- CCIV shares rally nearly 8% on Wednesday.

- EV sector back on bulls minds as Biden backs California law.

- CCIV looks interesting on the chart but resistance ahead.

Update April 26: Churchill Capital Corp IV (NYSE: CCIV) closed April's penultimate trading week with a significant bounce of 4.5% to close at $20.55. Shares are up over 10% since closing at the trough of $18.45 on Tuesday. The main reason for the recovery is an upbeat mood in global markets and President Joe Biden's ambitious climate goals. Investment in green technologies would help Lucid Motors, which is merging with Churchill, sell cars and advance its business. The uptrend could continue on Monday as the "risk-on" mood prevails.

Just a little recap for those of you not familiar with the story. Churchill Capital IV is a Michael Klein-backed SPAC that merged with Lucid Motors to take it public. Michael Klein is a former Citi rainmaker with myriad connections in the financial markets. Lucid Motors is an electric vehicle startup that is due to release its first EV in the second half of 2021. The company is headed by a former Tesla chief engineer, Peter Rawlinson.

CCIV shares fell victim to the retail frenzy in evidence at the start of 2021 and rallied to extraordinarily expensive levels of nearly $65. The frenzy was mainly down to retail traders, who viewed CCIV and Lucid Motors as the next Tesla. Retail traders have grown increasingly frustrated at the lack of access to IPO deals and have turned to SPAC deals as a means of getting involved in a company early, akin to an IPO.

CCIV stock news

CCIV still looks expensive. The company has yet to roll out its first vehicle even though that is due shortly. Yes, it is an impressive looking car, but the auto industry is notoriously difficult and expensive to enter and grow. Tesla managed it as it was basically a pioneer in the whole EV space. This is where Lucid is pitching itself – but actually at the more lucrative end of the market. However, all major auto manufacturers are pivoting sharply to EVs as consumer demand for electric power has increased. We are now at the point of no return. Recently, Volkswagen announced it would sharply ramp up its investment in EVs and associated battery technology. All other manufacturers have plans to go nearly or fully electric for the entire vehicle range between 2025 and 2030.

Lucid, by going after the upper end of the market, is placing itself in direct competition with BMW, Mercedes, Porsche, Tesla and others. This is serious competition. Porsche recently launched the all-electric Taycan. BMW has had the i8 supercar in production for a number of years, and Tesla itself is not going to let Lucid have a free run on the EV playing field.

CCIV stock forecast

While the valuation may be high, that is not as concerning to short-term traders. What is more pertinent here is the momentum, support resistance levels and, of course, careful risk management.

