New digital banks challenge HSBC’s Hong Kong dominance

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

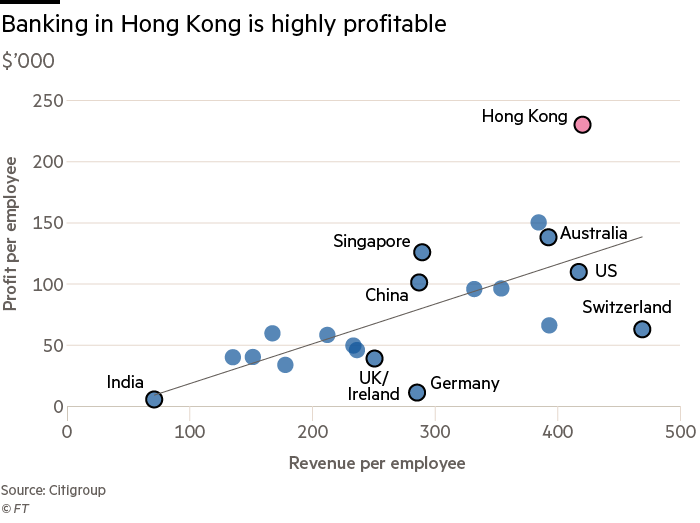

If a banker were to describe their dream consumer market, it would look a lot like Hong Kong. Lenders in the autonomous Chinese territory are exceptionally profitable, thanks to a wealthy customer base and high population density, which allows banks to operate with relatively few branches.

The chief beneficiary of this is HSBC, which has a 35 per cent share of the retail loan market, according to analysts at Goldman Sachs, via its own operation and Hang Seng Bank, a local lender it controls. It is so ubiquitous that residents refer to it simply as “the Hong Kong bank”.

An old colonial witticism has it that the three most powerful people in the territory, in reverse order, were the governor of Hong Kong, the chairman of HSBC and the head of the Jockey Club, which has a monopoly on gambling in the city.

But HSBC’s dominance is set to be challenged by eight new digital-only upstarts that have been granted “virtual banking” licences by the Hong Kong Monetary Authority in recent months.

The introduction of digital-only banks in Hong Kong has lagged behind other countries including India, South Korea and much of Europe, a fact some of HSBC’s rivals privately attribute to the bank’s close relationship with the HKMA.

The backers of the new banks — which will be launched in the next six to nine months — include established operators such as Bank of China Hong Kong and Standard Chartered, big Chinese technology groups including Tencent and Alibaba’s payments affiliate Ant Financial, plus a smattering of fintech start-ups.

“Hong Kong retail banking is super-profitable and HSBC, as the dominant bank, is über-profitable,” said Ronit Ghose, banks analyst at Citi. “It is our view that the new virtual banks are a major threat to HSBC’s profitability in the medium to long term.”

The HKMA does not expect the virtual banks to take a significant share of deposits from HSBC or other established lenders in the short term, according to a person briefed on its forecasts. But HSBC’s profit margins could take a hit if the bank is forced to fend off competition by cutting its fees or offering more competitive interest rates to depositors.

In a sign of HSBC pre-empting a more competitive market, the bank has in recent days scrapped the monthly fee for customers with deposits below HK$5,000 that is paid by 3m of its Hong Kong customers. It will also scrap associated charges faced by some smaller depositors, such as counter transaction fees. Other banks are expected to follow suit.

HSBC’s Hong Kong retail operation is by far its most profitable business. Goldman Sachs estimates that HSBC and Hang Seng make a return on equity of 21 per cent and 24 per cent in retail, respectively, more than twice what the bank generates overall. The entity housing its Hong Kong operations earned a net interest margin — the difference between what it pays to depositors and earns on loans — of 2.06 per cent last year versus 1.16 per cent for the UK and 1.08 per cent in the US.

“HSBC has been on its high horse in the way it treats its customers,” says one adviser to the bank, who points out that Hong Kong residents regularly complain about its poor customer service. “The virtual guys won’t steal lots of deposits but they could compress margins for the bank, which makes roughly 60 per cent of its pre-tax profit in Hong Kong.”

