3 Companies Trading at Historical Low Price-Book Ratios

The price-book ratio, which is the ratio of a company's market cap to its net assets, is one measure that investors can use to determine whether or not a stock is fairly valued. In theory, it is what shareholders would receive if the company went bankrupt and its assets were liquidated, though in practice, factors such as intellectual property and lack of buyers for certain assets cannot be factored in.

However, unlike the price-earnings ratio, the price-book value is calculated even during periods when a company experiences a net loss. Thus, companies trading at their historical low price-book ratios can provide a good starting point for finding attractive value opportunities.

According to the GuruFocus Historical Low Price-Book screener, the following companies are trading at their historical low price-book ratios as of March 27. They also have high GuruFocus profitability and predictability ratings.

CVS Health

CVS Health Corp. (NYSE:CVS) is a U.S. retail health care company based in Woonsocket, Rhode Island. It operates the CVS Pharmacy chain.

On March 27, shares of CVS traded around $58.60 for a market cap of $77.38 billion, a price-earnings ratio of 11.54 and a price-book ratio of 1.2.

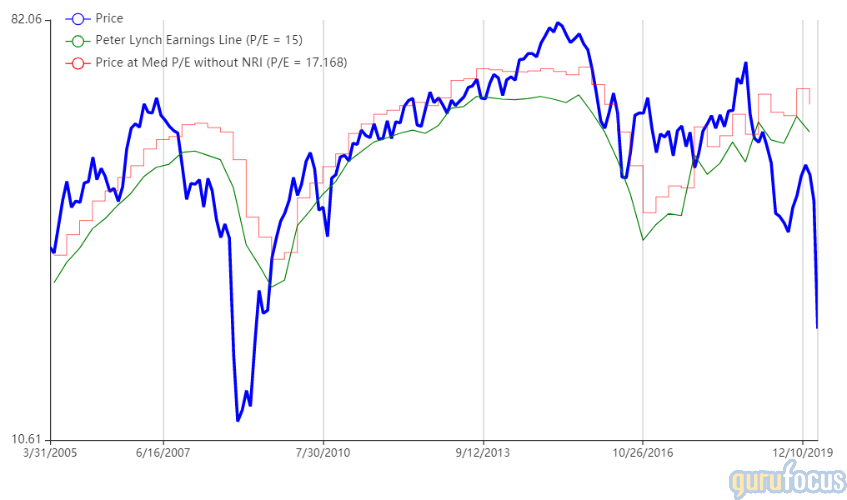

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rating of 8 out of 10 and a business predictability rating of 5 out of 5 stars. The Peter Lynch chart suggests that the stock is trading below its intrinsic value.

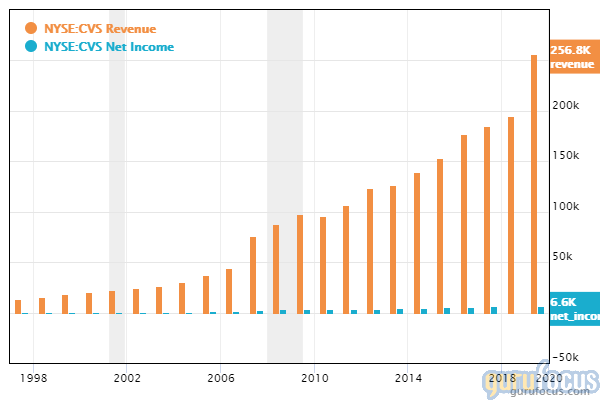

The company has steadily grown both revenue and net income over the years. Its operating margin of 4.87% is average for the industry, but the return on capital of 42.56% is good.

Nordstrom

Nordstrom Inc. (NYSE:JWN) is a century-old U.S. luxury department store chain based in Seattle.

On March 27, shares of Nordstrom traded around $16.01 apiece for a market cap of $2.63 billion, a price-earnings ratio of 5.32 and a price-book ratio of 2.68.

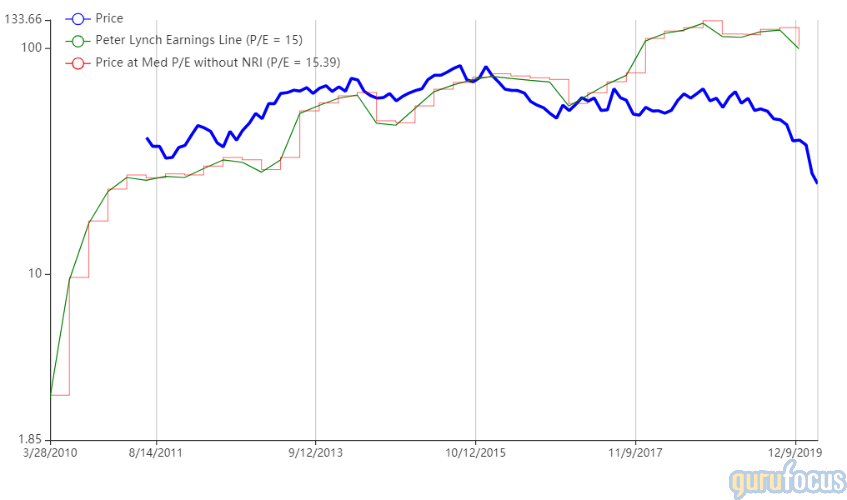

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rating of 9 out of 10 and a business predictability rating of 4.5 out of 5 stars. According to the Peter Lynch chart, the stock is undervalued.

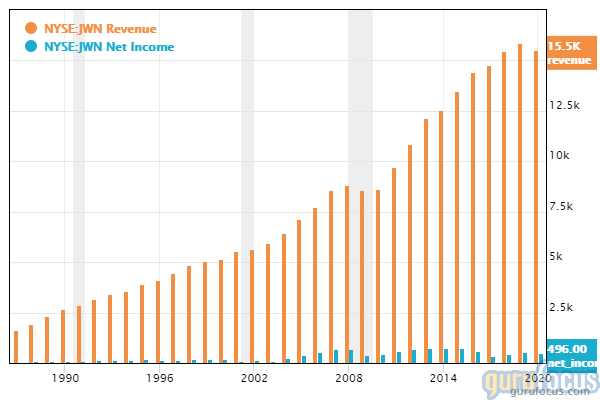

Nordstrom's operating margin of 5.06% is above the industry average. Revenue and net income had already begun to contract slightly in fiscal 2019, despite three-year growth averages remaining strong.

AMC Networks

AMC Networks Inc. (NASDAQ:AMCX) is a diversified media operator that owns several cable channels, as well as a chain of theaters that bear its name.

On March 27, shares of AMC traded around $24.83 for a market cap of $1.38 billion, a price-earnings ratio of 3.74 and a price-book ratio of 2.11.

GuruFocus gives the company a financial strength rating of 4 out of 10, a profitability rating of 10 out of 10 and a business predictability rating of 4.5 out of 5 stars. According to the Peter Lynch chart, the stock is trading below its intrinsic value.

The return on capital of 58.04% and operating margin of 25.25% are higher than 78.47% of competitors. The three-year revenue growth rate of 12.1% and three-year Ebitda growth rate of 12.7% also indicate strong profitability.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research or consult registered investment advisors before taking action in the stock market.

Read more here:

3 Digital Health Care Stocks to Consider as Doctors Move Online

Warren Buffett's Predictable Stocks Outperforming on Market Weakness

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.