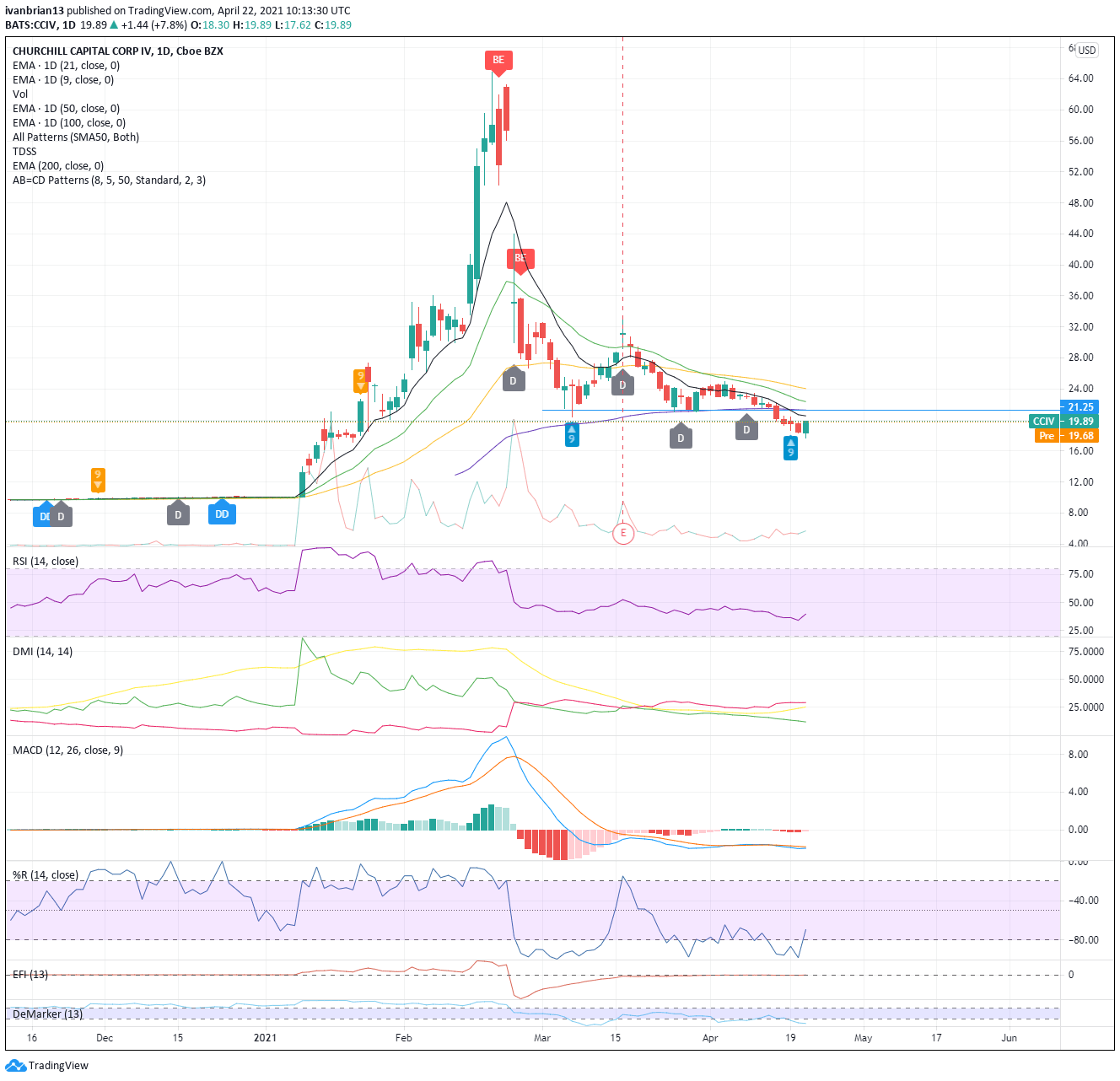

Since the spike highs in mid-February, CCIV shares have been in a steady decline. Falling from $64.86 to $20.40 in a couple of weeks.

This week has seen the first signs of hope for bulls on the chart with a Tom DeMark buy signal flashing on Monday. Tom DeMark is a sequential indicator that tries to identify when a price move is exhausted. This indicator is a version of TD Sequential that has proven very popular with investors since its inception. This move received some nice confirmation yesterday with a sharp rally.

Electric vehicle stocks were boosted by news that President Biden is considering making California's strict emission laws, favouring EVs, nationwide. President Trump had rolled back those laws to help the struggling legacy automakers.

The first resistance to any move will come from the moving averages. Currently, the 9-day MA sits at $20.52. A break here is definitely needed to show some short-term momentum. Following on its resistance at $21.27, this is a combination of the 100-day MA and the resistance line from the series of lows at the end of March.

Failure to break the 9-day moving average should see a resumption of the downtrend, with $13.20 being the target. This is where the initial rally closed back on January 11.

The indicators are not really giving any strong signals. The Moving Average Convergence Divergence (MACD) is close to a bearish cross and needs to be watched carefully. The Relative Strength Index (RSI) is not showing any oversold or overbought conditions and neither is the Williams oscillator.

The overall view is still bearish as we remain below the short-term moving averages and in a strong downtrend. CCIV is still making new lows and only the Tom DeMark buy signal is clouding the picture.

Previous updates

Update April 22: After touching its lowest level since late January at $17.62 on Wednesday, Churchill Capital Corp IV (NYSE: CCIV) staged an impressive recovery and snapped a five-day losing streak to close nearly 8% higher at $19.90. Although CCIV managed to climb to a weekly top of $20.65 after the opening bell on Thursday, it lost its momentum and was last seen losing 1.65% on a daily basis at $19.55. The souring mood seems to be weighing on broader markets. Pressured by a Bloomberg report suggesting that US President Joe Biden is planning to ramp up the capital gains tax to as high as 43.4%, Wall Street's main indexes fell sharply. As of writing, the S&P 500 Index was down 0.5% on a daily basis.

Update: Churchill Capital Corp IV (NYSE: CCIV) has kicked off Thursday's trading session with a slide of some 0.80% to $1.973, at the time of writing. The blank-check company that is merging with Lucid Motors is unable to take advantage of President Joe Biden's ambitious new climate goals. The EV-maker is still struggling with the aftermath of the rise and fall of its shares. The technical graphs are showing that more falls are coming.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.