Why Advance Auto Parts Inc’s (NYSE:AAP) CEO Pay Matters To You

Tom Greco has been the CEO of Advance Auto Parts Inc (NYSE:AAP) since 2016. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at other big companies. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Advance Auto Parts

How Does Tom Greco’s Compensation Compare With Similar Sized Companies?

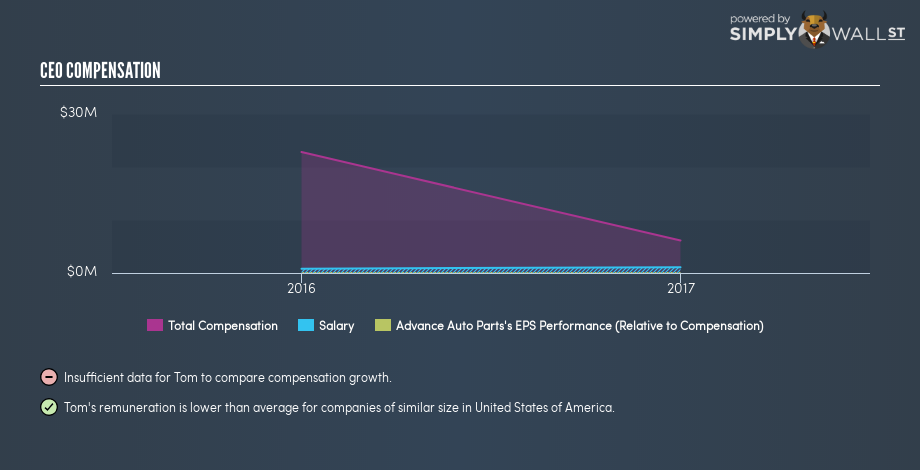

At the time of writing our data says that Advance Auto Parts Inc has a market cap of US$12.7b, and is paying total annual CEO compensation of US$6m. When we examined a group of companies with market caps over US$8.0b, we found that their median CEO compensation was US$11m.

This would give shareholders a good impression of the company, since most large companies pay more, leaving less for shareholders. Though positive, it’s important we delve into the performance of the actual business.

You can see a visual representation of the CEO compensation at Advance Auto Parts, below.

Is Advance Auto Parts Inc Growing?

Advance Auto Parts Inc has reduced its earnings per share by an average of 2.3% a year, over the last three years. The trailing twelve months of revenue was pretty much the same as the prior period.

Unfortunately there is a complete lack of earnings per share improvement, over three years. And the flat revenue hardly impresses. It’s hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration.

It could be important to check this free visual depiction of what analysts expect for the future.

Has Advance Auto Parts Inc Been A Good Investment?

Advance Auto Parts Inc has not done too badly by shareholders, with a total return of 4.5%, over three years. But they probably don’t want to see the CEO paid more than is normal for companies around the same size.

In Summary…

Advance Auto Parts Inc is currently paying its CEO below what is normal for large companies.

Shareholders should note that compensation for Tom Greco is under the median of a group of large companies. But the business isn’t growing earnings per share, and the returns to shareholders haven’t been wonderful. So while shareholders shouldn’t be overly concerned about CEO compensation, we suspect most would prefer see improved performance, before increasing pay. So you may want to check if insiders are buying Advance Auto Parts Inc shares with their own money (free access).

Or you might prefer gaze upon this detailed graph of past earnings, revenue and cash flow .

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.