’s Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

-Written by Rich Dvorak, Junior Analyst for DailyFX

-Follow @RichDvorakFX on Twitter