The market snapped a two-day losing streak and ended at a record closing high on February 11, backed by positive global cues, index heavyweight Reliance Industries, and good corporate earnings season.

The benchmark indices remained higher for the major part of the session, though there was volatility. The BSE Sensex rose 222.13 points to 51,531.52, while the Nifty50 climbed 66.80 points to 15,173.30 and formed a small bullish candle on the daily charts.

"A long positive candle was formed on Thursday, after the formation of Doji or high-wave type candle pattern of Wednesday. Technically, this pattern could indicate a completion of minor downward correction with range movement of the last two sessions and the market is now ready for further upside," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"One may expect further upside towards 15,257 and higher in the next 1-2 sessions. A sustainable move above 15,260 could pull Nifty towards a new upside of 15,400-15,500 levels in the near term. Immediate support is placed at 15,050," he said.

He further said the market breadth has turned positive, but still not convincing. "There is an expectation of further improvement in the breadth as the index moves up."

The Nifty Midcap 100 and Smallcap 100 indices closed positive by 0.18 percent and 1.81 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,096.3, followed by 15,019.3. If the index moves up, the key resistance levels to watch out for are 15,219.4 and 15,265.5.

Nifty Bank

The Nifty Bank declined further by 31 points to 35,752.10 on February 11. The important pivot level, which will act as crucial support for the index, is placed at 35,547.14, followed by 35,342.17. On the upside, key resistance levels are placed at 35,983.24 and 36,214.37.

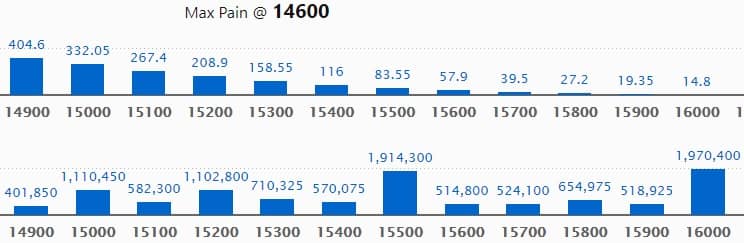

Call option data

Maximum Call open interest of 19.70 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,500 strike, which holds 19.14 lakh contracts, and 15,000 strike, which has accumulated 11.10 lakh contracts.

Call writing was seen at 16,100 strike, which added 1.19 lakh contracts, followed by 15,800 strike which added 76,650 contracts and 15,200 strike which added 56,250 contracts.

Call unwinding was seen at 15,000 strike, which shed 1.18 lakh contracts, followed by 14,500 strike which shed 16,800 contracts and 14,900 strike which shed 16,425 contracts.

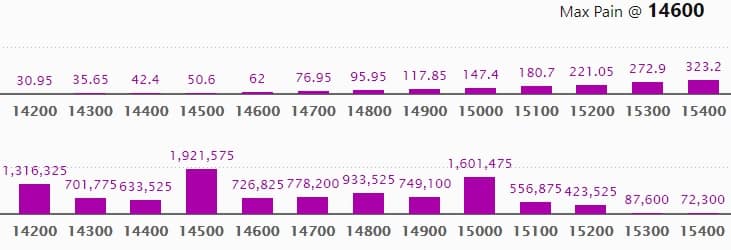

Put option data

Maximum Put open interest of 19.21 lakh contracts was seen at 14,500 strike, which will act as crucial support level in the February series.

This is followed by 15,000 strike, which holds 16.01 lakh contracts, and 14,200 strike, which has accumulated 13.16 lakh contracts.

Put writing was seen at 15,000 strike, which added 1.7 lakh contracts, followed by 15,100 strike, which added 1.67 lakh contracts and 14,900 strike which added 1.36 lakh contracts.

