The Right Way to Add Bonds to Your Portfolio

When markets are choppy, bonds add ballast to your portfolio, offering stability no matter what interest rates do.

Speculating on the direction of interest rates is a popular sport in the bond market. But it’s proving a challenging one lately. The U.S. economy is perking along, and when that happens, bond interest rates usually rise. But not this time. For the first quarter of 2019, gross domestic product increased at an annual rate of 3.2%, compared with 2.2% in the fourth quarter of 2018. But 10-year bond rates actually declined—from 3.1% in mid May 2018 to 2.4% a year later. (Prices and returns are as of May 17.)

One explanation may be a disconnect between economic growth and inflation. Despite moderate-to-good GDP increases, inflation has been tame for seven years now, averaging just 1.6%. Or perhaps businesses and investors are expecting the economy to cool off. After all, this expansion is now the longest in at least 165 years, since records have been kept. And the consensus estimate of economists surveyed by Blue Chip Economic Indicators is for GDP growth of only 2.3% this year.

The reason bond investors fixate on where interest rates are headed is that bond prices move in the opposite direction of interest rates. Here’s why: A bond is an IOU, a promise that a borrower—the U.S. Treasury, Procter & Gamble, or the Three Rivers Park District in Minnesota—will pay you back on a set maturity date and, along the way, will pay you interest.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In almost all cases, those interest payments are fixed, in contrast with dividend payments from stocks, which the issuing company can vary at will. When a bond is issued, its rate, or coupon, is set by market forces influenced by three factors. The first is maturity, or how long the borrower can keep the loan before returning the principal; investors—lenders in this case—want higher rates for a longer term. The second is the danger of default, or credit risk. What are the chances that the borrower will get into trouble and miss interest or principal payments? The third factor is the prevailing interest rate. Interest rate risk refers to the fact that prevailing rates can vary widely over the term of the bond.

For example, if you buy a $10,000 Treasury bond yielding 5% and rates rise to 8%, then your bond won’t be worth as much if you sell it before maturity. Its market price will fall. After all, investors will be able to buy a similar bond that pays $800 in interest a year, compared with your bond paying $500. If rates fall, however, your 5% bond will be worth more. Its price on the market will rise. If you think interest rates will drop in the years ahead, then you can make money buying today (at presumably low prices) and selling tomorrow (at higher ones).

Adding stability. But that’s not a sport I like. Speculating about where interest rates are headed is probably a fool’s errand. Instead, think of bonds as adding ballast to your portfolio. Deployed well, they give your portfolio stability, no matter where interest rates are headed.

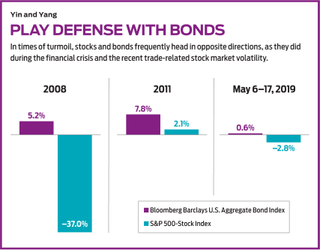

When you put together a portfolio, a rock-solid principle is to find groups of assets that are not correlated. When the prices of some go down, the prices of others go up—or, at least, don’t go down as much. Stocks and bonds are classic uncorrelated assets. When stocks rise sharply, it usually indicates that optimistic businesses and consumers are doing more borrowing and anticipating more inflation, which in turn means higher interest rates. And those higher rates equal lower bond prices. Conversely, when the economy slows, rates fall, so bond prices rise. For this reason, high-quality bonds are supposed to be the safer part of your portfolio.

My preference is to play it safe, owning either solid corporates or U.S. government bonds with maturities in the range of seven to 10 years.

The best way to protect yourself from interest rate risk is to build a ladder. Laddering bonds dampens the risk that your portfolio will take an outsize hit when prevailing market rates rise. Say you have $50,000 to invest. Rather than putting all the money into bonds that mature the same year, spread out the maturities over 10 years. Pay $10,000 for a bond that matures in two years, another $10,000 for a bond that matures in four years, and so on to year 10. When the two-year bond matures, take the proceeds and buy a new bond maturing in 10 years, and so on. If rates have risen, that new bond will pay more than the last. And you won’t be a big loser if you have to sell your bond portfolio early.

Then there is the matter of which bonds to buy. It’s complicated. Bonds issued by businesses vary in risk. A high-yield, or junk, bond from Chesapeake Energy maturing in 2027 recently yielded about 9%; at the same time, a higher-rated, investment-grade 2027 bond from Bank of America yielded about 3%. Municipal bonds, which are issued mostly by state and local governments and whose interest payments are exempt from federal tax, can make sense for high-income taxpayers, but the contract between borrower and seller is often complex and opaque. One feature of munis is that many of them can be called, or cashed by the issuer before maturity if interest rates fall.

