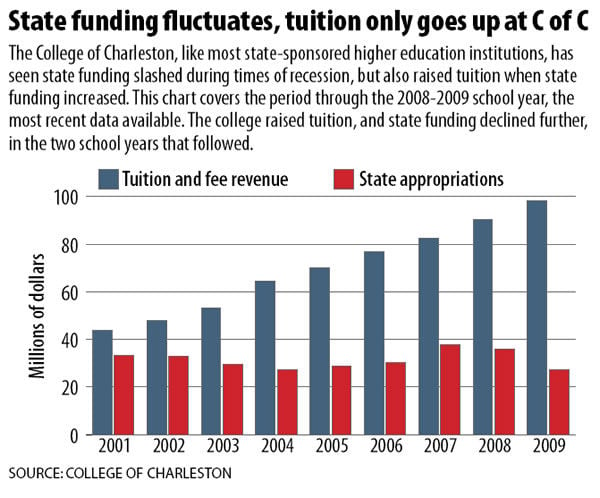

When South Carolina lawmakers slashed funding for public colleges and universities, tuition soared.

But tuition did the same thing during better times, when lawmakers raised higher education funding.

While lawmakers and college officials point the finger of blame at each other, annual tuition increases over the past decade have nearly tripled the cost of a four-year degree from a South Carolina public university.

Weak state support for higher education in South Carolina is one reason why in-state tuition is the highest in the Southeast and twice that of neighboring states, but that's only part of the answer. Institutions also compete with one another for applicants and prestige, and one way they do that is by improving facilities and amenities for students -- often at great cost.

College of Charleston -- this year's poster child for tuition increases with an eye-popping 14.8 percent increase to in-state rates -- teaches the same number of students as it did a decade ago, but as of 2009 it had 50 percent more building space, 322 more employees and nine times as much debt.

The college had more than $18,000 in debt for every full-time student in 2009, compared with just over $2,000 per student in 2000, according to the school's annual financial report.

"Some of these institutions are increasing costs in every place but instruction," said Dave Spence, president of the Southern Regional Education

Board, a 16-state bipartisan consortium of state and education officials. "Something has to change in this equation."

College of Charleston does not have the highest in-state tuition in South Carolina, but it increased $1,326 this year to $10,314. Just 10 years ago the college's tuition was $3,630.

During the same decade when tuition nearly tripled there were two recessions, family incomes stagnated and investment returns were flat, offering families little hope of keeping up with the cost of college.

"I'm going to be in so much debt when I graduate that I have to get a good job," said Randall Fernanders, 20, a College of Charleston junior and international business major from Spartanburg. "I don't know where the money is going."

If the tuition trend is repeated for another decade, today's 8-year-olds would need about $120,000 to cover four years of in-state tuition starting in 2020. Plus room and board.

"And we keep doing a lot of construction," Fernanders said. "I don't know why."

Colleges blame steep cuts in state funding.

"The state of South Carolina is funding higher education at about exactly the same level as in 1986," said College of Charleston Provost George Hynd.

State funding has fallen off a cliff, to be sure, and now accounts for less than 10 percent of College of Charleston's funding. But that's not the whole story behind tuition increases.

The college suffered a roughly $5.3 million drop in state appropriations for the 2010-11 school year but raised tuition and fees by $12.7 million. Overall, the college's budget increased by about 10 percent, according to a summary prepared for its Board of Trustees.

The Citadel raised tuition 13 percent, not entirely because state funding decreased.

"This year the tuition and fees increase helped cover part of the state appropriation cut, but it also bolstered financial aid and provided resources to maintain and enhance the academic quality and leadership experience our cadets and families expect and deserve," said Jeff Perez, vice president for external affairs.

At a time when many are warning that the United States is falling behind other nations in terms of higher education, the price of a degree in the Palmetto State is increasingly moving out of reach.

How high can it go?

"I think we have to recognize that South Carolina has reached a limit on tuition, or is approaching the point where it affects access," Spence said. "We're falling behind as a nation, and states that do not increase access to post-secondary education are going to fall behind economically."

"There's absolutely no choice," he said. "We're going to have to find ways to do more with less."

