John Hussman Continues to Buy Gold Mining Companies

- By Tiziano Frateschi

The American investor John Hussman (Trades, Portfolio) bought shares in the following stocks in both third and second quarter of 2018.

Warning! GuruFocus has detected 1 Warning Sign with HOLI. Click here to check it out.

The intrinsic value of HOLI

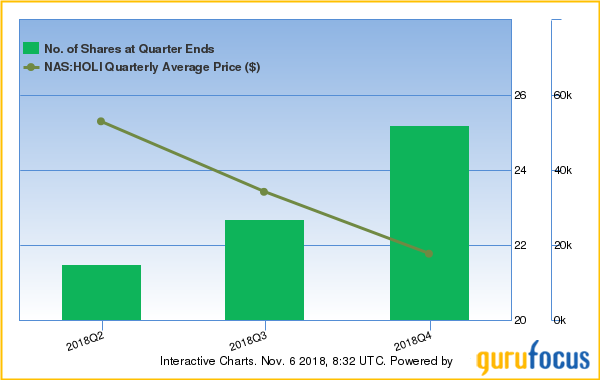

Hollysys Automation Technologies Ltd. (HOLI)

In the second quarter, the guru increased his position by 30.80% and added 92.59% in the third quarter.

With a market cap of $1.13 billion, the company provides automation technologies in China. Its revenue of $18.68 billion has grown 3.20% over the last five years.

Chris Davis (Trades, Portfolio) is the largest shareholder of the company among the gurus with 10.16% of outstanding shares, followed by Jim Simons (Trades, Portfolio) with 0.25% and Chuck Royce (Trades, Portfolio) with 0.21%

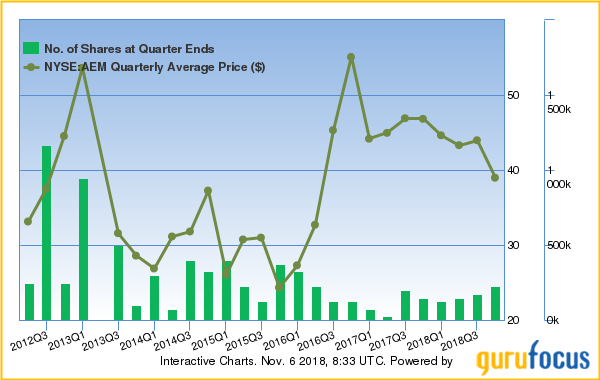

Agnico Eagle Mines Ltd. (AEM)

The investor added 16.67% to his holding in the second quarter and 28.57% in the third quarter.

The Canadian gold mining company has a market cap of $8.49 billion. Its revenue of $2.21 billion has raised 3.90% over the last five years.

The company's largest guru shareholder is First Eagle Investment (Trades, Portfolio) with 5.32% of outstanding shares, followed by Simons' firm with 0.75%, Pioneer Investments (Trades, Portfolio) with 0.48% and John Paulson (Trades, Portfolio) with 0.26%.

Anglogold Ashanti Ltd. (AU)

Hussman increased his position 42.86% in the second quarter and 30.20% in the third quarter.

The gold miner which operates in eight countries and three continents, has a market cap of $4.29 billion. Its revenue of $4.39 billion has grown 1.70% over the last five years.

Paulson is the largest guru shareholder of the company with 3.58% of outstanding shares, followed by Howard Marks (Trades, Portfolio) with 1.03%, First Eagle Investment (Trades, Portfolio) with 0.52% and Simons with 0.45%.

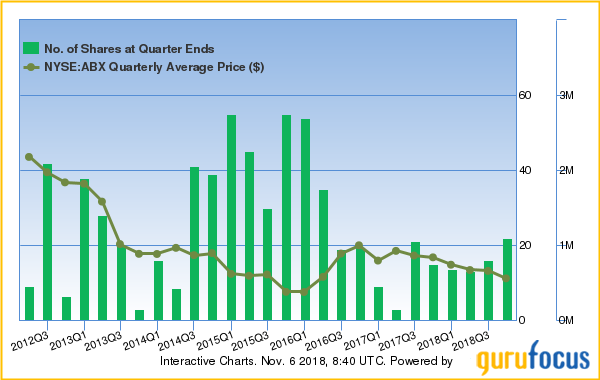

Barrick Gold Corp. (ABX)

In the second quarter, the guru raised the holding by 23.08% and added 37.5% in the third quarter.

