Methanex (MEOH) Q1 Earnings Beat Estimates, Revenues Down Y/Y

Methanex Corporation MEOH posted profits (attributable to shareholders) of $23 million or 21 cents per share in the first quarter of 2020, down from $38 million or 50 cents per share in the year-ago quarter.

Adjusted earnings per share (barring one-time items) in the reported quarter were 10 cents, which surpassed the Zacks Consensus Estimate of 7 cents.

Revenues declined 17.4% year over year to $745 million in the quarter. The results were impacted by lower year-over-year methanol prices.

Adjusted EBITDA tumbled 28.9% year over year to $138 million.

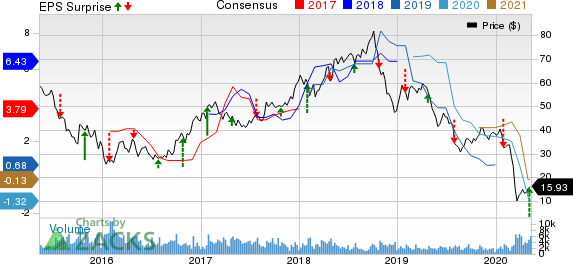

Methanex Corporation Price, Consensus and EPS Surprise

Methanex Corporation price-consensus-eps-surprise-chart | Methanex Corporation Quote

Operational Highlights

Production in the quarter totaled 2,007,000 tons, up 11% year over year. Total sales volume was 2,788,000 tons, up 2.4% year over year.

Average realized price for methanol was $267 per ton in the quarter, down 19.3% from $331 in the prior-year quarter.

Financials

For the reported quarter, cash flow from operating activities was $142 million, down 33.3% year over year. The company had cash and cash equivalents of $823 million, up 188.7% year over year.

Outlook

Methanex expects demand for methanol to be lower in the second quarter on a sequential comparison basis due to the impacts of the coronavirus pandemic and a low oil price environment. As a result, the company anticipates financial results to be lower in the second quarter as compared to the first quarter. Notably, it stated that it cannot accurately forecast the degree of impact at this point of time due to uncertainties regarding the duration and extent of the coronavirus pandemic, and the low oil price environment.

Further, Methanex deferred roughly $500 million in capital expenditure on its Geismar 3 project for up to 18 months due to substantial uncertainty, arising from the coronavirus pandemic.

Moreover, the company reduced maintenance capital expenditure for 2020 by $30 million. It also reduced the quarterly dividend by 90%, representing roughly $100 million in annualized cash savings.

Price Performance

Shares of the company have lost 66.2% in the past year compared with the industry’s 24.3% decline.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic materials space are Equinox Gold Corp. EQX, Franco-Nevada Corporation FNV and Newmont Corporation NEM.

Equinox Gold currently sports a Zacks Rank #1 (Strong Buy) and has a projected earnings growth rate of 231% for 2020. The company’s shares have gained 49.2% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has a projected earnings growth rate of 22% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have rallied 89.2% in a year.

Newmont has a projected earnings growth rate of 85.6% for the current year. The company’s shares have rallied around 108% in a year. It currently has a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

FrancoNevada Corporation (FNV) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Equinox Gold Corp (EQX) : Free Stock Analysis Report

To read this article on Zacks.com click here.