Hi, Quartz Africa readers!

Black Market

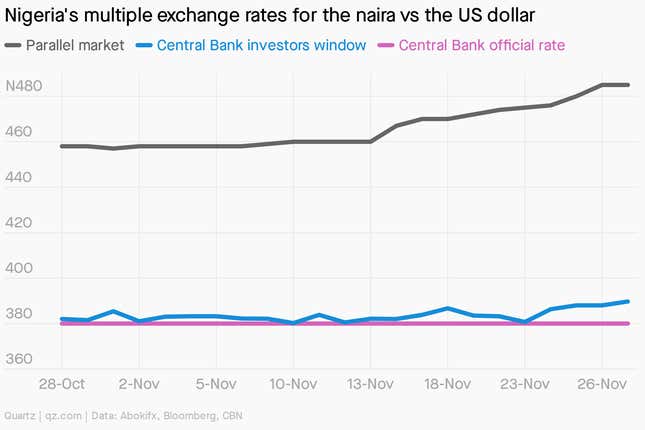

At any point in the last few years, Nigeria’s naira has always had multiple exchange rates.

As of Friday (Nov. 27), the parallel market rate was 24% higher than the investors window rate provided by the country’s central bank and that was, in turn, 2% higher than the Central Bank of Nigeria’s official rate.

The divergent rates have long been a striking feature of Nigeria’s economy but more so in the last half decade as the country’s financial authorities have attempted to micro-manage the supply of foreign exchange and “defend” the naira.

The recent push stems from monetary policy trends in 2016 when, amid a recession, Nigeria’s government stubbornly refused to devalue the naira despite a widening gap between official and black market rates. And, when it eventually did, it turned out to be a managed float as it simply moved the currency’s value from one peg to another.

With the proverbial genie out of the bottle, the past five years have been a never-ending experiment to manage a currency crisis of varying proportions. Things reached a head earlier this week when Godwin Emefiele, Nigeria’s central bank governor claimed the parallel market rate “cannot be the basis” to determine the naira’s real value. Emefiele’s argument included describing parallel markets as “illegitimate” and “shallow.”

Yet, with the parallel market rates not fixed by the central bank unlike others, black market operators often deliver a more accurate verdict on the levels of the supply, demand, and prices of the dollar. The naira, which started the year at around 360 naira to the dollar on parallel markets, is now on the verge of crossing the psychologically important “red line” of 500 naira.

To be clear, a high black market exchange rate is terrible for import-dependent businesses that cannot access foreign exchange from official government channels given existing restrictions. As such, a recourse to black market operators is done only out of necessity on the back of the government’s ongoing currency policies.

It’s a curious situation that continues to stump analysts who advocate for more flexibility on the part of the government to mitigate the ongoing effects of its currency policies. But, as many have found, in government circles, conversations about the naira’s exchange rate appear to be more focused on political optics than economic expediency.

Aza, an African currency broker, predicts dollar demand pressure will increase through the festive Christmas season and that’s a prospect that could bring an even more unpalatable economic reality for the Nigerian government. A 7% increase in current black market exchange rates will mean Nigeria’s monthly minimum wage amounts to $58 or $1.87 per day—a figure that’s below the current United Nations international poverty line.

— Yomi Kazeem, Quartz Lagos correspondent

Stories this week

Ebola’s Covid vaccine learnings. There are concerns African countries will struggle to acquire then distribute Covid-19 vaccines at sub-freezing temperatures. But Uwagbale Edward-Ekpu finds lessons from the successful distribution of an Ebola vaccine in DR Congo could help future Covid vaccines.

A $15,000 US visa bond for Africans. The outgoing Trump administration wants visitors to the US from 15 African countries to pay a $15,000 bond in order to acquire a visa. It applies to countries with high visa overstay numbers.

Nigeria’s northwest insecurity. While the world has focused on northeast Nigeria’s travails with Boko Haram, the farms and small towns of the country’s northwest have become overrun by attacks, kidnappings, and arbitrary tax regimes by local bandits, writes Mark Amaza.

Insights from an African genomics study. Very few Africans have been included in studies looking at genetic variation before now, writes Zané Lombard about an African genomics study with her colleagues. It revealed several gems of African history and migration as well as clinical research into the impact of specific variants on health outcomes.

