Indian market kicked start the year 2022 on a robust note with 2 percent gain supported by banking and oil and gas stocks, despite rising concern over the COVID infections and a Hawkish FOMC stance.

The BSE Sensex last week added 1,490.83 points (2.55 percent) to end at 59,744.65, while the Nifty50 gained 458.65 points (2.6 percent) to close at 17,812.70 levels.

On the sectoral front, BSE Bankex and Oil & Gas indices rose 6.3 percent and 5.3 percent, while Healthcare and Information Technology indices lost 1-2 percent.

Broader indices perform in-line with main indices with the BSE Midcap and the Smallcap indices rising 2 percent each.

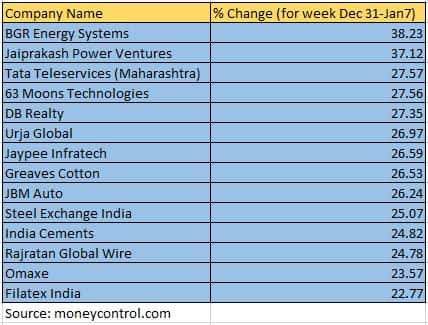

Some 122 small-cap stocks gained 10-38 percent. These include BGR Energy Systems, Jaiprakash Power Ventures, Tata Teleservices (Maharashtra), 63 Moons Technologies, DB Realty, Urja Global, Jaypee Infratech, Greaves Cotton, JBM Auto, Steel Exchange India and India Cements.

On the other hand, Hinduja Global Solutions, Spandana Sphoorty Financial, Surya Roshni, Dhanuka Agritech, Brigade Enterprises, Jubilant Industries, Max Healthcare Institute, Asian Granito India and Persistent Systems were amomg the major small-cap losers.

"Domestic equity markets started 2022 on a strong note with majority indices moving in the north direction this week. Despite rising COVID cases in India and globally, the markets moved higher as the severity of Omicron variant seems to low. The BSE 30 and NSE 50 indices inched up by 2.6 percent each during the week," said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

"After witnessing correction in recent weeks, the BSE Bankex index staged a strong comeback with returns of 6.5 percent this week. Defensives like BSE IT and BSE Healthcare gave negative returns during the week," he said.

FIIs turned out to be net buyer in January till date. The 10-year US treasury yield moved higher during the week and crude oil prices (Brent crude) increased beyond the $80 mark and is inching closer to the October 2021 highs.

"Inflation concerns, higher interest rate scenario and increasing COVID cases are some of the challenges for the market. Domestic markets over the next one month will closely track the upcoming quarterly results and the Union Budget," Chouhan said.

The BSE Midcap index added 2 percent led by the AU Small Finance Bank, Rajesh Exports, Cholamandalam Investment and Finance Company, Federal Bank, Page Industries and IDBI Bank.

"Domestic bourses kicked off the new year on a strong footing backed by positive sentiments in the global markets but succumbed to selling pressure after the release of the Fed meeting minutes. The minutes pointed to a faster than expected policy rate hike considering elevated US inflation levels. Surging Omicron cases and stricter restrictions kept the market highly volatile throughout the week,” said Vinod Nair, Head of Research at Geojit Financial Services.

“India’s Manufacturing PMI continued to be in the expansion zone at 55.5 in December supported by strong momentum in production and new orders, although the growth was slower on a sequential basis. Meanwhile, the service PMI index moderated to 55.5 in December from 58.1 in November and India’s unemployment rate rose to 7.9% owing to muted economic activity in rural and urban India amid rising Omicron cases.”

“The banking sector outshone other sectoral indices as few private lenders reported double-digit business growth during the third quarter,” said Nair.

Where is Nifty50 headed?

Ajit Mishra, VP - Research, Religare Broking

Markets are likely to consolidate further after the recent surge and it would be healthy. Meanwhile, volatility is likely to remain high, citing mixed global cues and COVID-related updates.

Besides, upcoming macroeconomic data (IIP, CPI, and WPI) and the beginning of the earnings season could further add to the choppiness.

We recommend continuing with a positive-yet-cautious approach and preferring hedged positions.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

For the last couple of sessions, the index is consolidating near this key Fibonacci level. The hourly Bollinger Bands have become flat, suggesting that the consolidation can continue for some more time. The overall structure shows that this is a healthy consolidation, which will prepare the setup for the next up move.

So, for the next few sessions, sideways action can take place in the range of 17,650–18,000. On the downside, 17,650-17,600 will provide cushion for any minor degree dip whereas on the higher side, 18,000 mark is expected to keep the rise in check for the short term.

Palak Kothari, Research Associate, Choice Broking

On the technical front, the index has been trading with higher high and higher low formation on a weekly chart as well as formed open marubozu candlestick which suggests an upside rally in the counter. On a four-hourly chart, the index has formed a hammer kind of candlestick pattern which adds bullish momentum for upcoming sessions.

The index has been trading above 21 and 50-HMA which suggests strength in the counter. However, a momentum indicator MACD trading with a positive crossover on the daily time-frame.

The index has support at 17,500 levels, while resistance comes at 18,000 levels, crossing above the same can show 18,200-18,300 levels. On the other hand, the Bank Nifty has support at 36,800 levels while resistance at 38,300 levels.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!