GBP/USD FORECAST UPDATE #4: After retaking the $1.3 level, Tuesday's rally in the Pound to US Dollar exchange rate ran out of steam and reversed as concerns over a lack of progress from cross-party Brexit talks and a potential leadership challenge reasserted their negative impact on the Sterling.

After falling to a two-month low of $1.29268, Cable extended losses in early Wednesday trading with GBPUSD last seen trading at $1.29162.

Currency strategist, Jane Foley at Rabobank wrote "Everyone has been a bit disillusioned about the chances of a compromise,” adding the GBP could re-test February lows of $1.2775.

For the Greenback, Wednesday's session is relatively data-sparse with Friday's GDP growth release the key data point of the week.

GBP/USD FORECAST UPDATE #3: Following a sluggish start to Tuesday's session, the Pound-Dollar rate embarked on a considerable intra-day rally, gaining against the Greenback to retake and hold the key $1.3 level.

At the time time of writing, the £ to $ exchange rate was last seen trading at $1.30060, up 0.2% for the session thus far.

The move higher for the GBP came despite continued evidence to suggest cross-party Brexit talks were unlikely to make any headway and mounting concerns that PM May is set to face an imminent leadership challenge.

For the Greenback, Tuesday's new home sales and Richmond Manufacturing Index releases aren't anticipated to yield much in the way of market impact ahead of Friday's all-important advanced estimates of first quarter growth.

While the current consensus forecast is for a static, 2.2% print, ING economists are "looking for an above consensus reading of 2.5% (trade making a positive contribution, with consumer spending and investment holding up) suggesting ongoing support for the dollar."

GBP/USD FORECAST UPDATE #2: The Pound to Dollar exchange rate remained subdued amid thin Bank Holiday Monday trading with Sterling drifting lower to touch a fresh six-week low at $1.29749.

Into Tuesday's session, GBP-USD failed to pull away from the lower-bound of the near-term range with Cable last seen trading at $1.29841.

Ahead of key releases later in the week (US GDP growth, core durable goods orders), Tuesday's session will see the return of Brexit as UK lawmakers return to parliament following the Easter recess to resume cross-party Brexit talks. Continued frustration over PM May's handling of the process from within her own party has seen expectations of a leadership challenge resurface with the 1922 committee set to meet to discuss options to oust the PM.

Commenting on the suppressed British £, MayBank analysts wrote "GBP drifted lower on renewed fears that PM May’s leadership could be challenged internally again."

From a technical perspective, bias is now to the downside for Cable as Hantec Markets' Richard Perry explains "Finally we have seen a downside break of the key support area at $1.3000 on a closing basis. This level has been defended repeatedly over a nine week period, but are the bulls now finally beginning to yield? Perhaps so, but today's reaction will be key. After the Easter break, traders will return and the significance of today’s move could be crucial," adding "Continued closing below $1.3000 would put Cable on the path towards the old pivot around $1.2800/$1.2815."

GBP/USD FORECAST UPDATE: With a distinct lack of directional drivers during Monday's Bank holiday session, the Pound Sterling to Dollar (GBPUSD) exchange rate trawled recent range lows with Sterling last seen at $1.29846, down a shade from the weekly open.

With UK lawmakers set to return to Parliament on Tuesday, Brexit-related news-flow is expected to resume over the coming sessions, providing some much-needed impetus for directional price action.

Meanwhile for the US, following a quiet start to the week, mid-week will see the latest Core Durable Goods Orders figures (forecast to rebound from -0.1% to +0.2%) ahead of Friday all-important GDP release - with gross domestic product growth for Q1 forecast to remain firm at 2.2%.

GBP/USD FORECAST CLast week saw the Pound to US Dollar exchange rate slide towards recent range-lows despite relatively upbeat data coming out of the UK.

Having kicked off the weekly session just shy of $1.308, the GBP/USD drifted steadily lower over the course of the week targeting March/April range lows with the cross seeing out the week subdued at the $1.3 level, down half a percent.

Upbeat Labour Market & Retail Stats Fail to Staunch GBP Losses

The week started out on a positive note for the British £ with the latest round of labour market statistics indicating that while many sectors had felt the pinch of Brexit uncertainty, the jobs market had remained firm, and indeed improved.