Jumia’s bid to enable African e-commerce. Jumia, which is often described as Africa’s Amazon, built its brand as being pioneer of pan-African online retail. But its latest moves point to a new focus on enabling third party e-commerce.

Uganda’s Huawei pact. In Uganda, activists are worried president Museveni’s security officials are now using Huawei’s facial recognition technology to track down anti-government protesters, reports Stephen Kafeero.

Dealmaker

•Netherlands-based impact venture capital firm Goodwell Investments backed Chicoa Fish Farm, a Mozambique-based agriculture player with $1.5 million in a Series A funding round.

•Egyptian e-commerce startup ExpandCart raised $2 million in a Series A round led by Sawari Ventures with the participation of Agility Ventures, Graphene Ventures, and unnamed angel investors.

•Ukheshe, a South African fintech firm, has acquired Oltio, which developed the digital payments platform for Masterpass, Mastercard’s QR code payments service. Oltio was owned by Mastercard, which bought it from Standard Bank in 2018.

Quartz gems: How we eat now

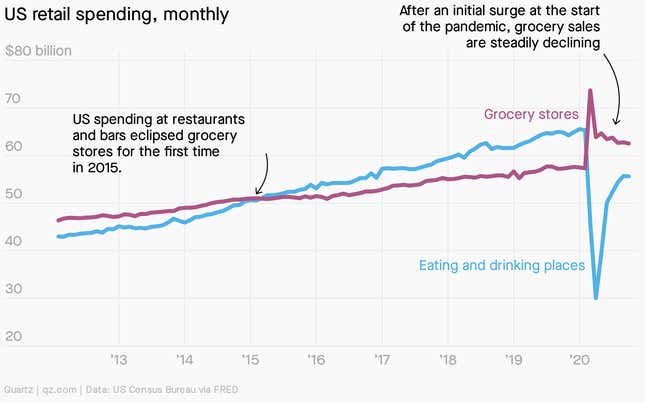

Nine months into the pandemic, Quartz looked at the biggest gastronomical shifts around the globe, and the local, and multinational businesses being impacted by them. Who benefits, who’s harmed, and when this is all over, which changes will last?

Whether it’s shifts in home cooking, the suffering restaurant industry, or the role of food in our culture and politics, we found a mix of creative solutions to difficult situations, ingenious adaptations to short-term shortages, and even some hope for the future. Read more in our field guide to how we eat now.

Other things we liked

Lebanese are fleeing… to Africa. Lebanon, the third most-indebted country in the world, is going through an unprecedented economic crisis. For Africa Report, Chloé Domat spoke with young Lebanese escaping the turmoil to several key African countries.

China’s African traders vs Alibaba. After China closed its borders due to the pandemic, African traders there, and regular African visitors, found trade very difficult. Wu Peiyue reports for Sixth Tone on how Alibaba stepped in and tightened its grip on the China-Africa trade corridor.

African artists on the rise. As the interest in contemporary African art picks up yet again on the global stage, Wabwire Joseph Ian in Artsy looked at 15 African artists who have continued to create despite conditions of invisibility and marginalization.

The NBA’s Nigerian future. With a record number of draft picks this year, the number of Nigerian-origin athletes in the NBA has ballooned. Martenzie Johnson in The Undefeated explores Nigeria’s past and growing influence in the world’s top basketball league.

ICYMI

Google Research Scholar Program 2021. The program for early career professors is taking submissions from professors globally who are teaching at universities and have received their PhD within seven years. (Dec. 2)

The JUA Kickstarter Fund. A newly launched $1 million fund for African entrepreneurs is calling for applications. (Jan. 31)

CERN Online Summer Student Program 2021. The three-month program at the Swiss-based organization for nuclear research is open to current Bachelor or Master degree students in physics, engineering, computer science, or mathematics. (Jan. 31)

*This brief was produced while listening to Amewuga – (Noukpékpé Makpézan part.1) by Elom 20ce (Togo)

Our best wishes for a productive and ideas-filled week ahead. Please send any news, comments, suggestions, ideas, $15,000 (don’t ask what for) and basketball training shoes to africa@qz.com. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.