Put unwinding was seen at 14,200 strike, which shed 89,400 contracts, followed by 14,300 strike which shed 21,075 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

38 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

23 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

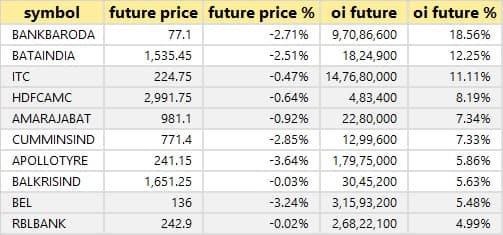

40 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

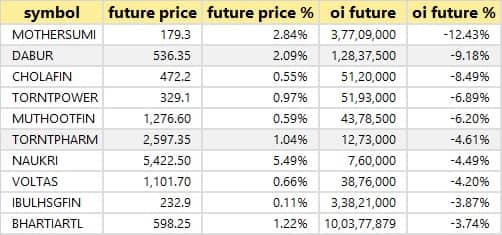

39 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

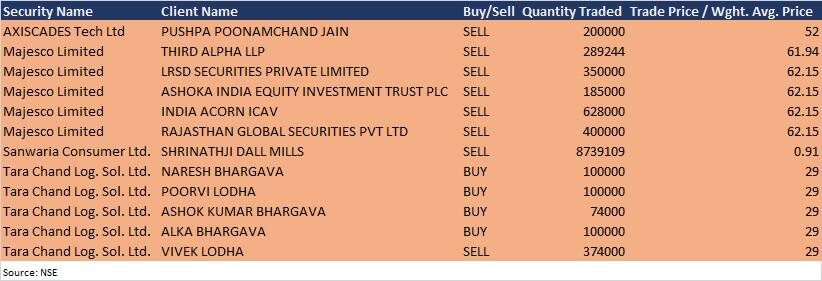

Bulk deals

(For more bulk deals, click here)

Grasim Industries, Bharat Forge, Glenmark Pharmaceuticals, Advanced Enzyme Technologies, Anant Raj, Apollo Micro Systems, Apollo Hospitals Enterprise, Bharat Dynamics, Cochin Shipyard, Dilip Buildcon, Delta Corp, Embassy Office Parks REIT, Force Motors, GE T&D India, GIC Housing Finance, GMR Infrastructure, Godrej Industries, Hindustan Aeronautics, Indiabulls Housing Finance, Inox Wind, ITI, Lux Industries, Mazagon Dock Shipbuilders, Mishra Dhatu Nigam, MOIL, Motherson Sumi Systems, Nagarjuna Fertilizers, NALCO, The New India Assurance Company, PC Jeweller, PTC India, Siemens, Sobha, Sterling and Wilson Solar, Voltas and Zuari Agro Chemicals are among 953 companies to announce their quarterly earnings on February 12.

Stocks in the news

Ashok Leyland: The company posted loss at Rs 19.4 crore in Q3FY21 against profit of Rs 27.7 crore in Q3FY20, revenue rose to Rs 4,813.5 crore from Rs 4,015.6 crore YoY.

Power Grid Corporation: The company reported higher consolidated profit at Rs 3,367.7 crore in Q3FY21 against Rs 2,672 crore in Q3FY20, revenue increased to Rs 10,142.5 crore from Rs 9,364.4 crore YoY.

ACC: The company reported sharply higher consolidated profit at Rs 472.4 crore in October-December quarter 2020 against Rs 273.3 crore in October-December quarter 2019, revenue rose to Rs 4,144.7 crore from Rs 4,060.3 crore YoY.

Prestige Estates Projects: The company reported sharply lower consolidated profit at Rs 87.8 crore in Q3FY21 against Rs 216.4 crore in Q3FY20, revenue fell to Rs 1,847.6 crore from Rs 2,680.9 crore YoY.

Oil India: The company reported higher consolidated profit at Rs 889.69 crore in Q3FY21 against Rs 709.39 crore in Q3FY20, revenue fell to Rs 2,137.34 crore from Rs 2,957.19 crore YoY.

ITC: The company reported lower consolidated profit at Rs 3,587.09 crore in Q3FY21 against Rs 4,050.4 crore in Q3FY20, revenue rose to Rs 14,124.48 crore from Rs 13,307.54 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 944.36 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 707.68 crore in the Indian equity market on February 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - BHEL and SAIL - are under the F&O ban for February 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!