Osterweis Commentary: Investment Grade Credit Report: An Impressive First Half

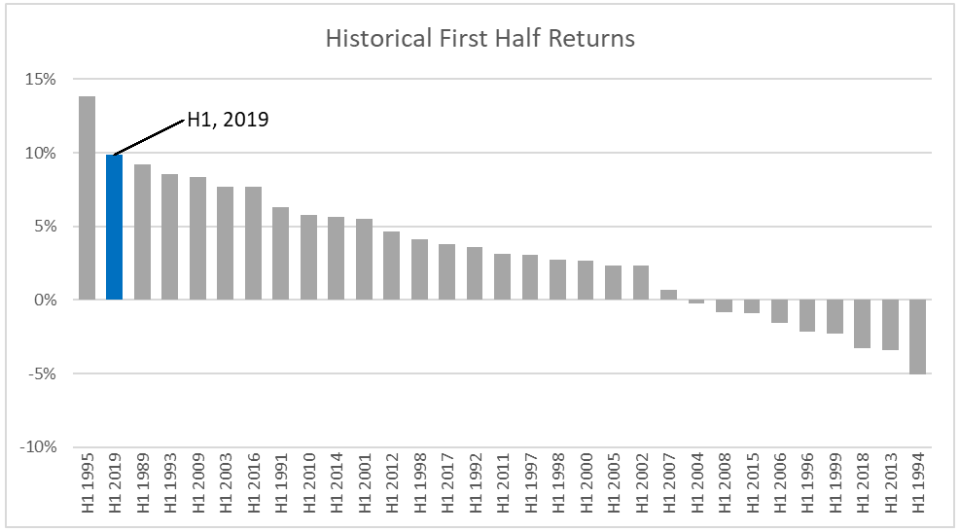

A confluence of positive factors propelled the investment grade (IG) credit market during the first half of 2019. Declining treasury yields, combined with a 38 basis point (bp) tightening of spreads, resulted in a total return of 9.85% for the Bloomberg Barclays U.S. Corporate Index, its best H1 (first half) performance since 1995. The index also delivered an excess return (the portion of the return due to changes in spread rather than interest rates) of 3.91%, which was its best since 2009.

Source: Osterweis, Bloomberg Barclays U.S. Corporate Index

The BBB segment of the investment grade market performed particularly well, which aligned with our expectations, as we felt the sector had been unnecessarily oversold at the end of last year. BBBs delivered the strongest results among all IG rating categories, posting a total return of 10.87% and an excess return of 4.85%. In fact, they even outperformed the Bloomberg Barclays U.S. Corporate High Yield Index (9.94%), which was the first time in five years.

Source: Osterweis, Bloomberg Barclays U.S. Corporate Index, U.S. Corporate High Yield Index

Support from the Fed

The Federal Reserve's pivot at the end of 2018 from a restrictive policy to an accommodative policy triggered rallies in virtually every financial asset, including investment grade credit. Since the beginning of the year, yields in the Bloomberg Barclays U.S. Corporate Index have plummeted 1.04%.

Source: Osterweis, Bloomberg Barclays U.S. Corporate Index

The IG market has benefitted not only from a sustained rally in Treasuries, which was primarily due to market expectations around Fed rate cuts, but also from concurrent spread tightening, which reflects an improvement in the market's outlook about credit risk.

Favorable Market Technicals

In addition, during the first half of 2019 the IG market benefitted from a rebound in global demand and a simultaneous decrease in supply, further driving up prices.

Domestic flows into investment grade mutual funds were extremely strong during the first half, reversing a trend of net outflows during the fourth quarter of 2018. In addition, foreign investment was also net positive, reversing a trend from 2018.

Despite the precipitous decline in U.S. IG yields, they are still substantially higher than most international yields, a powerful incentive for foreign investors.