My preference is to play it safe, owning either solid corporates or U.S. government bonds with maturities in the range of seven to 10 years. U.S. government bonds come in two varieties: those issued by the Treasury itself and those issued by agencies and government-sponsored entities, such as the Tennessee Valley Authority or Fannie Mae. The Treasury not only issues a wide variety of debt in different maturities—ranging from four-week bills to 30-year bonds—but it also offers TIPS, or Treasury Inflation-Protected Securities, whose returns are linked to the inflation rate. Agency and GSE bonds carry a slightly higher interest rate than Treasuries with little or no extra risk. You can buy bonds from brokerage firms or, in the case of Treasuries, online through www.treasurydirect.gov.

For many investors, however, the best way to own bonds is through mutual and exchange-traded funds. Unfortunately, fund buying can also be tricky because managers may be making purchases based on risky bets that interest rates will rise or fall. It’s better, therefore, to buy either managed funds with a low portfolio turnover or index funds.

Ideal is Vanguard Intermediate-Term Bond Index Fund (symbol VBILX). The majority of its holdings are U.S. Treasuries, but it also owns corporates to boost the yield, which was recently 2.9%. The expense ratio is 0.07%, and the average maturity is about seven years. Another good choice, iShares 7-10 Year Treasury Bond (IEF, $107), is an ETF that owns only Treasuries, with average maturities of 8.3 years. Expenses are 0.15%, and the yield is 2.3%. If you worry that inflation is returning, invest in iShares TIPS Bond (TIP, $114), an ETF that holds TIPS with maturities averaging eight years.

Finally, consider Fidelity GNMA (FGMNX), a mutual fund that primarily owns Ginnie Mae securities. Ginnie Mae (the Government National Mortgage Association), a corporation within the U.S. Department of Housing and Urban Development, guarantees mortgages for first-time and low-income home buyers participating in federal programs. The fund recently yielded 2.7%. Just remember that bonds are not for gambling. They are for keeping your portfolio on an even keel, even if you have no idea what the economy, inflation, and interest rates hold in store. (For another take on bonds, see The 2019 Midyear Outlook for Income Investing.)

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence.

To continue reading this article

please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

-

Stock Market Today: Nasdaq Soars Ahead of Tesla Earnings

Stock Market Today: Nasdaq Soars Ahead of Tesla EarningsThe EV stock rose nearly 2% ahead of its highly anticipated Q1 earnings report, due after tonight's close.

By Karee Venema Published

-

GM Stock Accelerates After Earnings Beat

GM Stock Accelerates After Earnings BeatGeneral Motors beat expectations for the first quarter and raised its outlook for the year. Here's what you need to know.

By Joey Solitro Published

-

Bond Basics: What the Ratings Mean

Bond Basics: What the Ratings Meaninvesting Knowing the creditworthiness of your bond issuer can help limit the risk of default and maximize yield.

By Donna LeValley Published

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.

By Donna LeValley Published

-

Bond Basics: Ownership

Bond Basics: Ownershipinvesting Bonds come in a variety of forms, but they all share these basic traits.

By Donna LeValley Published

-

Bond Basics: Pick Your Type

Bond Basics: Pick Your Typeinvesting Bonds offer a variety of ways to grow wealth and fortify your portfolio. Learn about the types of bonds and how they work.

By Donna LeValley Published

-

Silicon Valley Bank, Signature Bank Failures Send Bank Stocks Reeling

Silicon Valley Bank, Signature Bank Failures Send Bank Stocks ReelingFinancial stocks continued to sell off following the collapse of regional lenders SVB and Signature Bank.

By Karee Venema Last updated

-

Stock Market Today: S&P 500 Snaps Weekly Losing Streak

Stock Market Today: S&P 500 Snaps Weekly Losing StreakAI stocks were big winners on Friday after C3.ai posted solid earnings and guidance.

By Karee Venema Published

-

Stock Market Today: Stocks Bounce Back; UNP Rallies After CEO Splits

Stock Market Today: Stocks Bounce Back; UNP Rallies After CEO SplitsThe major benchmarks closed higher Monday after notching their worst week of the year on Friday.

By Karee Venema Published

-

Five Ways to Diversify Your Portfolio During a Recession

Five Ways to Diversify Your Portfolio During a RecessionInvesting successfully during a recession is tough. However, you can protect and grow your portfolio with various diversification strategies.

By Justin Grossbard Published