India has ramped up its strategic oil reserves since mid-March in view of the slump in crude prices and hopes to fill it to the brim by May end, yet, the country’s oil import bill in FY20 could be just a little over $100 billion, much lower than $111.9 billion reported in FY19.

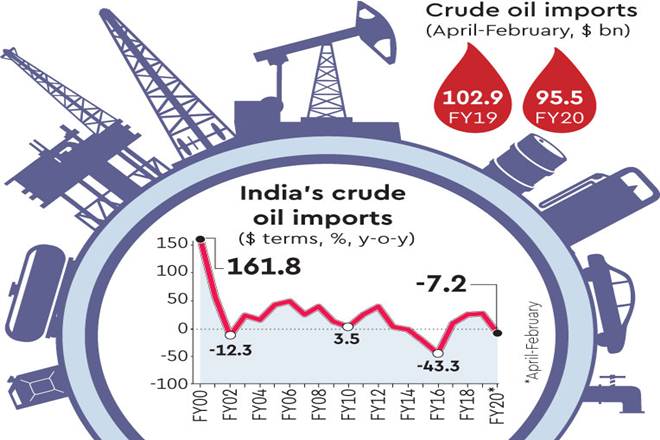

Against the projected $111.3 billion (233 million tonne) for FY20, India imported just $95.5 billion (207 million tonne) of crude oil in April-February of the fiscal, which was even 7.2% lower than in the year-ago period (6.6% lower in rupee term).

Though the March import data have not been officially released yet, according to global oil market research agency Refinitiv, India imported 20.3 mt of crude in the month — the highest monthly import volume since October 2019. Purchases continued at a brisk pace in April too. The monthly average imports in April-February FY20 was 18.8 mt.

Refinitiv said Indian “refiners were among the first to cash in on the low-price environment”, and were “among the first to pick up the extra Middle Eastern (West Asian) barrels”.

India’s crude import bill may decline by 57% to $43 billion in FY21 if the Indian basket price remains subdued at around $25 a barrel through the current fiscal year, in what could give a big relief to the country’s current account. The price of the Indian crude oil basket, which stood at an average of $64 a barrel in January, is now around $20.

Indian basket has fallen 39% month-on-month in March to $33.36 a barrel. Even though currently there is very low demand for petroleum products owing to the lockdown to contain the coronavirus outbreak, Indian refiners have picked up more than usual quantities of crude from global markets, apparently to fill up the storage caverns.

Meanwhile, domestic consumption of petroleum products in FY20 remained flat at 213.7 MT as sales of transportation fuels plummeted in March amid the country-wide lockdown.

According to provisional data by the government’s petroleum planning and analysis cell, diesel usage dipped 1.1% to 82.6 mt in FY20, while demand for the aviation turbine fuel fell 3.6% to 8 MT in the financial year. Sources said petrol and diesel demand in the first half of March was 60% lower year-on-year. The demand must have plunged further in the second half of the month and remained at the level in April.

However, the additional low-cost imports, experts pointed out, may be used to fill up the country’s strategic petroleum reserves. According to sources, about 60% of the 5.3 mt the country’s strategic reserve capacity is currently full, and state-owned oil marketing companies (OMCs) are using their procurement channels to take advantage of the current low crude prices to fill it up to the brim by the end of May.

The government had estimated FY20 crude imports at 233 MT, at a cost of $111.3 billion. However, the projections assumed the average Indian basket crude price at $66 per barrel between October, 2019 and March, 2020, whereas the actual rate was $56.7 per barrel.

The country’s strategic petroleum reserve facilities are located in Visakhapatnam (1.3 mt), Mangaluru (1.5 mt) and Padur (2.5 mt). As per the consumption pattern of FY18, the storage is estimated to provide for about 9.5 days of crude oil requirement. On March 16, OMCs had stock for another 64.5 days. Crude can be stored in the facilities for as long as 60 years.