According to the data from the Office for National Statistics (ONS), average wage growth accelerated at a pace of 3.5% (3m/y), representing the fastest pace in over a decade while unemployment held steady at the multi-decade low of 3.9%.

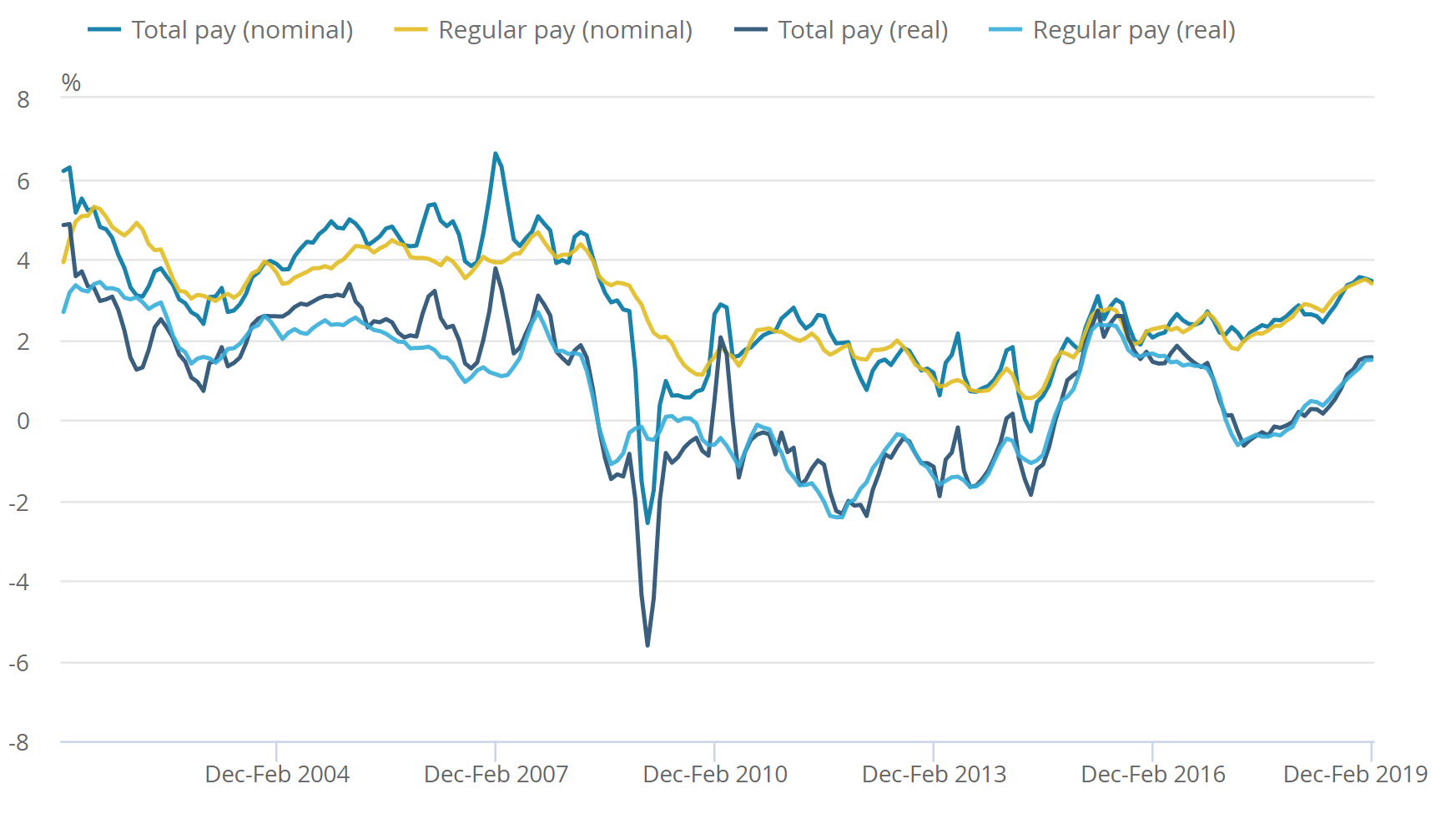

Above: Office for National Statistics Average Earnings Index

While some aspects of the UK economy have faltered in the face of Brexit uncertainty, the labour market continues to be source of optimism, not to mention upwards inflationary pressures.