That's going to be a tough sell because colleges are getting more applicants than ever, despite the tuition hikes.

"We wonder just how much parents and students can afford, but in the context of that … there are still three or four institutions in the state that are charging more than we are," Hynd said. "Our in-state applications over the last three years are up 22 percent, and out-of-state applications are up 12.2 percent, so clearly we continue to be desirable."

When colleges have growing demand for their services regardless of the cost, budget-cutting pressures can be muted.

"Our success at striking that balance between the cost to attend The Citadel (which includes access to financial aid) and ensuring high quality can be measured by the growing number of students and families that see The Citadel as their best college option," Perez said.

Even before the large tuition and fee increases approved this year at College of Charleston, The Citadel and other public institutions, South Carolina's in-state tuition was the highest in the region and well above the national average.

Racking up debt

So, what's a parent to do? Family incomes have hardly budged in years -- for lower-income families they have dropped, in real terms -- and those able to set aside money for college have found that tuition hikes quickly outpace their investments.

Savings plans with tax advantages, such as South Carolina's Future Scholar 529 plan, can help, but they are not a sure thing. A dollar invested in the stock market a decade ago is, after all, worth just 93 cents today.

Student loan debt can be a solution, but also a problem.

"We've seen student debt levels rising for a generation, and they're at a point where they are a real concern," said Lauren Asher, president of the nonprofit Institute for College Access and Success. "That debt can affect all sorts of decisions that are important to the state and national economy -- can they afford to buy a house, have a family, save for retirement?"

"A generation ago, if you were from a low- to moderate-income family and went to a public institution, and worked part time, you could come out without student loans," she said.

Asher said financial aid has not kept up, and the average South Carolina graduate carries $21,000 in debt.

Courtney Gibbs, a 21-year-old College of Charleston business major from Florence, said she's needed loans to cover about half the cost of her degree, and the latest tuition increase "means I had to take out more loans."

Gibbs plans to pursue a graduate degree, which will mean borrowing even more.

Spence said states need to reconsider how they allocate financial aid.

"What you're going to hear is that South Carolina gives out a lot of aid, and that's true, but it's largely merit-based aid," Spence said. "And students from lower-income families tend to be less academically prepared."

College officials would like to see more student aid and increased appropriations, but don't necessarily see student loan debt as a problem.

"The debt load for our students, when they graduate, is only about $20,000, which is about the price of a new car," Hynd said.

He said the college plans to use $3 million from its tuition increase for scholarships.

The education lottery

It remains unclear how scholarships funded by the South Carolina Education Lottery have affected tuition.

Not long ago, South Carolina students who qualified for a $5,000 merit-based LIFE scholarship, the most popular lottery-funded award, could use it to pay the entire cost of tuition and fees at most in-state public universities. But the amount of the scholarship has remained the same while the cost of tuition has increased.

Now, eight years after the lottery's launch in January 2002, students who want to attend the state's four-year schools must come up with about half the cost of tuition, basically the same they paid before the lottery.

Some state lawmakers have said lottery scholarships have made it easier for university leaders to raise tuition. Most freshmen at the state's largest schools, including the College of Charleston, Clemson University and the University of South Carolina, receive a scholarship. That scholarship money keeps them from feeling the full weight of tuition, so they are less likely to complain about the increases. The lawmakers reasoned that without an outcry from parents, school leaders were less likely to curb tuition increases.

Using College of Charleston as an example, it's easy to see where the perception that the lottery contributes to tuition increases comes from. For the 2002-03 school year, when lottery funding kicked in, the college raised in-state tuition 21 percent and followed up with a 27 percent increase the following year.

But those years came during the depths of the last recession, when state funding for higher education was falling fast. University leaders raised tuition, at least in part, to make up for the dramatic cuts in state funding.

Spence said that with South Carolina's high tuition rates, "you're going to need a lot more need-based aid to make it affordable."

But the state's budget problems are not expected to get better next year, and the kind of financial aid increases and college cost-cutting advocated by Spence and others seems unlikely to materialize.

"In general, I think that no matter where a student goes to school," Hynd said, "they can probably expect tuition increases."