Section 179 is one of the most substantial tax deductions available to US companies, but some common misconceptions are keeping small businesses from taking full advantage of it.

January 23, 2023

Dan Furman

Section 179 is one of the more misunderstood parts of the US tax code. While many companies take advantage of the tax deduction for equipment purchases, a surprising number of US businesses do not.

Data is hard to come by, but according to a 2016 report by the US Department of the Treasury, the Section 179 allowance was used generally in the 70 to 80% range for C and S corporations, and somewhat lower at around 60 to 70% for partnerships and individuals.

Considering that almost all companies will buy some type of eligible equipment annually and that Section 179 is largely designed to be a small-business deduction, these numbers seem a little low — especially the 60 to 70% number.

While some companies may make the conscious choice not to use Section 179 and instead depreciate assets yearly, it is very likely that many businesses are either unaware of the tax code or have misconceptions about it.

What follows are three common misconceptions regarding Section 179, and the reality for each of them. But first, a brief overview of Section 179.

What is Section 179?

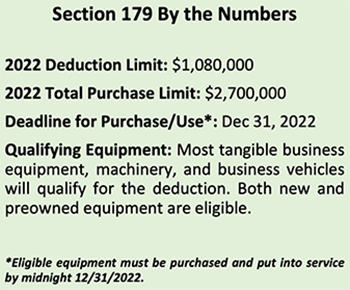

Section 179 is the provision of the US tax code that allows a business to fully depreciate eligible equipment the year it is purchased and put into service.

Put simply, a business can deduct the full cost of purchased equipment from its taxable income, up to the 2022 limit of $1.08 million.

For example, if a company spends $30k on new computers for the office, and another $25k on new office furniture, the entire $55k can be deducted from its 2022 taxable income, resulting in a substantial reduction in taxes paid.

Three common misconceptions

Misconception: Section 179 is only for large companies with millions in revenue.

The truth: Section 179 can be used by any business.

Due to the deduction limit that exceeds a million dollars, many smaller companies are under the impression that only larger enterprises with that level of equipment spend are eligible.

|

This is simply not true. Section 179 can be used by even the smallest kitchen-table sole proprietorship buying one computer. The only caveat even remotely related to this is that the business must be profitable — i.e., actually having taxable income from which to make the deduction. The size of the company is not a factor in eligibility: Any legally recognized US business, regardless of size or number of employees, can use Section 179.

In fact, the $2,700,000 purchase limit (after which the Section 179 deduction is reduced on a dollar-for-dollar basis) ensures that Section 179 is more of an SME deduction than a large corporate one.

Misconception: You must fully pay for the equipment to deduct it.

The truth: Financed equipment is eligible for a full price deduction, regardless of how much a company actually paid out for it during the year.

A company does not have to fully pay for the equipment to take a full purchase price deduction. As long as the eligible equipment is considered an asset on the balance sheet, the company can take the Section 179 deduction. This includes financed equipment and many non-operating leases, as well.

This can lead to an interesting situation that many companies utilize as an accounting strategy: Depending on the cost of the equipment, the tax savings from the Section 179 deduction may exceed the total amount of the monthly payments that year, which makes acquiring the equipment a net gain for the current year.

Misconception: Only new equipment is eligible for a Section 179 tax deduction.

The truth: Both new and preowned equipment are eligible. The only restriction for a company in this respect is “new to them.” Many businesses save substantial money by buying pre-owned equipment, and then further save on taxes by taking a Section 179 deduction on it.

The bottom line

The misconceptions surrounding Section 179 likely keep many companies from considering it. And while some companies or accountants may have reasons to forgo the deduction and, instead, depreciate assets by a small annual amount, not knowing the facts regarding Section 179 should not be a reason to miss out on it. The tax savings can be significant, and every company should be aware of the impact the deduction can have on its bottom line.

Section 179 was originally put in place back in 1958 to help US companies invest in themselves, and has undergone considerable increases and revisions since. Today it is one of the most substantial and inclusive tax deductions available to US companies.

As always, consult with your tax professional regarding questions on deductions and/or specific equipment eligibility. But Section 179 is a tax deduction that all US businesses, regardless of size, should consider.

|

About the author

Dan Furman is Vice President of Strategy at Crest Capital, which provides small and mid-sized companies financing for new and used equipment, vehicles, and software, as well as offering equipment sellers a simple and risk-free financing program.

All views expressed in this article are those of the author and do not necessarily represent the policy or position of Crest Capital and its affiliates. These views are also professional opinion only — always speak to your accountant or tax professional regarding any financial matters.

You May Also Like