Will Monmouth REIT's E-Commerce Fueled Growth Fall To The Bottom Line?

Monmouth R.E. Inv. Corp. (NYSE: MNR) has been hitting the ball out of the park when it comes to growing its portfolio of new industrial buildings.

However, a nagging concern has been that the FFO and AFFO per diluted share have essentially remained the same over the past few years, despite the large growth recently in the size of the MNR portfolio.

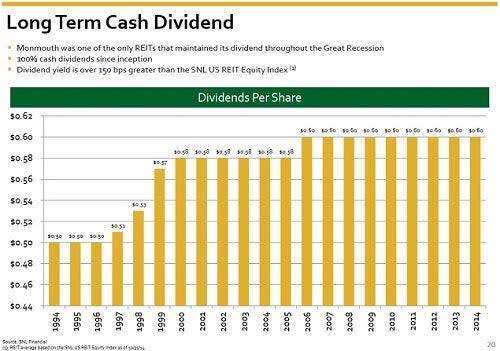

This has resulted in the MNR dividend remaining unchanged at $0.60 per year since 2006 -- currently yielding just over 5 percent.

Newer Modern Buildings

Monmouth's exponential growth has in large part been driven by third-party logistics giant FedEx Corporation (NYSE: FDX), which historically has accounted for ~50 percent of annual base rents for MNR.

Additionally, Monmouth has done a great job of acquiring Class-A buildings on sites that have room for expansion. Typically the leases negotiated for expansions are at more favorable terms for the landlord than the initial lease term on build-to-suit facilities such as these.

E-Commerce Tailwinds

A July 2014 report, authored by global logistics giant Prologis Inc (NYSE: PLD), does a great job of outlining why e-commerce is such a huge growth driver for the new Class-A facilities that Monmouth has been acquiring.

Prologis report highlights:

E-commerce is a sizable and growing share of demand, currently representing 10 percent of all new tenants around the world, up from less than 5 percent just three years ago.

For every billion in sales, traditional bricks and mortar retailers require 2.5 million square feet of retail space, and ~300,000 square feet of logistics space.

In contrast, E-commerce retailers require 1 million square feet of fulfillment space, or ~3x the space of traditional bricks and mortar.

Access for employees in the U.S. and Europe requires additional land for parking; while in Asia, proximity to mass transit is essential.

Larger customers often require higher clear ceiling heights for mezzanine floor space and operations.

Monmouth's Latest Quarter - FQ1

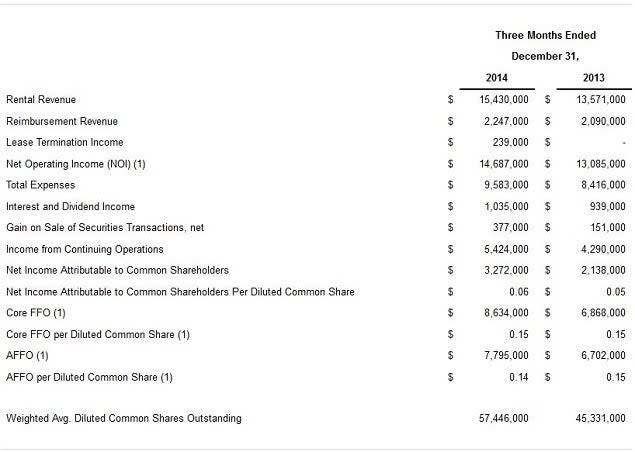

Here are the latest MNR results reported after the bell on February 4:

Although the company reported a sequential Q/Q AFFO increase of 17 percent compared to the quarter ended Sept. 30, 2014, the Y/Y AFFO results actually decreased from $0.15 to $0.14.

Monmouth overall portfolio occupancy as of December 31, 2014 was an excellent 97.4 percent, reflective of the strong leasing activity reported during the quarter.

Key Takeaways From The Simon Property Group Q4 Earnings Call...Including An Elephant

Investor Takeaway

In addition to five new Class-A build-to-suit facilities for $68.3 million during the quarter ended December 31, 2014, Monmouth announced an acquisition pipeline consisting of nine new Class-A build-to-suits, totaling ~2.8 million square feet for an aggregate purchase price of $266.8 million.

These are significant additions for a REIT with a current market cap of $675 million -- but will they be accretive to AFFO on a diluted share basis?

The answer to that key question -- along with guidance regarding dividend increases, if any -- will certainly be on the minds of analysts and MNR investors listening to the upcoming call.

Monmouth will be hosting its FQ1 earnings conference call at 10:00 AM EST on February 5, 2015.

See more from Benzinga

Key Takeaways From The Simon Property Group Q4 Earnings Call...Including An Elephant

Real Estate Bulls Continue To Battle Retail Analyst Bears On Sears Holdings

15 Facts Investors Should Know About Millennials, According To The White House

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.