The company which produces and sells gold and copper, has a market cap of $15.37 billion. Its revenue of $7.56 billion fell 8.20% over the last five years.

The company's largest guru shareholder is First Eagle Investment (Trades, Portfolio) with 3.14% of outstanding shares, followed by Simons with 0.24%, Pioneer Investments (Trades, Portfolio) with 0.18% and Bestinfond (Trades, Portfolio) with 0.14%.

Goldcorp Inc. (GG)

The guru boosted his holding 128.57% in the second quarter and by 50% in the third quarter.

With a market cap of $8.27 billion, the company explores, develops and acquires precious metal properties. Its revenue of $3.11 billion has increased 1.20% over the last five years.

With 4.29% of outstanding shares, First Eagle Investment (Trades, Portfolio) is the company's largest guru shareholder, followed by Pioneer Investments (Trades, Portfolio) with 0.38%, Paulson with 0.09% and Simons with 0.07%.

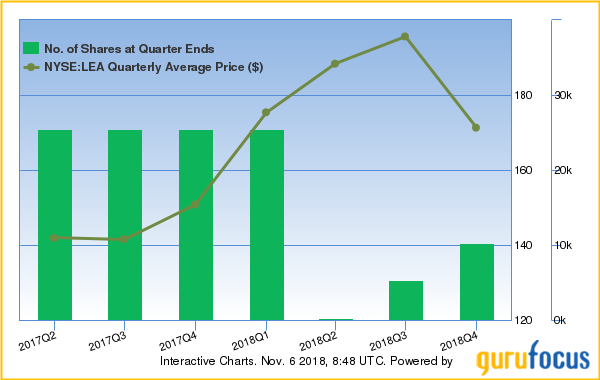

Lear Corp. (LEA)

Hussman boosted his stake by 1,666.67% in the second quarter and 94.34% in the third quarter.

With a market cap of $8.97 billion, the company operates in the auto parts industry. Its revenue of $21.56 billion has raised 13.70% over the last five years.

The largest shareholder among the gurus is Simons with 0.28% of outstanding shares, followed by Steven Cohen (Trades, Portfolio) with 0.22% and Lee Ainslie (Trades, Portfolio) with 0.08%.

Newmont Mining Corp. (NEM)

In the second quarter, the investor increased the holding 22.22% and then boosted it 27.27% in the third quarter.

The company which produces gold in the U.S., Australia, Peru and Ghana, has a market cap of $17.27 billion. It has a revenue of $7.10 billion that has fallen 7.90% over the last five years.

First Eagle Investment (Trades, Portfolio) is the company's largest guru shareholder with 1.79% of outstanding shares followed by Pioneer Investments (Trades, Portfolio) with 0.3%, Mario Gabelli (Trades, Portfolio) with 0.17% and John Buckingham (Trades, Portfolio) with 0.01%.

Randgold Resources Ltd. (GOLD)

The guru increased his stake 12.5% in the second quarter and 33.33% in the third quarter.

With a market cap of $7.8 billion, the company operates five gold mines in Africa. Its revenue of $1.18 billion has climbed 6.30% over the last five years

The largest shareholder among the gurus is First Eagle Investment (Trades, Portfolio) with 1.31% of outstanding shares, followed by Simons' firm with 1.27%.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

6 Companies With Strong Earnings, Revenue Growth

Tom Gayner Expands Multiple Positions in 3rd Quarter

Mario Gabelli Trims Keurig Dr Pepper, Chemed Positions

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with HOLI. Click here to check it out.

The intrinsic value of HOLI