This Outperforming Consumer Staple Checks All the Boxes

After a November to remember, stocks have kicked off December on a sour note, as selling pressure has dominated the action due to global growth concerns. Prospects of an economic downturn have outweighed optimism surrounding an easing of China’s stringent COVID policies. And even as the Fed is set to slow the pace of rate hikes next week with an anticipated 50-basis point hike, interest rates are expected to remain high for some time to help tame inflation.

Adding fuel to the fire, a chorus of alarming commentary from Wall Street bank executives yesterday weighed on investor sentiment. Bank of America CEO Brian Moynihan told investors at a financial conference that the firm’s research points to “negative growth” in the first quarter next year. While he stated that the contraction should be on the milder side, it doesn’t exactly paint a bright picture for the economy heading into the new year. Most bank CEOs are expecting a recession in the coming quarters.

New market leaders have emerged this year. Sector rotation has been on full display, with institutions foregoing growth and technology names and shifting to more defensive positions. While energy has been the hottest sector year-to-date, many energy companies have come under attack in recent weeks as oil prices have come down and signs of a peak in inflation continue to emerge.

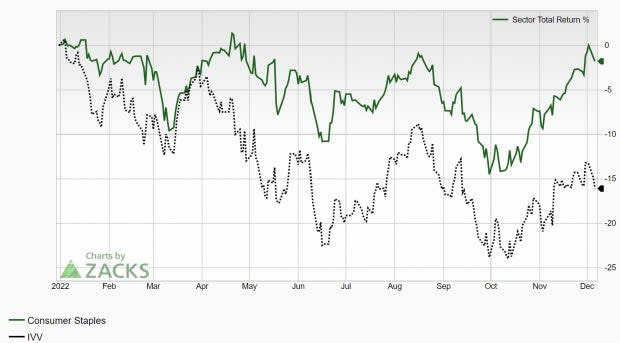

Not surprisingly, one sector that has remained steadfast in its performance through all the volatility is consumer staples. The Zacks Consumer Staples sector is showing resilience this year as the general market continues its correction. Many individual companies within this sector have broken out to new highs this year, serving as another sign of strength. Take a look at the relative performance of the Zacks Consumer Staples sector in 2022:

Image Source: Zacks Investment Research

The sector is down less than 2% on the year, while the S&P 500 is still off more than 17%. As investors, we want to target sectors, industry groups and individual stocks that are outperforming the market. It is crucial that we maintain maximum flexibility and adjust our approach to what the market is doing. Rather than initiate a knee-jerk reaction, it’s important to keep an open mind about the future. Preparing for a variety of outcomes can help us deal with that uncertain future.

The stock we will analyze below is part of this leading sector. This long-term stock market winner is part of the Zacks Food – Miscellaneous industry, which currently ranks in the top 25% out of approximately 250 industry groups. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform over the next 3 to 6 months. By focusing on stocks within leading industries, we can dramatically improve our investing success.

General Mills, Inc. (GIS)

General Mills is a global manufacturer and marketer of branded consumer foods. The company sells products such as ready-to-eat cereals, yogurts, soups, dessert and baking mixes, frozen pizza, snack bars, as wells various organic items and pet food through retail stores. GIS also supplies its products to the foodservice and commercial baking industries. Some of the company’s most recognized brands include Annie’s, Betty Crocker, Bisquick, Cheerios, Fruit by the Foot, Pillsbury, Total, Wheaties, and Yoplait. General Mills was founded in 1866 and is based in Minneapolis, MN.

GIS has exceeded earnings estimates in three of the past four quarters. The consumer foods provider has delivered a trailing four-quarter average earnings surprise of 6.1%, helping the stock advance over 32% this year. As we can see below, GIS has trended well and is making a series of 52-week highs – a bullish sign.

Image Source: Zacks Investment Research

Analysts have raised their full-year earnings estimates for GIS by 0.25% in the past 60 days. The Zacks Consensus Estimate for fiscal 2023 EPS now stands at $4.09 per share, which translates to growth of 3.81% relative to last year. Sales are expected to climb 2.77% to $19.52 billion.

What the Zacks Model Reveals

The Zacks Earnings ESP (Expected Surprise Prediction) seeks to identify companies that have recently witnessed positive earnings estimate revision activity. The technique has proven to be quite useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better with a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year backtest.

A Zacks Rank #2 (Buy), GIS boasts a +0.24% Earnings ESP for the fiscal second quarter. Another earnings beat may be in the cards for GIS when the company reports these results in just a few weeks on December 20th.

Make sure to consider this steady consumer staple as a candidate for your portfolio if you haven’t already done so.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report