McDonald's has embraced many changes in recent years related to sustainable food: a full transition to cage-free eggs throughout the U.S. and Canada, chicken raised without antibiotics, and milk from cows that have not been treated with artificial growth hormones. But do not expect a Beyond Mac or Impossible Quarter-Pounder on the fast-food giant's menu in the U.S. anytime soon.

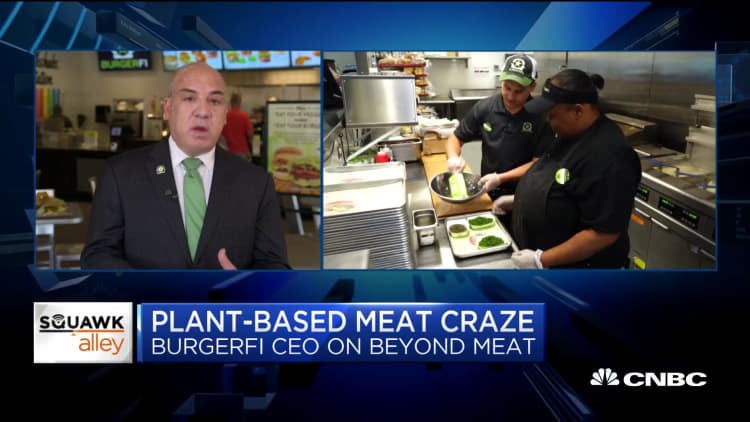

The demand for vegan burgers and alternative meat is a trend that McDonald's CEO Steve Easterbrook recently told CNBC the company is taking "a good look at," but he was coy about any plans. Meanwhile, its U.S.-based competitors are rushing to add lab-derived plant-based menu items.

Last year White Castle began selling the Impossible Slider, a burger made from plant-based (soy) protein created by Impossible Foods. In May, Little Caesars became the most recent to officially jump on board, announcing a new pizza topped with plant-based sausage that Impossible Foods has been testing the waters for; KFC's U.S. president, Kevin Hochman, has said it is in an "exploration phase right now" about adding plant-based fried chicken.

The appeal of alternative meat has even hit Hooters, whose parent company recently signed a deal with Beyond Meat, the Impossible Foods' competitor that derives its plant-based protein from peas and has been the best IPO of 2019, up more than 500%, a surge that has drawn serious attention to the sector. Beyond Meat also delivered a first-ever earnings report as a public company this month that surpassed expectations. Barclays recently estimated that the alternative-meat space has grown to become a $140 billion industry.

Consumer demand and competition

Morgan Springer, former co-founder of organic food-delivery start-up Sprig, says that the evolving consumer consciousness, "parallel to the disruption of dairy," is driving the surge in interest for plant-based protein. And for giant companies looking to retool their processes, "it's a matter of survival at this point."

Beyond Meat and Impossible Foods are served in almost 20,000 restaurants across the country, and the list of restaurant chains responding to perceived consumer demand is growing daily: TGI Fridays, Carl's Jr, Del Taco Restaurants and Red Robin also now plan to offer pea- or soy-based burgers. Consumer interest is so strong that Impossible Foods has been struggling to keep up with an unprecedented surge in demand.

Impossible Foods founder and CEO Pat Brown recently had to recruit more than 100 volunteers from Impossible's R&D ranks to work 12-hour shifts in production, packing burgers into boxes and manning conveyor belts in 40-degree temperatures. The company has plans to increase its 70-employee workforce at its sole manufacturing facility in Oakland, California, add a third shift and build a second production line. It also is setting up a European production arm.

But McDonald's Easterbrook alluded to one of the big challenges for the U.S. restaurant sector in his recent CNBC appearance, saying the company needs to continue weighing alternative meat's demand against the complexities involved with introducing it in their kitchens. "The question is, will the demand make it worth absorbing the complexity because this will drive the business? I mean, we had a similar discussion maybe four years ago around all-day breakfast, where it certainly adds complexity to the operation, but the demand was sufficient that, you know, we want to find a way to absorb that," he said.

Rob Leclerc, a founding partner at foodtech venture capital firm AgFunder, says that the current food industry's success has been in part predicated to finding a combination of cheap raw ingredients for its kitchens. Companies able to handle complexities in the kitchen — in effect, find the recipes that meet consumer preferences while also being cost-effective — will ultimately win.

"I don't think [the strategy] is just limited to plant-based proteins," Leclerc said. "I think we're talking about a consumer who has certain demands and — if unmet by McDonald's — are willing to go to a smaller franchise that focuses on those demands specifically."

"It's even more important for us than the bigger brands," said Jamie Richardson, vice president at White Castle, which was early to capitalize on the trend introducing Impossible Sliders (priced at $2) in April 2018. "We have less margin for error and started to see the trend with Gen Z and millennials more interested in non-meat alternatives."

A sector facing slower growth

It is not only consumer demand driving the escalation of the alternative-meat arms race. The restaurant sector has experienced no growth to slow growth in recent years and needs to find new ways to bring in foot traffic and entice customers to spend on higher-priced menu items.

The U.S. food-service sector overall has seen traffic range from an increase of 0.6% to a decline of as much as -0.4% in recent years, according to NPD Group. Quick-service restaurants have done better than midscale and casual dining sectors, with recent growth as high as, but no greater than, 1%. The size of the average check has been outpacing the growth in traffic since 2015, at an average of roughly 2% growth, but NPD notes that dollars are reflective of costs and not more people going to restaurants, making traffic the more accurate measure. NPD Group's annual traffic forecast for 2019 and 2020 anticipates a continued lack of sizable growth, with 2019 up a little and 2020 expected to decline.