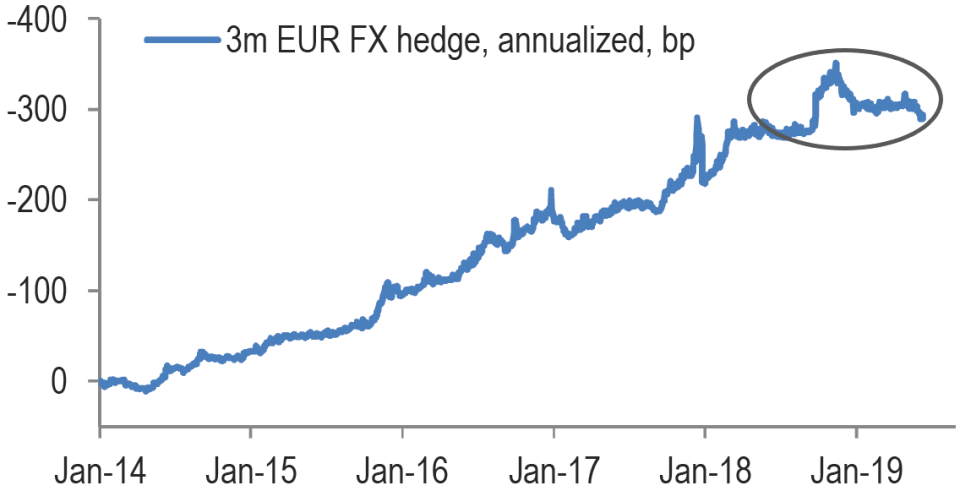

Even with the added expense of currency hedging, IG fixed income returns are better in the U.S. than in Europe. Moreover, as you can see from the chart below, hedging costs have been decreasing recently, which contributed to the inflows.

Source: JP Morgan

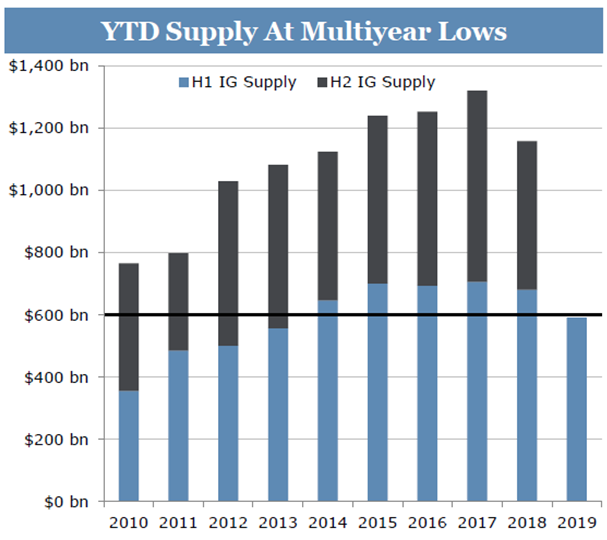

At the same time, supply from U.S. IG issuers fell substantially during the first half, also reversing a significant market trend. As the chart below shows, year-over-year gross supply (the total amount of new issuance) is down 7%, and more importantly year-over-year net supply (the amount of new issuance less the amount of maturing debt) is down 20%. We'll keep a close eye on issuance for the remainder of 2019, as reduced levels generally indicate that corporations are trying to keep their debt levels in check.

Source: Wells Fargo

Credit Fundamentals Not Improving

Despite all the positive performance, we have not seen investment grade credit fundamentals improve meaningfully in 2019. According to Morgan Stanley1, during the first quarter median leverage ratios across the IG market, ticked higher to 2.34x, as last twelve-month EBITDA rose only 1.4% while debt grew 2.8%. Similarly, interest coverage ratios declined to 10.26x as interest expense increased 3.1%. Additionally, free cash flow continues to be diverted towards share buybacks, dividends and mergers & acquisitions. However, the BBB space is the silver lining to this story as nearly half of the 25 largest BBB issuers have reduced their debt levels this year. We believe this is a significant contributor to the strong BBB performance in 2019.

Looking Ahead

For the balance of 2019, we think risk markets will largely take their direction from the Fed and central banks across the globe. That said, we feel that most of the return resulting from spread tightening for 2019 has largely been realized. We believe the performance of IG credit for the second half of the year is unlikely to match 1H19 and expect it will rely upon carry and interest for the bulk of its return. Within the credit spectrum, we still favor firms that are committed to reducing debt and leverage. We will remain vigilant and monitor any signs of animal spirits knocking our companies off this path.

1 - Morgan Stanley, "1Q19 US Credit Fundamental Review," June 17, 2019

Opinions expressed are those of the author, are subject to change at any time, are not guaranteed and should not be considered investment advice. Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities."

This article first appeared on GuruFocus.