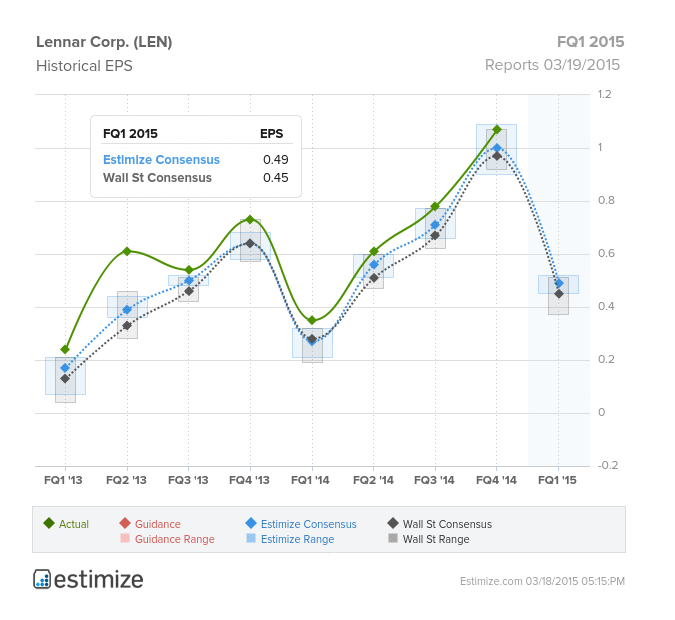

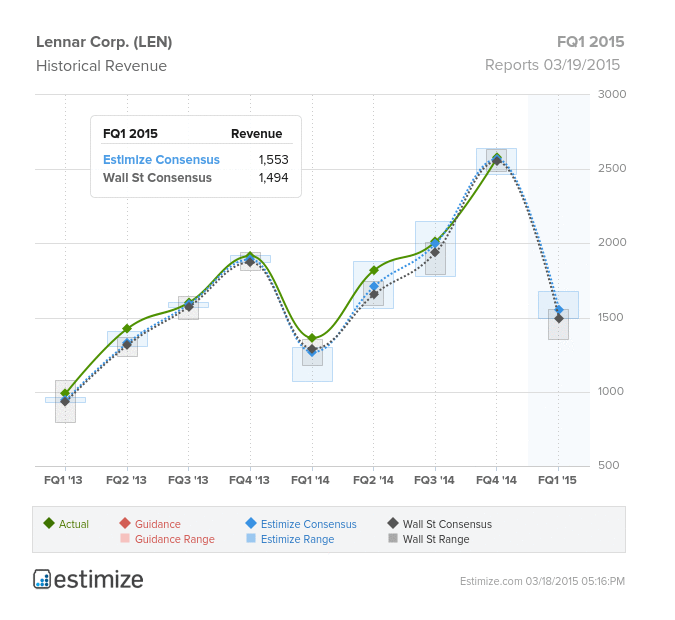

S&P 500 homebuilder, Lennar Corporation (NYSE:LEN) is scheduled to report first quarter results before Thursday’s opening bell. The Estimize consensus is looking for EPS of $0.49 -- above Wall Street’s $0.45 expectation. That would mark the third consecutive quarter of profit growth over 40%. Revenues are anticipated to come in at $1.55B, just slightly higher than the Street’s consensus of $1.49B, representing YoY growth of 4%.

With the exception of Q2 2014, Lennar has been posting double-digit -- even triple-digit profit growth -- every quarter since Q1 2012. Despite an economic recovery that began in 2009, the housing recovery didn’t really have legs until late 2012/early 2013. From Q4 2012 - Q2 2013 Lennar’s results were proof of this, with profit growth registering 125%, 200% and 190%, respectively, in those three quarters.

The housing recovery continued it’s run in 2014 which thus far has spilled into 2015, with some indicators still appearing mixed. The Housing Market Index which surveys the National Association of Home Builders about general economic and housing conditions came in strong throughout Lennar’s Q1 reporting period (December, January and February). However, buyer traffic began to slump in February, reflecting a lack of first time buyers in the market. Many explain this decline also has to do with low levels of inventory. Home sales were much more robust than expected towards the end of 2014, stealing a share of housing inventory from the beginning of 2015. Even so, homebuilders expect a strong acceleration in new home sales this year to an annual pace of 572,000 from last year’s 435,000, and even surging as high as 807,000 in 2016.

However, while there is optimism, certain indicators are still looking weak, with housing starts falling 17% in February due to winter storms in the Northeast and Midwest, something sure to be mentioned in Lennar’s report tomorrow. Despite this, building permits rose 3%. Mortgage applications, long a pain point for banks also rose 12% in February, over strong numbers in January. As we head into peak season for housing, we expect Lennar to share a bright outlook for the spring and summer.

In their Q4 report released in mid-January, Lennar cited a dip in gross margins, and warned that 2015 margins would be squeezed by rising building costs and higher incentives. After the report, shares fell 7% but have since recovered. Lennar’s stock is now up 10% for the year.