Restaurant Brands' Burger King, which has seen positive upward momentum in the past week despite recent turbulence, reported a big debut for the Impossible Whopper, which in a St. Louis test market outperformed the chain's national foot traffic average by 18.5% in April. The Impossible Whopper, which costs a dollar more than the classic Whopper, is made with mostly soy protein, potato protein, coconut oil, sunflower oil and heme.

Restaurant Brands' Tim Hortons chain is now testing Beyond Meat's breakfast sausage.

Nestle and even Tyson Foods, one of the world's biggest meat producers, have recently announced plans to start selling meat substitutes of their own in the U.S. "Giant companies will only change when they sense an existential threat," Springer said. "They'll only evolve when they know they're going to die if they don't. ... There's probably an awareness that without evolution, that company will gradually decline."

Phenomenon or fad?

The McDonald's CEO did not dismiss the trend, telling CNBC, "I don't think it's faddish. Whether it maintains its same level of buzz I think is what's interesting."

McDonald's recently debuted a soy-and-wheat-based patty from Nestle in Germany, called the Big vegan, as a permanent addition to the menu.

The first question Beyond Meat CEO Ethan Brown faced on his first quarterly conference call with analysts earlier in June was about the repeat rate for orders in restaurants. "Any sense of what the difference between like trial and repeat is?" an analyst from Bank of America asked.

"We don't have as much data as we'd like in this category. We do have some," Brown said. "And our repeat rates are actually quite high relative to some of the animal-based meats that are in the category that were being evaluated, as well as some of the plant-based alternatives. ... Our panel data with that a 40% to 50% repeat rate for the Beyond Burger in certain markets. But this is an area that we're going to continue to invest in from a marketing research prospective, to make sure that we are continuing to retain the consumers. But that number, over 40%, is actually very, very high for this category for CPG products in general where we are."

White Castle introduced the Impossible Slider in three test markets in April 2018 — Chicago, New York and New Jersey — and expanded the menu item to all 380 of its restaurants in September. While White Castle's Richardson would not share specific sales figures, he said that during the first eight weeks of the national rollout, same-store sales were ahead of competitors. Key competitors in that period were up 1% versus the prior year, while White Castle was up 4%. "We know that the launch helped market share gains," Richardson said.

Giant companies will only change when they sense an existential threat. They'll only evolve when they know they're going to die if they don't.Morgan Springerformer co-founder of Sprig, an organic food-delivery start-up

White Castle also noted that it is seeing meat eaters buy both the Impossible Slider and a double bacon cheeseburger.

Richardson said White Castle's small-sized burgers contribute to this trend, as does the curiosity factor. But the interest isn't ending after the first order. "It's definitely part of the ordering behavior — people are coming back for it again and again."

Some industry experts still believe that the rush to plant-based proteins is best described as a fad, but that does not mean companies won't profit from it.

"Fads are something you can make a lot of money off of and improve your bottom line," said Melissa Abbott, vice president of culinary insights for The Hartman Group, a food culture consultancy based in Bellevue, Washington. She stressed that for companies making this move, there is a need "to make sure that you're being authentic in the way that you're presenting this offering."

Leclerc said the authenticity of the plant-based protein adoption is part of fundamental challenges that many legacy companies face.

"This [authenticity] is fundamentally difficult for very large consumer brands that are trying to satisfy the largest possible base of consumers," he said.

What Leclerc referred to as "flexitarian diets" will reshape many food categories. "All CPG (consumer packaged goods) categories are experiencing widespread de-commoditization," he said, explaining consumers' hunger for new ideas that shake up the status quo in restaurants and supermarkets. "I think large companies need to be able to serve that marginal customer who comes from an increasingly small, self-segregating group."

While the health consequences of switching to a plant-based protein diet have not received enough study yet, companies like Beyond Meat and Impossible Foods have focused much of their marketing on the environmental havoc wreaked by the industrial livestock agriculture system.

"I think that is a massive consumer trend that will continue as long as people learn more about how environmentally damaging meat is," said Springer of Sprig, the organic food-delivery start-up.

According to PETA, animal agriculture is responsible for more greenhouse gases than all the world's transportation systems combined. That, in addition to the enormous amount of water required, also has brought attention to the environmental impact of traditional meat farming.

These environmental concerns, in addition to personal health trends, are part of the movement that food companies need to understand, said Erel Margalit, founder and executive chairman of Jerusalem Venture Partners. "Companies creating a lot of havoc on the environment are going to need to reevaluate what they're doing."

The reevaluation is not limited to fast food. "I think [big companies] have to reinvent themselves if consumers are going to continue to see them as relevant," Margalit said. He said the food business is the best example of how a generational change can have huge repercussions for the status quo in business.

"They want to know where their food comes from, how it's packaged, where it's raised ethically, and where it's going. … They love to eat, but they want to know that it's environmentally kosher."

JVP recently partnered with snacking company Mars to fuel foodtech research and innovation in Israel.

"If the 19th century was about profit and the 20th century was about profit and risk, then the 21st century is clearly about profit, risk and impact," he said.