Developed markets economist, James Smith of ING wrote "The key takeaway from the latest UK jobs report is the continued strength in wage growth. At 3.4%, regular pay is growing close to its fastest rate since the financial crisis."

Despite the upbeat assessment of the UK jobs market, the GBP's decline against the Greenback barely faltered.

Wednesday's UK inflation releases were a mixed bag. While universally failing to meet consensus forecasts, headline consumer price inflation and core CPI both held steady at 1.9 and 1.8%, respectively with lower food prices offsetting increased petrol costs.

Combined with the earlier wages reports, the figure means that wages continued to outpace consumer price rises, a positive for consumers.

In response to the data, chief economic adviser to the EY Item Club, Howard Archer wrote "Any help to consumer purchasing power is particularly welcome as the economy is likely to be hampered by prolonged Brexit uncertainties following the flexible extension of the UK’s exit from the EU to 31 October.

"Consumers have generally been the most resilient part of the economy and they have been helped by real earnings growth climbing to 1.6 per cent in the three months to February, which was the best level since mid-2016.”

Thursday saw the latest UK retail sales confirm that consumer spending remained solidly upbeat with the total value of sales at the retail lelvel increasing by 1.1%, soundly beating the consensus forecast for a 0.3% decline.

Developed markets economist, James Smith of ING wrote "we think consumer spending could continue to perform well in the near-term. The latest Brexit extension to the end of October could see consumer confidence rise a little over the next couple of months as some of the ‘no deal’ concerns temporarily dissipate."

Summarising the weekly events, Lloyds Commercial Banking cross-asset strategist, Robin Wilkin wrote "The past week’s UK economic data showed inflation was still below target in March. However, there were also indications that the labour market remains buoyant and of rising pay growth. Meanwhile, stronger-than-expected March retail sales added to the evidence that a resilient consumer is helping ensure that the economy continues to grow."

Looking ahead, with UK lawmakers set to reconvene following their Easter recess, focus is expected to revert to Brexit as efforts to secure a cross-party deal continue.

Reports thus far haven't been very optimistic with consistent news-flow suggesting neither the Conservative nor Labour party have compromised to a level adequate to find some middle-ground.

Other GBP/USD Currency Exchange News

Mixed Economic Data Leaves US GDP Growth Expectations Mixed

Last week was relatively quiet for the Greenback on the economic data front with the most notable releases coming late in the week. According to the US Census Bureau, both core and non-core retail sales rebounded from previous declines to print above-forecast at 1.2% and 1.6% respectively.

Elsewhere, a number of FOMC speakers struck a fairly upbeat tones in a series of speeches throughout the week while the latest Atlanta Federal Reserve GDPNow model projected that the pace of economic expansion may have accelerated to 2.4% annualised (compared to 2.2% in Q42018).

Given improving news-flow over recent weeks, investor focus will be on next week's Advance GDP growth estimates with a consensus forecast calling for 1.8%, significantly lower than the Atlanta Fed's projection.

Commenting on the upcoming GDP release, ING economists wrote "Trade should make a positive contribution, while consumer spending and investment should have held up. Inventories are likely to be a modest drag, but we think the market is being a little too pessimistic in predicting an expansion of 1.8%. We're looking for 2.1% growth."

Pound to US Dollar Exchange Rate Outlook: Constructive

For Cable, next week's events could inject some volatility into markets with Brexit returning to the headlines.

Commenting on the Pound-to-Dollar amid low-volatility, directionless G10 FX, Lloyds Commercial Banking global cross asset strategist, Robin Wilkin, wrote "The coiling/contracting range of GBPUSD in particular shows potential for a break-out in that time-frame. 3-month volatility has dropped back to the three year range lows", adding "Our underlying technical outlook is still constructive, but a break of 1.3400 is needed to confirm a move into an upper medium-term range under the 1.40-1.45 key long-term resistance."