Tiffany Duron had just finished up Hurricane Harvey repairs on her Northeast Houston home when outbreaks started to shake the country.

Dealing with the pandemic would have been much easier if her family didn’t just get through damage from the storm: They had only just started to get back on their feet when COVID-19 hit Greater Houston.

When her husband lost work as an electrician, she became the breadwinner of her family. Duron, a hospital nurse, also had the pressure of more mouths to feed: Her two nieces, who weren’t making ends meet, moved into her home. All in all, she was supporting a household of six.

“It was really a test to our marriage, I could tell you that,” Duron said. “We’ve had conversations of ‘how we’re going to cut down’ or ‘what are we going to go without for a while?’ But I mean we were pulling through. All you can do is just keep going and keep the Lord as your number one.”

The loss of income has forced Duron’s family to make some lifestyle changes. They could no longer see the occasional movie or eat at their favorite restaurants, and instead have relied on low-cost meals that can feed more people.

“Ramen noodles, that’s all we ever eat now,” Duron said. “Sandwiches, you know, things like that.”

Duron’s family isn’t alone. A year and a half into the pandemic, most Houston households are still struggling to pay their bills, according to a recent survey by NPR, the Robert Wood Johnson Foundation and the Harvard Chan School of Public Health.

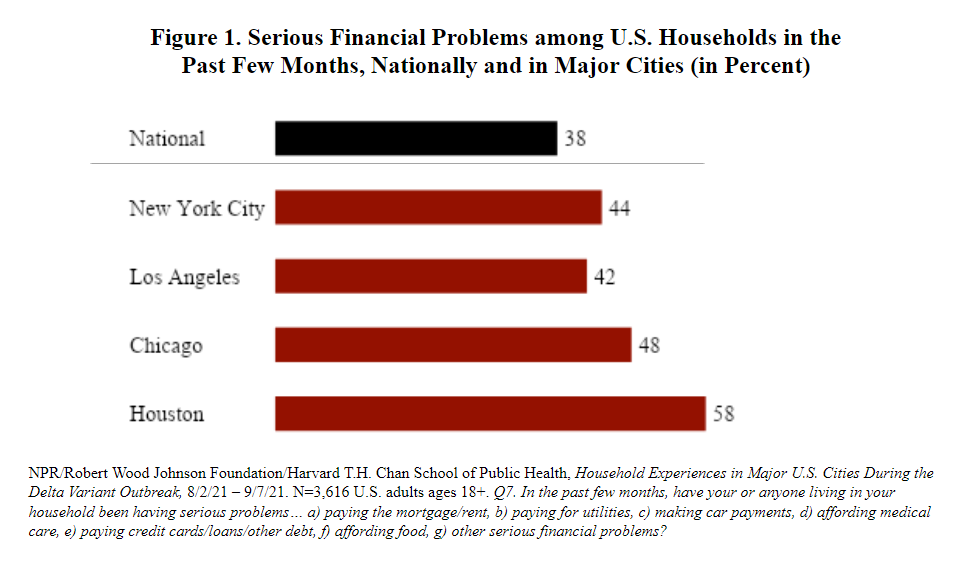

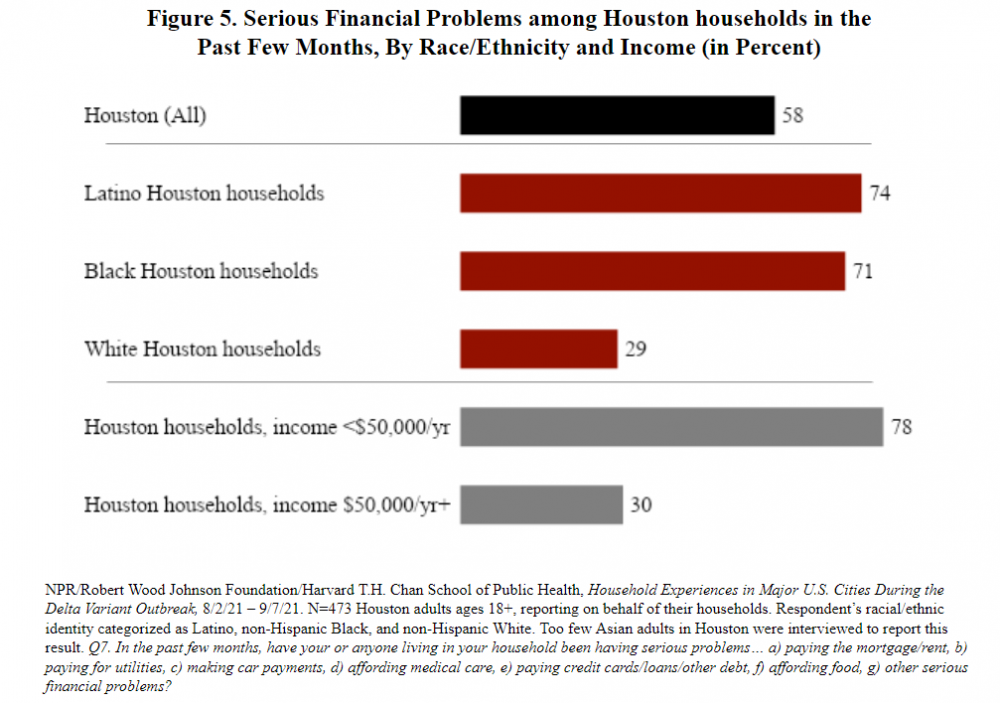

The survey found that 58% of Houston households are behind on basic expenses like rent, car payments, medical bills and food. The number of families with financial woes has barely budged in the last year — 63% reported these same struggles, according to a similar report published in Sept. 2020.

The prolonged economic impacts of the pandemic were felt most deeply in Black and brown communities, according to the survey. More than 70% of Black and Latino households in Houston reported financial problems, compared to 29% of white respondents.

Jie Wu, an urban researcher at Rice University’s Kinder Institute, said the compounding disasters of Hurricane Harvey, February’s winter storm and COVID-19 have set many Houstonians back financially.

“Houston has experienced multiple natural disasters before the pandemic,” Wu said. “It’s no surprise that when the COVID-19 virus spread, area residents started having more financial problems.”

Racial disparities have played a role in financial wellbeing well before the pandemic, Wu said. The lack of financial literacy and the lack of access to credit for communities of color has made it difficult to build up savings. In 2019, 39% of Houstonians couldn’t afford a $400 emergency expense, according to the 2019 Kinder Houston Area Survey.

