Navient to Make First Data Its Technology Solutions Partner

Navient Corporation NAVI and First Data Corporation have entered into an agreement, under which the latter will take over the student loan technology platform of the former for federal and private education loans. The deal is likely to close in third-quarter 2018.

First Data is a leading commerce-enabling technology and solutions company which provides a wide variety of processing services. With this agreement, it will become the primary provider of technology solutions for Navient’s loan portfolio.

Also, First Data will establish a separate platform — First Data Education — which will be led by the current group president, Asset Management and Servicing at Navient, Jeff Whorley. Also, employees managing Navient’s information technology platform, so far, will become part of First Data.

Navient will, however, continue to provide key services such as customer service, data insights, default prevention, back office support, and other services that have made it one of the largest servicers of student loans. Also, it will continue servicing loans of its wide customer base that includes those serviced under a contract with the U.S. Department of Education.

Navient believes this deal to have a positive impact on its long-term cost structure. The company’s executive vice president and chief information officer, Patricia Lawicki, said “This agreement with First Data enhances our ability to bring agility, scalability and innovation across our digital technologies enabling us to continue to deliver better outcomes for the student borrowers we serve.”

Navient’s focus on tapping growth opportunities is anticipated to boost its overall business performance. Further, a gradually improving economy and declining unemployment rate are expected to provide support to the company. However, it continues to struggle with declining revenues and strict regulations in the student lending market.

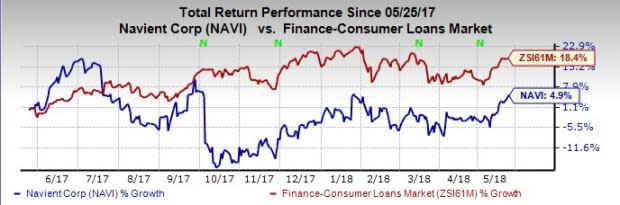

Shares of Navient have gained 4.9% over the past year, underperforming 18.4% growth of the industry it belongs to.

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

SLM Corporation’s SLM Zacks Consensus Estimate for current-year earnings has been revised 2% upward in the last 60 days. Also, its share price has risen 9.2% over the past year. It carries a Zacks Rank #2 (Buy).

First Cash FCFS currently has a Zacks Rank of 2. Its earnings estimates for 2018 have been revised 4.3% upward over the last 60 days. Further, in the past year, the company’s shares have gained 75.2%.

The Zacks Consensus Estimate for Encore Capital Group’s ECPG current-year earnings has been revised 1.9% upward in the last 60 days. Also, its share price has appreciated 7% in a year’s time.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SLM Corporation (SLM) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

First Cash, Inc. (FCFS) : Free Stock Analysis Report

Encore Capital Group Inc (ECPG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research