Meeting Agenda: Preferential issue of shares. Please add to watchlist to track closely.

Ami Organics Share Price

Ami Organics share price insights

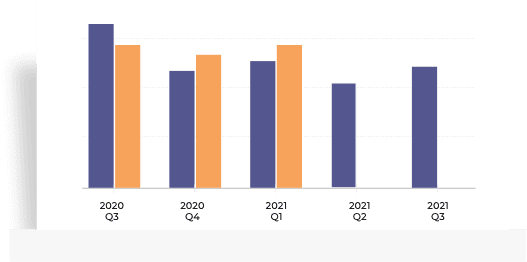

Company has spent less than 1% of its operating revenues towards interest expenses and 7.92% towards employee cost in the year ending 31 Mar, 2023. (Source: Consolidated Financials)

Company has used Rs 33.04 cr for investing activities which is an YoY decrease of 73.35%. (Source: Consolidated Financials)

Ami Organics Ltd. share price moved up by 0.29% from its previous close of Rs 1,216.40. Ami Organics Ltd. stock last traded price is 1,219.90

Share Price Value Today/Current/Last 1,219.90 Previous Day 1,216.40

Key Metrics

PE Ratio (x) | 107.45 | ||||||||||

EPS - TTM (₹) | 11.32 | ||||||||||

MCap (₹ Cr.) | 4,486.15 | ||||||||||

Sectoral MCap Rank | 29 | ||||||||||

PB Ratio (x) | 7.55 | ||||||||||

Div Yield (%) | 0.00 | ||||||||||

Face Value (₹) | 10.00 | ||||||||||

Beta Beta

| - | ||||||||||

VWAP (₹) | 1,215.69 | ||||||||||

52W H/L (₹) |

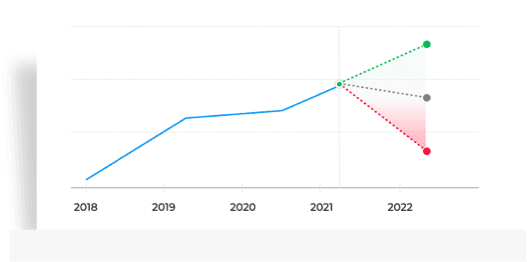

Ami Organics Share Price Returns

| 1 Day | 0.22% |

| 1 Week | 1.15% |

| 1 Month | 8.01% |

| 3 Months | 12.19% |

| 1 Year | 17.02% |

| 3 Years | N.A. |

| 5 Years | N.A. |

Ami Organics News & Analysis

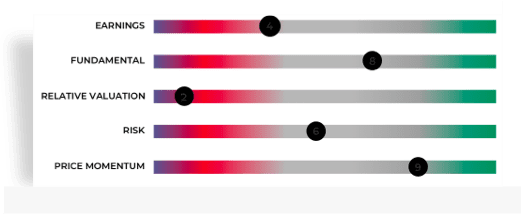

Ami Organics Share Recommendations

Recent Recos

Current

Mean Recos by 5 Analysts

SellSellHoldBuyStrong

Buy

That's all for Ami Organics recommendations. Check out other stock recos.

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 1 | 1 | 1 | 2 |

| Buy | 3 | 3 | 3 | 4 |

| Hold | 1 | 1 | 1 | - |

| Sell | - | - | - | - |

| Strong Sell | - | - | - | - |

| # Analysts | 5 | 5 | 5 | 6 |

Peer Comparison

Ami Organics Stock Performance

Ratio Performance

Choose from Peers

Choose from Stocks

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Loading...- See All Parameters

MF Ownership

MF Ownership details are not available.

