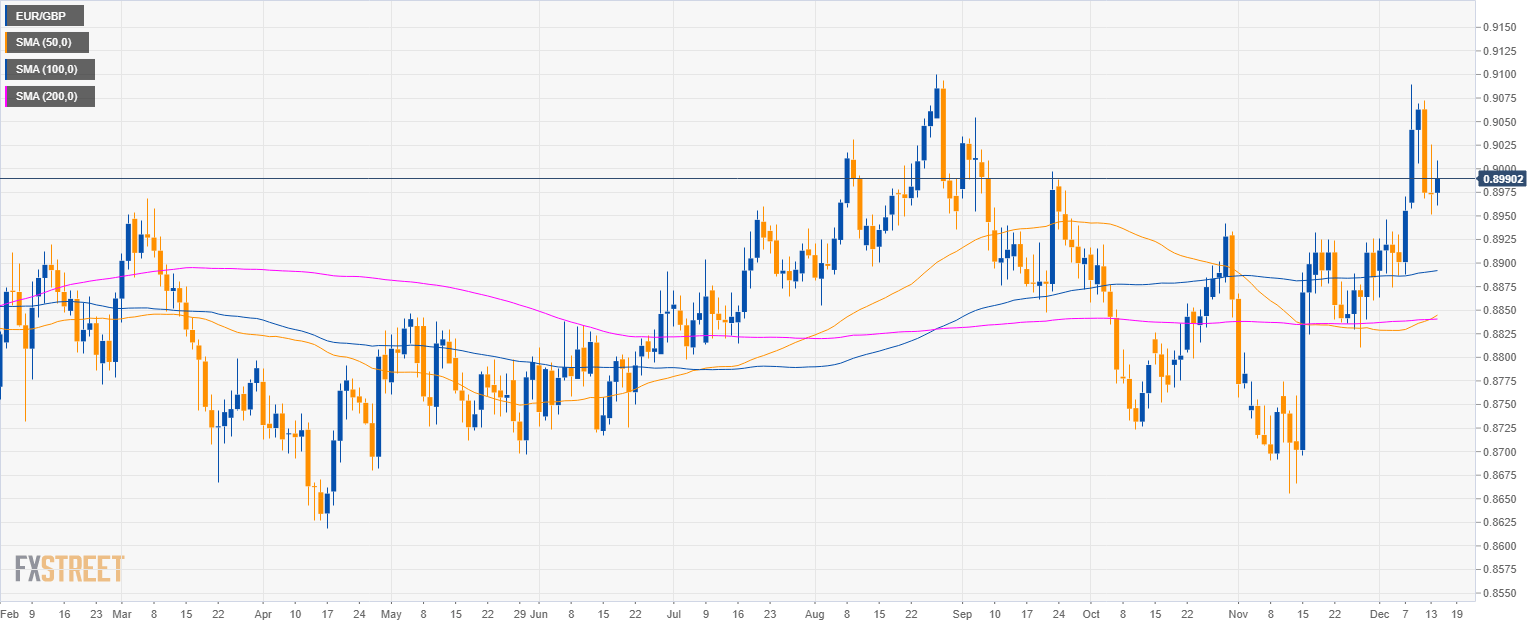

EUR/GBP daily chart

- EUR/GBP is trading in a bull trend above flat 50, 100 and 200-day simple moving averages.

