|

|

|

|

| April 24, 2024 |

|

Jobless claims in U.S. decrease; Wage theft complaints are on the rise

Fewer Americans than forecast filed first-time claims for unemployment insurance payments last week, extending the period of volatility typically seen in July.

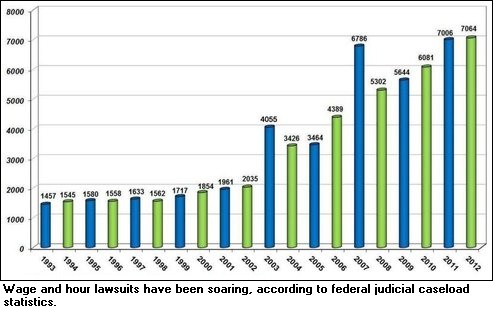

Applications for jobless benefits decreased by 35,000 in the week ended July 21 to 353,000, Labor Department figures showed Thursday. Economists forecast 380,000 claims, according to the median estimate in a Bloomberg News survey. Changes in the annual auto plant shutdowns that occur this time of year have made it difficult to adjust the data for seasonal variations, the Labor Department has said. Statistical noise aside, slowing economies in Europe and China, which have reduced global demand for goods, may continue to curb employment. The U.S. presidential election and a looming battle over tax cuts and government spending may also be making businesses reluctant to hire. “All in all, the labor market is gradually healing,” said Ryan Sweet, a senior economist at Moody’s Analytics Inc. in West Chester, Pennsylvania. “We’ve got to take this report with a grain of salt. The jobs market is still tough and we’re setting ourselves up for a soft second half of the year.” Orders for durable goods climbed more than projected in June as a surge in demand for aircraft and military hardware overshadowed a slump in business equipment spending, data from the Commerce Department also showed today. Bookings for goods meant to last at least three years rose 1.6 percent for a second month. The median forecast of economists surveyed by Bloomberg called for a 0.3 percent gain. Estimates for first-time claims ranged from 365,000 to 400,000 in the Bloomberg News survey of 51 economists. The Labor Department revised the prior week’s figure to 388,000 from an initially reported 386,000. The weekly measure of the labor market has been distorted this month by automotive plants. Demand for new cars has led automakers like Chrysler Group LLC and Nissan Motor Co. (NSANY) to skip, delay or shorten their typical mid-year factory shutdowns to retool for the new model year. The result has been large, unexpected swings in unemployment claims. Volatility continues The volatility may last one more week, a Labor Department spokesman said as the figures were released to the press. The four-week moving average, a less-volatile measure of jobless claims, fell to 367,250, the lowest since March, from 376,000. The number of people continuing to collect jobless benefits shrank by 30,000 in the week ended July 14 to 3.29 million. The continuing claims figure does not include workers receiving extended benefits under federal programs. Those who have used up their traditional benefits and are collecting emergency and extended payments increased by about 27,000 to 2.59 million in the week ended July 7. Initial jobless claims reflect weekly firings and tend to fall as job growth, measured by the monthly non-farm payrolls report, accelerates. Labor Department figures earlier this month showed that the job market is making little progress, with payrolls expanding by a less-than-forecast 80,000 workers in June. Excluding government agencies, private hiring increased 84,000, the weakest in 10 months. Unemployment rate The unemployment rate held at 8.2 percent to mark the 41st consecutive month that joblessness has remained above 8 percent, the longest stretch of such elevated levels in the post-World War II era. Ford Motor Co. (F), which said it would idle 13 U.S. plants for one week instead of two for its annual summer shutdown, lowered its outlook for the year as ballooning losses in Europe overshadowed earnings in North America. (Source: Bloomberg) Growing number of workers complain about being shortchanged There’s a simple workplace axiom: You put in your hours and get paid for them. Alas, this doesn’t always happen. There’s been a record spike in wage and hour violation claims by employees thanks to sustained tough economic times, an increase in enforcement by the government, and confusion over, or disregard of, overtime pay provisions. Already this year, there have been a record number of lawsuits filed under the Fair Labor Standards Act, which covers wage and hour provisions, with 7,064 filed so far this year. That's up from 7,006 filed for all of 2011 and just 2,035 cases filed a decade ago, according to data compiled by employment law firm Seyfarth Shaw. The Department of Labor's wage and hour division collected a record $224 million in back wages from employers in the latest fiscal year for more than 275,000 workers. “Many workers still have a hard time taking advantage of their legal protections,” said Jeffrey Michael Hirsch, associate professor at the University of North Carolina’s law school and a contributing editor to the Workplace Prof Blog. “Low-wage employees, in particular, often don't earn enough to attract attorneys, although class actions might help in some cases, so you see a lot of cases of unremedied wage theft.” In those cases, he said, the Labor Department sometimes gets involved, especially to "send a message to employers." The Labor Department, which sees 125 to 150 cases annually, has stepped up its efforts and pursues litigation when it cannot settle out of court, said Sonia Melendez, a spokeswoman for the agency. “The wage and hour division has stepped up enforcement efforts on behalf of vulnerable workers, such as low-wage workers, migrant or seasonal laborers, workers with limited English language skills and workers who are unaware of their rights or are reluctant to file a complaint when subject to labor violations,” she said. The bulk of wage and hour lawsuits deal with misclassification of employees, alleged uncompensated ‘work’ performed off the clock and miscalculation of overtime pay, said Richard Alfred, an attorney and chairman of Seyfarth Shaw's wage and hour litigation practice. He attributes the rise in lawsuits to: - Weakness of the economy, resulting in layoffs - Outdated federal and state laws, which have failed to keep up with changes in technology - A lack of clarity in existing law, making it difficult to classify which workers need to be paid for overtime - Potential for lucrative recovery by plaintiffs and their attorneys High-profile cases, such as a wage and hour case involving Wal-Mart, have gotten many employees, employers and lawyers to stand up and take notice. In May, Wal-Mart agreed to pay nearly $5 million in back wages and damages to more than 4,500 employees who were misclassifed as being exempt from overtime rules. That paled in comparison to the $352 million the company paid in 2008 to settle allegations it didn't provide workers with proper rest and meal breaks but served notice that the Labor Department is paying close attention. “Misclassification of employees as exempt from FLSA coverage is a costly problem with adverse consequences for employees and corporations,” said Secretary of Labor Hilda Solis at the time of the announcement. “Let this be a signal to other companies that when violations are found, the Labor Department will take appropriate action to ensure that workers receive the wages they have earned.” Massive monetary awards have increased the profile of such cases, making them attractive to some lawyers, Hirsch said. But he said the awards also have made smart employers more careful. "One thing a lot of management-side firms do is perform internal audits for clients to make sure there aren't problems, particularly with overtime classifications," he said. Not everyone is as focused on the issue, he added. “I'd like to think that employers of low-wage workers are getting the message, but I'm not sure that's the case in general. You still hear about violations all the time.” (Source: NBC News) Story Date: July 27, 2012

|