“Among minorities, that number jumped to almost half,” Wu said. “Just one very small emergency expense away from depleting their savings. That just says something about the lack of financial resilience in our community. ”

Houstonian Tiffany Duron had just finished Hurricane Harvey repairs on her home when the COVID-19 pandemic began.

Wu added that disaster relief in the form of rental assistance, food stamps and unemployment benefits has been available to help Houstonians without savings, but it hasn’t always reached people who need it.

People often rely on nonprofits and community groups to access the social safety net and connect with resources. While some may turn to family for help, the option isn’t available for many people of color, who are less likely to have generational wealth.

That’s something Houstonian Anessa Guess didn’t have when she was unemployed for eight months while the pandemic ravaged the Houston area.

“I take care of myself,” Guess said. “Both my parents have passed away, so I mean that literally.”

When the pandemic first hit, the work slowed down at the creative production agency at which she was employed. Guess said the workplace became a very toxic environment, and she started to experience severe migraines. She knew she had to quit after her doctor urged her to go to the ER.

“To be honest, I feel like the only way that I will ever be able to take care of medical bills is if I won the lottery or something,” Guess said.

The report found that nearly twice as many Houstonians struggled to pay for medical bills, compared to the national average. That’s likely because Houston has the highest uninsured rate in the country, said Elena Marks, the CEO of the Episcopal Health Foundation.

Anessa Guess was unemployed for eight months during the pandemic.

“It’s not a mystery at all,” Marks said. “The other cities that this study compared Houston to have expanded Medicaid and Texas has not. Those states have also been very active in trying to enroll people in all sorts of insurance, whether it’s public insurance or (Affordable Care Act) marketplace plans. Texas is not.”

Guess’ high-deductible insurance left her with thousands of dollars of medical debt after her trip to the emergency room. With new bills and loss of income, she often had to be particular with her savings, such as choosing to pay rent or keeping the internet on.

Months later, Guess said she recently started a new job in a much healthier environment. Her savings are depleted, and she’s working to build them back up, but hopes that one day she’ll be able to pay off all her debt and start her own side business.

“I’m not trying to be rich or anything,” Guess said. “The goal is to just be in a position where I can live comfortably and I don’t have to make so many trade-offs. Like if I do need new glasses it won’t cut into me paying my cell phone bill on time.”