Investors Are Betting Big Against Shake Shack -- Why They're Wrong

Burger fans love Shake Shack (NYSE: SHAK), but a lot of investors don't feel the same way. The fast-growing restaurant chain is attracting plenty of naysayers these days. There were 10.7 million shares of Shake Shack sold short at the end of November, a number that may not seem like a lot but represents nearly half of the stock's public float.

The short interest ratio of 47% is high, and given the stock's modest average daily trading volume of roughly 622,000 shares, it would theoretically take 17 days for shorts to clear out of Shake Shack at that pace. There's a lot of money riding on the stock heading lower, but Shake Shack's fundamentals and recent momentum suggest that betting against the former market darling is not such a good idea.

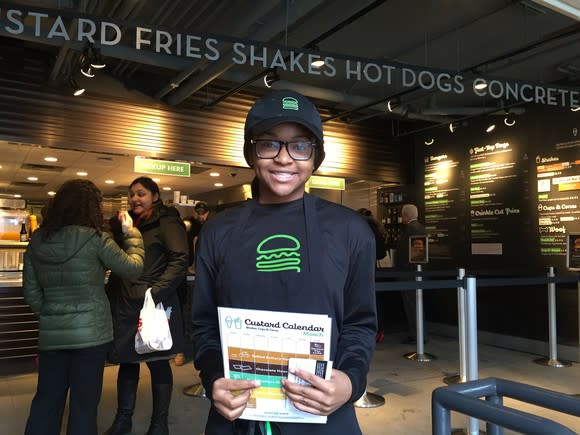

Image source: Shake Shack.

Love Shack

Shake Shack stock flew out of the gate when it went public in early 2015 at $21. The stock was closing in on $100 just three months later, and that's when valuation concerns began weighing on the investment. Shake Shack has defied its early volatility by holding relatively steady lately. The stock traded exclusively in the $30s for a 15-month run dating back to the summer of last year. Shares finally cracked the $40 ceiling last month, hitting fresh two-year highs earlier this week.

One would think that a tight trading range and stability -- the stock's one-year beta clocks in at a reasonable 1.22 -- would bore the pessimists. Speculative shorts like hunting for fast-moving prey, and Shake Shack's been a sloth. The two things keeping the boo birds close are the recent negative comps and the stock's rich valuation.

Let's tackle the problematic store-level sales trend first. Shack Shack saw its revenue climb 27% in its latest quarter, but that was entirely the handiwork of expansion. Shake Shack's store count has grown from 105 to 143 over the past year. Comps slipped 1.6%. This is the third quarter in a row of negative comps. Margins can get squeezed when unit-level sales are going the wrong way, but at least Shake Shack managed double-digit earnings and operating profit growth for the quarter.

Shake Shack stock still rallied following last month's third-quarter results. Earnings exceeded Wall Street's profit targets for the third quarter in a row, and the chain actually boosted its full-year revenue and comps guidance.

We've seen Shake Shack's top-line guidance for 2017 inch higher in three of the past four quarters. The burger flipper's comps outlook did go from a gain of 2% to 3% to flat to a decline of 2% to 3%, but last month it revised the unit-level sales decline to between 1.5% and 2%. An uptick in expansion and even heartier growth plans on tap for 2018 will keep the top line coasting, and comps appear to be stabilizing.

Finding value in the overvalued

Valuation concerns have been dogging Shake Shack since its initial rally in early 2015, and if we boil things down to revenue and earnings multiples, we're going to make value investors queasy. Shake Shack is trading at 86 times this year's projected earnings and a sky-high 77 times next year's target. Even looking out to 2019, we're at a P/E ratio of nearly 60.

High multiples and sluggish unit-level trends seem to give the bears the upper hand here, but let's not forget that the stock's not trading at two-year highs this week by accident. For starters, even through this year's first three quarters of negative comps, we've seen profits exceed analyst expectations by 13% to 25%. If Wall Street's underestimating Shake Shack's power now -- meaning that those forward multiples are inflated -- just imagine the earnings power possible once comps turn positive again.

Shake Shack also stands to be a major beneficiary of corporate tax rate reform -- if it passes -- as a fast-growing chain generating the lion's share of its revenue from company-owned domestic restaurants. Morgan Stanley upgraded the stock earlier this month, suggesting that favorable revisions to the tax code could push his new price target of $41 on the stock up to $50. The upgrade was also based on the uptick in expansion for 2018 and performance improvements.

The stock isn't cheap by most measuring sticks, and it's paying the price of the renaissance at traditional fast-food giants at the expense of the "better-burger" shops. It's still hard to bet against a stock hitting its highest levels in two years, coming off a quarter where it did nudge its revenue and comps guidance higher. The trend is Shake Shack's friend right now.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Rick Munarriz owns shares of Shake Shack. The Motley Fool is short shares of Shake Shack. The Motley Fool has a disclosure policy.