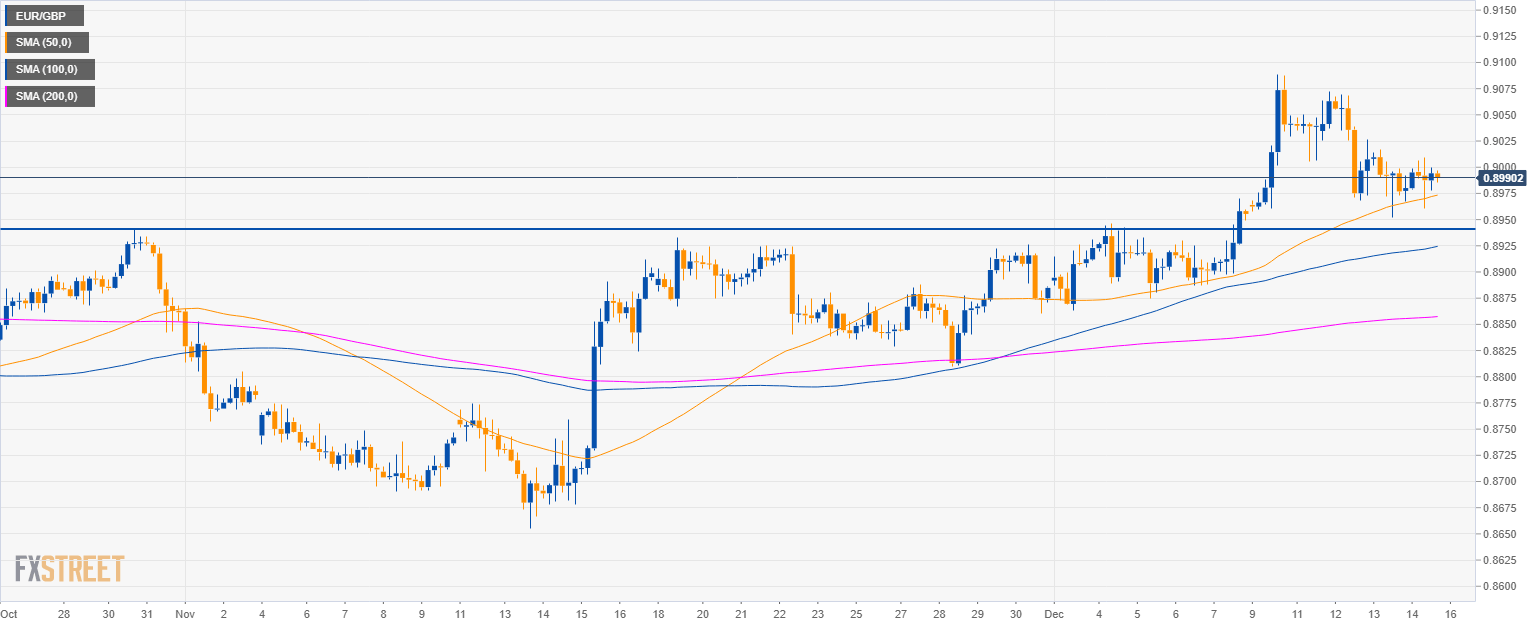

EUR/GBP 4-hour chart

- EUR/GBP is testing the 50 SMA.

- EUR/GBP is now trading just below the 0.9000 psychological level.

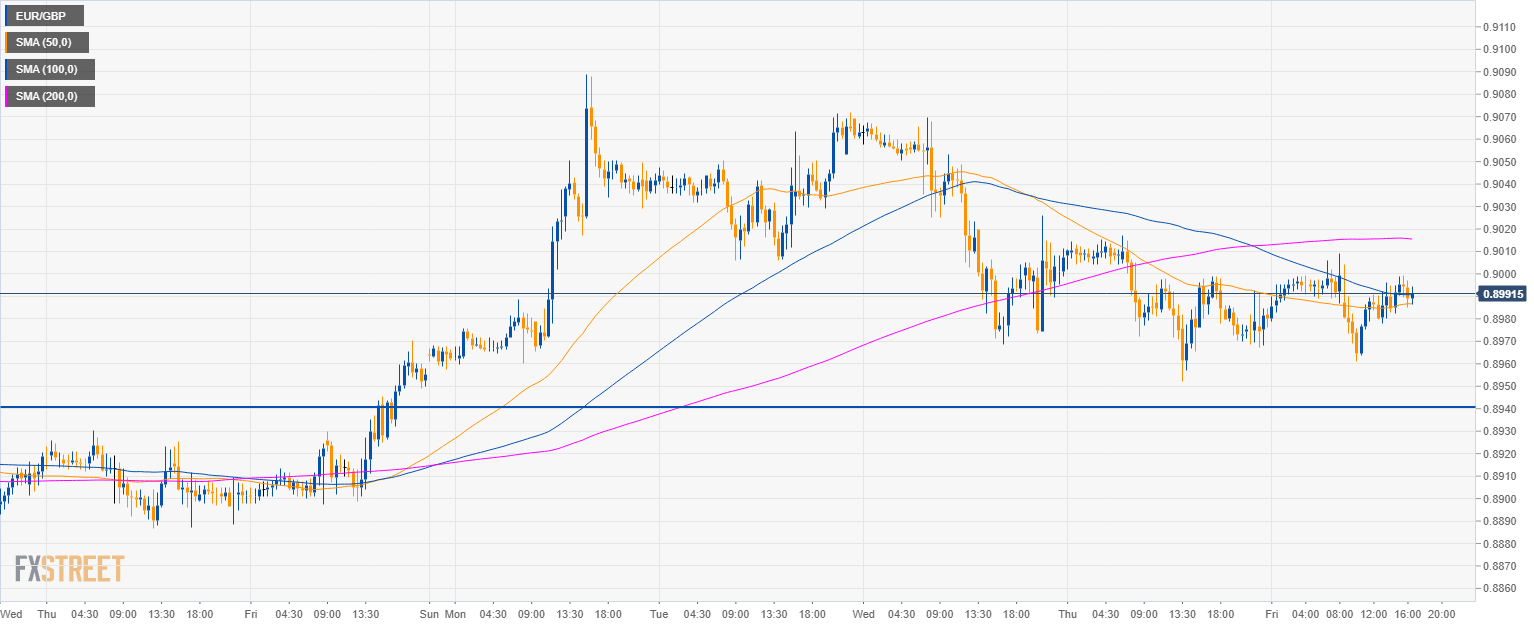

EUR/GBP 30-minute chart

- EUR/GBP is trading below the 200 SMA.

- EUR/GBP is losing steam and a dip to 0.8940 is the most likely outcome in the short-term.

Additional key levels

EUR/GBP

Overview:

Today Last Price: 0.8989

Today Daily change: 16 pips

Today Daily change %: 0.178%

Today Daily Open: 0.8973

Trends:

Previous Daily SMA20: 0.8917

Previous Daily SMA50: 0.8841

Previous Daily SMA100: 0.8891

Previous Daily SMA200: 0.8841

Levels:

Previous Daily High: 0.9026

Previous Daily Low: 0.8952

Previous Weekly High: 0.897

Previous Weekly Low: 0.8863

Previous Monthly High: 0.8932

Previous Monthly Low: 0.8656

Previous Daily Fibonacci 38.2%: 0.898

Previous Daily Fibonacci 61.8%: 0.8998

Previous Daily Pivot Point S1: 0.8941

Previous Daily Pivot Point S2: 0.891

Previous Daily Pivot Point S3: 0.8867

Previous Daily Pivot Point R1: 0.9015

Previous Daily Pivot Point R2: 0.9058

Previous Daily Pivot Point R3: 0.9089

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

TON crosses $200 million in Total Value Locked as its network integration continues to scale

In a recent development, the TON network surpassed $200 million in total value locked on Monday after seeing a major boost through The Open League reward program.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.