Goldman Sachs estimates that $4.8bn, or 17 per cent, of HSBC’s revenue in Asia is “at risk” from the threat of the new digital banks.

Mr Ghose said HSBC would also have to ramp up spending on technology to try to keep pace with the likes of Ant Financial and Tencent, which are “in a different category when it comes to innovation”.

Kevin Martin, head of retail and wealth for HSBC in Asia, said the bank was “alert” to the threat of the new competitors and that it had made improvements to its digital offering.

In 2017 the bank introduced PayMe, a digital wallet that allows consumers in Hong Kong to transfer small amounts of money to each other. The service, which now has more than 1.5m users, was launched as a defensive move to stop Ant Financial and Tencent from carving up Hong Kong’s payments market as they have in mainland China.

Both Ant Financial and Tencent have launched Hong Kong affiliates of their Alipay and WeChat Pay services in recent years, offering third-party payment services.

AliPay’s ewallet venture in Hong Kong joined forces with local billionaire Li Ka-shing’s CK Hutchison Holdings in March 2018 and by the first quarter of this year had signed up 50,000 merchants and more than 2m users. Tencent launched WeChat Pay HK in early 2016 but has not released comparable numbers.

“We’re not ignoring the fact that we’ve got eight new competitors,” said Mr Martin, who noted the high calibre of the investors in the new virtual banks. “But our reaction is, we know what we need to do and we’re doing it already.”

Some of HSBC’s established rivals have decided to launch their own digital lenders: StanChart has teamed up with Hong Kong Telecom and online travel agent Ctrip; Bank of China is working with the Jardine conglomerate and an offshoot of China’s JD.com ecommerce group.

StanChart also generates a significant chunk of its profits from Hong Kong retail banking — making $740m of pre-tax profit in the business last year, or 30 per cent of the total for the bank. However, its customer base is dominated by older wealthy customers, meaning the virtual bank could pick up new customers without cannibalising too much of its existing business.

Samir Subberwal, head of retail banking in China and Asia for StanChart, pointed out that its partners Ctrip and Hong Kong Telecom have about 5m customers to whom it can market the new venture.

However, Angel Ng, chief executive of Citigroup in Hong Kong, said the US bank decided not to launch a virtual bank offering “because there is nothing you can do with a virtual banking licence that you can’t do with a traditional banking licence”.

She said Citi was also deterred by a HKMA requirement stipulating that the new virtual banks cannot require customers to meet a minimum income threshold, because the US bank tends to target wealthier people in Hong Kong. The new virtual banks are also barred from opening physical branches.

Although Hong Kong is a highly profitable market, its population of 7.4m means it is still relatively small, and analysts said that many of the virtual-bank licensees harbour hopes of eventually launching services in mainland China.

The Chinese government is trying to create a “Greater Bay Area” including Hong Kong, Macau and mainland cities in the fast-growing Pearl River Delta — a region that has a population of 70m and rivals Australia in terms of gross domestic product.

A recent development plan for the region indicated that Hong Kong would be the main financial centre for the area and Beijing would “steadily expand the channels for mainland and Hong Kong residents to invest in financial products in each other’s market”. Jolyon Ellwood-Russell, a Hong Kong-based partner for law firm Simmons & Simmons who advised one of the applicants, said: “There’s no doubt this is where it is headed.”

Mr Subberwal at StanChart said he hoped mainland Chinese residents could sign up to its virtual bank “as and when the regulation allows that”.

Similarly, China-based backers of the new virtual banks are hoping to use the Hong Kong licences as a springboard to other Asian economies. “We’re planning to do it as a launch pad across Asia,” said Jonathan Larsen, chief innovation officer of Ping An, the large Chinese insurer that is also launching a virtual bank in Hong Kong.

Mr Martin at HSBC said its decision not to apply for a virtual banking licence could be revisited if holders were able roll out Hong Kong-based services throughout the Greater Bay Area, adding: “If something changed with the regulations, we’d review it.”

The chart titled “Banking in Hong Kong” has been amended since original publication to correct the respective company labels

Comments