Will Bed Bath & Beyond (BBBY) Keep Going Amid Cost Headwinds?

Bed Bath & Beyond Inc. BBBY has been witnessing mixed stock trends, with its transformation plan, digital momentum and store rationalization efforts keeping it in good stride. The company has been on track with its planned rollout of Owned Brands as part of its three-year transformation plan.

However, the ongoing supply-chain challenges, cost inflation, and a drop in store traffic due to the rising COVID-19 Delta cases have been hurting sentiment. The challenges hurt the company's top and bottom lines in second-quarter fiscal 2021.

Net sales declined 26% year over year and missed the Zacks Consensus Estimate. In the fiscal second quarter, total enterprise comparable sales (comps) inched down 1% year over year as traffic slowed in August. Core banner sales fell 11% year over year due to the drab performance in the Bed Bath & Beyond banner and the impact of fleet optimization. Adjusted earnings were 4 cents per share for the fiscal second quarter, down from 50 cents in the year-ago quarter due to dismal margins stemming from higher freight costs.

Management expects the headwinds to persist during part of the holiday season, thus, crushing hopes of a swift economic recovery.

Driven by the drab fiscal second-quarter results, management slashed the fiscal 2021 view. Bed Bath & Beyond envisions net sales of $8.1-$8.3 billion for fiscal 2021, down from the previously mentioned $8.2-$8.4 billion. It expects comps to be flat to marginally up for the remaining quarters versus the previously communicated low-single-digit range. It also expects adjusted earnings of 7-10 cents per share, down from the earlier stated $1.40-$1.55 for fiscal 2021.

For third-quarter fiscal 2021, the company anticipates sales of $1.96-$2 billion, including core sales and planned sales reduction as part of its store fleet optimization program. Comps are likely to remain flat year over year. Adjusted earnings between break-even and 5 cents for the fiscal third quarter.

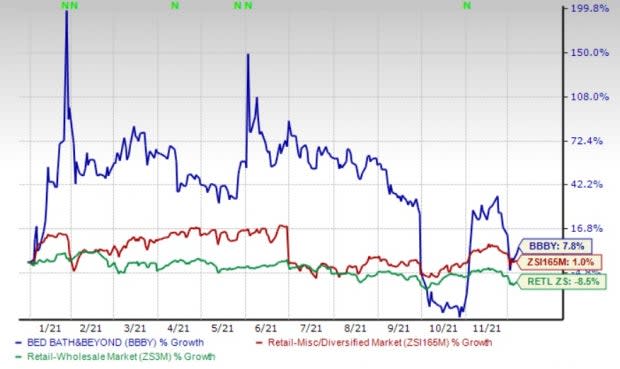

Image Source: Zacks Investment Research

Factors to Keep the Stock Going

As part of its three-year transformation plan, Bed Bath & Beyond is on an assortment expansion spree. It plans to introduce at least 10 Owned Brands in the next two years. The company highlighted that the new Owned Brands would cater to consumer needs across segments such as bed, bath, kitchen and dining, storage and organization, and home decor. The products will form part of the company's key category that contributes more than 60% to its revenues.

In the first half of fiscal 2021, Bed Bath & Beyond launched private-label brands (Owned Brands), including Nestwell, Haven and Simply Essential, Wild Sage, Our Table, and Squared Away. In third-quarter fiscal 2021, it launched its seventh and eighth owned brands, namely Studio 3B and H for Happy, respectively. Studio 3B offers contemporary home décor products, including décor, bedding, bath and accent furniture. The H for Happy collection includes many affordable products that bring a light-hearted and contemporary approach to seasonal and everyday celebrations. The company's high-margin Owned Brands have been performing beyond expectation.

Management expects the sales penetration of Owned Brands to grow from 10% to 30% in the first three years. The company expects to boost the gross margin by strategically managing costs and sourcing. Another major step in its comprehensive growth strategy includes launching thousands of products exclusively at Bed Bath & Beyond.

Bed Bath & Beyond continues to gain from its enhanced omnichannel capabilities, including buy online and pick up in store, and same-day delivery services. Management continues to bank on the robust digital channel and is making efforts to offer an improved customer experience. In doing so, it has entered the next phase of its supply-chain modernization via the partnership with Ryder and expanded its same-day delivery facility via a partnership with Roadie. Earlier, it partnered with DoorDash to expand its same-day delivery services across the United States and Canada. The company is also on track with enabling cross-banner browsing across Bed Bath & Beyond, buybuy BABY, and Harmon brands.

Bed Bath & Beyond is in the process of strategically expanding its store count apart from increasing the productivity of existing stores by adjusting the breadth and depth of its merchandise offerings to suit customer preferences. In 2019, the company announced its Store Network Optimization project, which is likely to generate savings of $100 million on an annual basis. This three-year-long plan will be executed across more than 450 stores, accounting for nearly 60% of its sales. Under its store remodel program, Bed Bath & Beyond remodeled roughly 70 stores in the reported quarter and is on track to remodel 130-150 stores in fiscal 2021.

The Zacks Rank #3 (Hold) company has a market capitalization of $1.9 billion. Year to date, BBBY has gained 7.8% compared with the industry's growth of 1%. It also compares favorably against the Retail-Wholesale sector's decline of 8.5%.

In the past 30 days, the company's estimates for fiscal 2021 earnings per share have been unchanged. For fiscal 2021, its earnings estimates are pegged at 84 cents per share, suggesting 183.2% growth from the year-ago period's reported figure.

Stocks to Watch

We have highlighted some better-ranked stocks from the broader industry, namely Build-A-Bear Workshop BBW, Tractor Supply Co. TSCO and MarineMax HZO.

Build-A-Bear Workshop currently sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 261.4%, on average. Shares of BBW have surged 412% year to date.

You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Build-A-Bear Workshop's current financial-year sales suggests growth of 54.1%. The same for earnings per share indicates growth of 298.1% from the year-ago period's reported figure.

Tractor Supply, a Zacks Rank #1 stock, has a trailing four-quarter earnings surprise of 22.8%, on average. The TSCO stock has gained 66% year to date.

The Zacks Consensus Estimate for Tractor Supply's current financial-year sales and earnings per share suggests growth of 19% and 23.9%, respectively, from the year-ago period's reported numbers. TSCO has an expected long-term earnings growth rate of 10.2%.

MarineMax currently carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 61.2%, on average. Shares of the company have gained 60.1% in the year-to-date period.

The Zacks Consensus Estimate for MarineMax's current financial-year sales and earnings per share suggests growth of 6.4% and 9.6%, respectively, from the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

Bed Bath & Beyond Inc. (BBBY) : Free Stock Analysis Report

BuildABear Workshop, Inc. (BBW) : Free Stock Analysis Report

MarineMax, Inc. (HZO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research