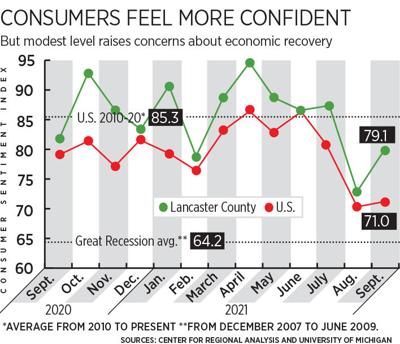

Consumer confidence in Lancaster County showed improvement in September, but remained in the subpar range of summer 2020, a worrisome sign for the ongoing economic recovery, a new survey shows.

The Consumer Sentiment Index here rose to 79.1 after plunging to 72.6 in August, its lowest score of the pandemic, the Center for Regional Analysis, part of the Economic Development Company of Lancaster County, reported on Wednesday.

Although the upswing was 6.5 points, center director Naomi Young called it a “weak” rebound, attributable to “very small changes across all components of the consumer sentiment measure” – which is based on the survey takers’ assessment of current conditions and future expectations.

It’s troubling, Young indicated, since consumer spending is the largest driver of economic activity.

“Persistent apprehension of current and future household finances and the view that it’s not a good time to make major purchases suggest that households will take a more precautionary position on spending,” she said in a statement.

“October’s poll will serve as a signal regarding holiday spending, a critical time of year for many consumer businesses,” Young added.

The local survey is conducted by the center during the first seven days of the month with the help of LNP | LancasterOnline. It’s crafted to produce results that can be compared to the national level of consumer confidence, measured by the University of Michigan.

Almost always, Lancaster County residents are more optimistic than Americans in general, a trend that held true in September. The national score improved slightly to 71.0 from August’s 70.2.

Taking a closer look at the views of local residents, which were compiled from 800 usable survey responses, Young observed “ongoing unease” yet “a notable shift in their source of concern.”

Instead of being primarily worried about the spread of COVID-19, she explained, the emphasis switched “to economic fundamentals. Like national results, households focused on the threats (that) inflation and labor-market conditions pose to their household’s wellbeing and the broader economy.”

For instance, many respondents said now is a bad time to make a major household purchase or buy a house, citing inflation, high prices and low inventories.

One respondent who felt now is a bad time to make a major household purchase explained, “Only buy if needed. The supply chains are having difficulty keeping up with orders and prices are high because of low supply and high demand.”

“Unless there is a need,” said another, “now is a good time to hunker down.”

TIM MEKEEL | Staff Writer

TIM MEKEEL | Staff Writer