- AUD/USD is on the verge of a downside continuation towards daily lows.

- DXY has headed for a test of 97 the figure again.

- FOMC minutes are coming up and could be the final catalyst of the week.

The US data dump ahead of the long weekend and Thanksgiving Holidays in North America has seen the US dollar mark fresh 16-month cycles highs on Wednesday. The dollar index DXY has rallied to a high 96.937.

Investors have started to price the prospect that the Federal Reserve will begin hiking rates in mid-2022, in stark contrast to the European Central Bank which is expected to remain more dovish as covid risks loom.

This is what makes today's FOMC minutes critical, albeit they come at a time as US traders will be looking to square positions ahead of the holidays, so it could go either way. Volatility or little trading activity until after the weekend and depending on the outcome.

Fed officials have contributed to the more hawkish view on US interest rates of late as the central bank faces stubbornly high inflation. The minutes will be scrutinised for signs of a faster pace of tapering and sooner timings of lift-off. Anything that points towards this should keep the US dollar underpinned into the close. This leaves high beta currencies, such as the Aussie vulnerable.

The following illustrates the daily lows and the prospects of a drop into here from an hourly perspective:

AUD/USD daily chart

The price is not far off from the prior daily lows in the 0.7170s, just some 15 pips at the time of writing and an hour ahead of the minutes.

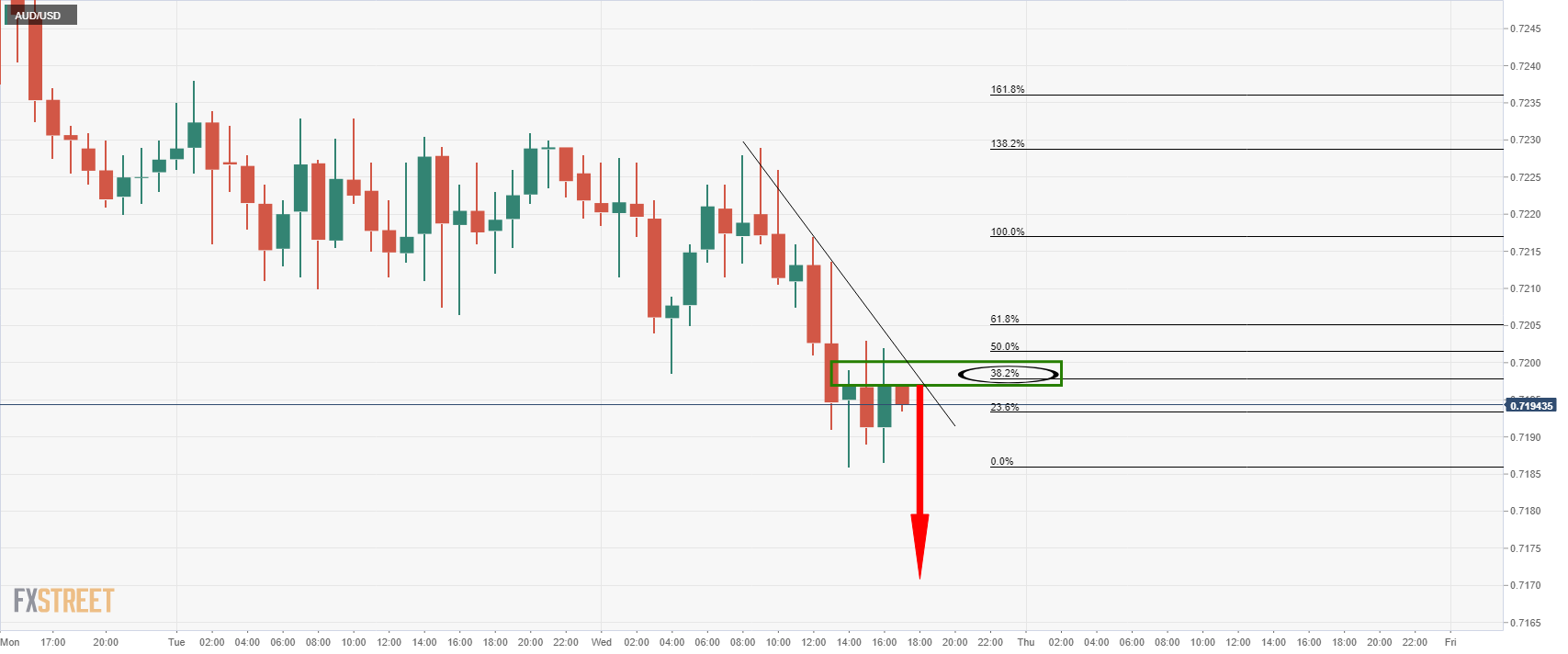

AUD/USD H1 chart

The price has already corrected to a 38.2% Fibonacci retracement level where it meets dynamic resistance and has stalled in the correction. This leaves scope for a downside extension from here.

If the US dollar can squeeze out the last remaining bears on the day and score fresh highs on the minutes into the 97's, then the above scenario in AUD/USD has a high probability of playing out.

DXY M15 chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.