EURUSD

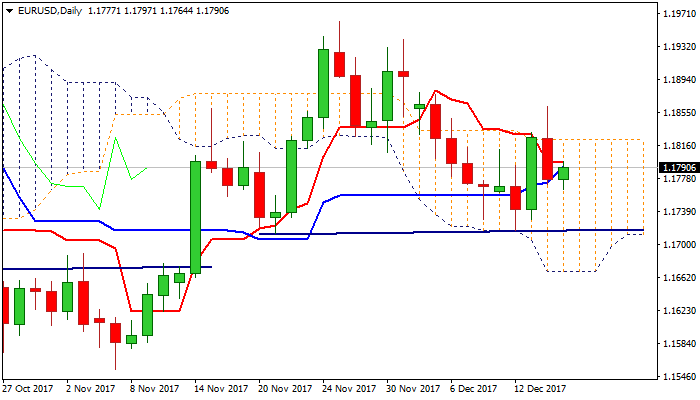

The Euro bounced to1.1800 zone after hitting new low at 1.1764 in Friday's Asian session trading. Bearish close on Thursday left long red candle with long upper shadow which weighs on near-term action. Euro's near-term sentiment remains fragile after Fed's decision on Wednesday boosted the greenback and the ECB kept monetary policy on hold on Thursday's meeting, but warned about persisting low inflation. Fresh concerns over US tax reform pressured dollar on Friday and may delay Euro's near-term bears, but downside risk is expected to remain in play while the price holds in the daily cloud. Recovery attempts should be ideally caped at 1.1800 resistance zone to keep key barriers at 1.1819/23 (20SMA/daily cloud top) intact. On the downside, 55 SMA which lies at 1.1759 (just under session low) marks initial support, ahead of pivots at 1.1718/09 (daily H&S pattern neckline/Fibo 61.8% of 1.1553/1.1961 rally) break of which would confirm bearish continuation for attack at daily cloud base at 1.1669.

Res: 1.1800; 1.1823; 1.1862; 1.1878

Sup: 1.1759; 1.1718; 1.1709; 1.1669

Interested in EURUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.