*Available only in Option VI

Mumbai/Kochi, 20 August 2021: Incorporated in the year 1998, a systemically important non-deposit taking NBFC in the gold loan sector, Muthoottu Mini Financers Limited (“Muthoottu Mini”/ ‘MMFL’), public issue of Secured and Unsecured Debentures (“NCDs”) of the face value of Rs. 1,000 each is now open.

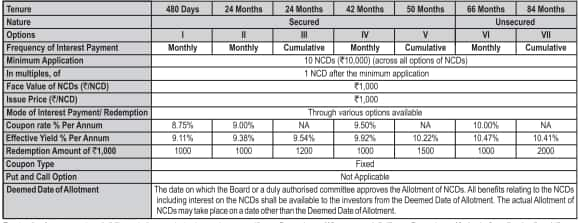

The 15th NCD Issue has a Base Issue Size of Rs. 125 crores, with an option to retain over-subscription up to Rs. 125 crores, aggregating up to a total of Rs. 250 crores. The NCD Issue offers various options for subscription of NCDs with coupon rates ranging from 8.75% - 10.00% p.a. The NCD Issue opened on August 18, 2021 and closes on September 09, 2021, with an option of early closure or extension.

As on 31st March 2021, MMFL had 3,86,110 gold loan accounts, predominately from rural and semi urban areas, aggregating to Rs. 1,935.10 crores which accounted for 97.04% of its total loans and advances. The yield on its gold assets during the last three fiscals have increased from 19.17% in FY2019 to 19.57% as on FY2021. Its net Non-Performing Assets for FY2021 stood at 0.75%, which is lower from 1.39% reported in the FY2019.

In addition to its gold loan business, it offers micro finance loan, depository participant, money transfer, insurance broking, PAN card related and travel agency services.

The Company, erstwhile part of a family business enterprise that was founded by Ninan Mathai Muthoottu in 1887, is now spearheaded by Nizzy Mathew, Chairwoman & Whole-time Director and Mathew Muthoottu, Managing Director.

The terms of each options of NCDs, offered under Issue are set out below:

Net proceeds of the Issue will be utilized for the purpose of onward lending, financing, and for repayment/prepayment of principal and interest on borrowings of the Company (at least 75%) - and the rest (up to 25%) for general corporate purposes.

The Secured and Unsecured NCDs offered through Prospectus dated August 13, 2021 are proposed to be listed on the BSE.

The Lead Manager to the Issue is Vivro Financial Services Private Limited.

MITCON Trusteeship Services Limited is the Debenture Trustee and Link Intime India Private Limited is the Registrar to the Issue.

About Muthoottu Mini Financiers Limited: (RBI Registration No: N-16.00175)

Muthoottu Mini Financiers Limited is an RBI registered non-deposit taking systemically important NBFC in the loan against gold financing sector, lending money against the pledge of household gold jewellery for over 2 decades. As on June 30, 2021 the Company had a network of 807 branches spread in the states of Kerala, Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, Haryana, Maharashtra, Gujarat, Delhi and Goa and the union territory of Puducherry and employed 3,117 persons in its business operations.

Disclaimer: Muthoottu Mini Financiers Limited is subject to market conditions and other considerations, proposing a public issue of Secured and Unsecured Redeemable Non Convertible Debentures and has filed the Prospectus with the Registrar of Companies, Kerala and Lakshadweep, BSE Limited and SEBI (for record purposes). The Prospectus is available on our website at www.muthoottumini.com, on the website of the stock exchange at www.bseindia.com and the website of the Lead Manager at www.vivro.net. All investors proposing to participate in the public issue of NCDs by Muthoottu Mini Financiers Limited should invest only on the basis of information contained in the Prospectus dated August 13, 2021. Please see section entitled “Risk Factors” beginning on page 15 of the Prospectus for risk in this regard.

LISTING: The NCDs offered through the Prospectus are proposed to be listed on the BSE Limited (“BSE”). Our Company has obtained ‘in-principle’ approval for the Issue from BSE vide its letter dated August 13, 2021. BSE shall be the Designated Stock Exchange for the Issue.

DISCLAIMER CLAUSE OF BSE: It is to be distinctly understood that the permission given by BSE should not in any way be deemed or construed that the Prospectus has been cleared or approved by BSE nor does it certify the correctness or completeness of any of the contents of the Prospectus. The investors are advised to refer to the Prospectus for the full text of the Disclaimer Clause of the BSE Limited.

DISCLAIMER CLAUSE OF RBI: The Company is having a valid Certificate of Registration dated April 13, 2002 and a Fresh Certificate of Registration dated January 1, 2014 bearing Registration No. N-16.00175 issued by the Reserve Bank of India under Section 45 IA of the Reserve Bank of India Act, 1934. However, RBI does not accept any responsibility or Guarantee about the present position as to the financial soundness of the Company or for the correctness of any of the statements or representations made or opinions expressed by the Company and for repayment of deposits/discharge of liability by the Company.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!