The stat that should worry nearly 400,000 Aussie homeowners

The softening property market continues to deal blows to Aussie homeowners across all states, with growing numbers of homeowners now possessing little or non-existent equity.

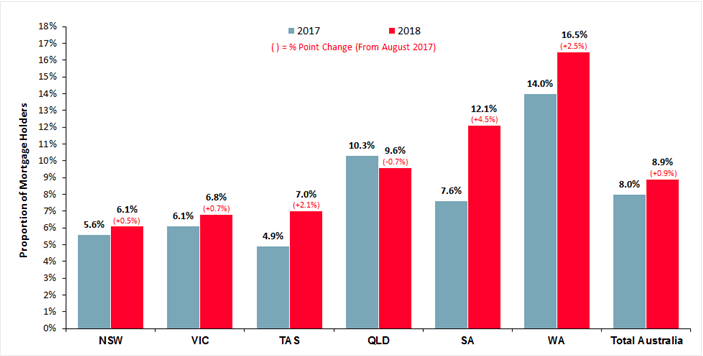

Nearly 9 per cent (8.9 per cent) of Australian mortgage-holders in Australia have little, or no real equity in their homes, according to new figures from research house, Roy Morgan.

That means that for 386,000 homeowners, the value of their home is only just equal to, or less than the amount they still owe their lender.

Concerningly, that figure is up 8.0 per cent on 345,000 homeowners a year ago.

Also read: NAB sets aside another $314 million for customer compensation

Homeowners with lower value homes are most at risk, Roy Morgan industry communications director, Norman Morris said.

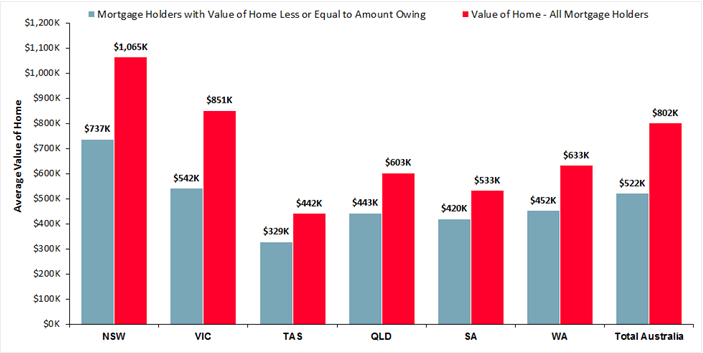

Roy Morgan described this group as those with an average home value of $522,000, compared to all mortgage holders, who have an average home value of $802,000.

“Borrowers in lower-value homes continue to be among the most likely to be faced with the problem of little or no equity in their homes,” Morris said.

“Higher-value properties with a mortgage appear to be facing a much less risky position because they are likely to have had their loan longer and may have had a far larger deposit, particularly if they have traded up.

Also read: Westpac to probe climate policy “anarchy”

“Although the majority of Australians with a mortgage have considerable equity in their home, the current trend is down in most areas and as a result there is likely to be an increase in the number of home loan borrowers with little or no real equity in their home,” he added.

When it comes to location, Western Australian homeowners are also in a risky position, with 16.5 per cent holding little or no equity in their home, up from last year and nearly double the national average.

“The mining boom and associated increase in housing demand and house prices in WA, followed by the slowdown in the mining sector in WA, and a decrease in house prices continues to see it having the highest proportion of mortgage holders faced with little or no equity in their home,” Morris explained.

“If house prices decline further in WA and unemployment increases then more mortgage holders will be facing a tough situation.”

Also read: Exec salaries too high: Telstra chairman

Continuing, he said the increase in the number of homeowners with no real equity presents a “considerable risk”, especially given the softening property market.

“Other potential contributing factors to this increase in mortgage stress include borrowers maintaining debt for other purposes rather than paying off their loan and the use of interest only loans. If home-loan rates rise, the problem would be likely to worsen as repayments would increase and house prices decline, with the potential to lower equity even further.”

Yahoo Finance

Yahoo Finance