Corporate Actions

Ami Organics Board Meeting/AGM

Ami Organics Dividends

- Others

Meeting Date Announced on Purpose Details Apr 26, 2024 Apr 23, 2024 Board Meeting Preferential issue of shares Apr 12, 2024 Apr 08, 2024 Board Meeting Others Feb 12, 2024 Feb 05, 2024 Board Meeting Quarterly Results Nov 08, 2023 Nov 02, 2023 Board Meeting Quarterly Results Sep 25, 2023 Sep 05, 2023 AGM A.G.M. Type Dividend Dividend per Share Ex-Dividend Date Announced on Final 30% 3.0 Sep 18, 2023 May 15, 2023 Final 30% 3.0 Jul 29, 2022 May 16, 2022 No other corporate actions details are available.

About Ami Organics

Ami Organics Ltd., incorporated in the year 2007, is a Small Cap company (having a market cap of Rs 4,486.15 Crore) operating in Chemicals sector. Ami Organics Ltd. key Products/Revenue Segments include Organic Chemicals and Other Operating Revenue for the year ending 31-Mar-2023. Show More

Executives

Auditors

- NR

Nareshkumar Ramjibhai Patel

Exe.Chairman & Mng.DirectorCCChetankumar Chhaganlal Vaghasia

Whole Time DirectorRMRam Mohan Rao Locande

Whole Time DirectorVNVirendra Nath Mishra

Whole Time DirectorShow More - Maheshwari & Co.,

Industry

Key Indices Listed on

S&P BSE SmallCap, S&P BSE Healthcare, S&P BSE AllCap, + 3 more

Address

Plot No. 440/4, 5 & 6,Road No. 82/A,Surat, Gujarat - 394230

More Details

FAQs about Ami Organics share

- 1. What's Ami Organics share price today and what are Ami Organics share returns ?Ami Organics share price was Rs 1,219.00 as on 25 Apr, 2024, 02:31 PM IST. Ami Organics share price was up by 0.22% based on previous share price of Rs. 1207.35. In last 1 Month, Ami Organics share price moved up by 8.01%.

- 2. Is Ami Organics a good buy?As per Refinitiv (erstwhile Thomson Reuters), overall mean recommendation by 5 analysts for Ami Organics stock is to Buy. Recommendation breakup is as follows

- 1 analyst is recommending Strong Buy

- 3 analysts are recommending to Buy

- 1 analyst is recommending to Hold

- 3. What has been highest price of Ami Organics share in last 52 weeks?In last 52 weeks Ami Organics share had a high price of Rs 1,388.95 and low price of Rs 1,004.45

- 4. Which are the key peers to Ami Organics?Top 10 Peers for Ami Organics are Privi Speciality Chemicals Ltd., Fineotex Chemical Ltd., Neogen Chemicals Ltd., Epigral Ltd., S H Kelkar & Company Ltd., Tatva Chintan Pharma Chem Ltd., Thirumalai Chemicals Ltd., Meghmani Organics Ltd., Yasho Industries Ltd. and Laxmi Organic Industries Ltd.

- 5. Who are the key owners of Ami Organics stock?

- Promoter holding has gone up from 39.41 (30 Jun 2023) to 39.91 (31 Mar 2024)

- Domestic Institutional Investors holding has gone up from 5.12 (30 Jun 2023) to 6.8 (31 Mar 2024)

- Foreign Institutional Investors holding has gone up from 6.72 (30 Jun 2023) to 8.98 (31 Mar 2024)

- Other investor holding have gone down from 48.75 (30 Jun 2023) to 44.31 (31 Mar 2024)

- 6. What are the key metrics to analyse Ami Organics Share Price?Ami Organics share can be quickly analyzed on following metrics:

- Stock's PE is 107.45

- Price to Book Ratio of 7.55

- 7. What is the market cap of Ami Organics?Ami Organics share has a market capitalization of Rs 4,486.15 Cr. Within Chemicals sector, it's market cap rank is 29.

Trending in Markets

Ami Organics Quick Links

Equity Quick Links

More from Markets

IPOStock market news

Budget 2022 Live Updates

Cryptocurrency

Currency converter

NSE holiday list

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.