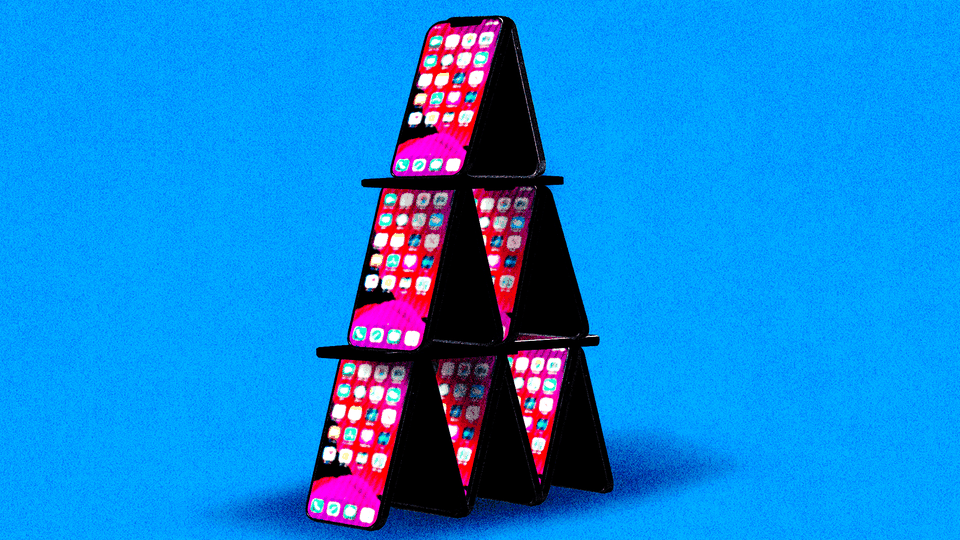

How Did Tech Become America’s Most Troubled Industry?

The U.S. economy’s most dynamic sector is suddenly hemorrhaging jobs.

Twelve thousand layoffs at Google. Eleven thousand at Facebook; 10,000 at Microsoft; 18,000 at Amazon; 8,000 at Salesforce; 4,000 at Cisco; 3,000-plus at Twitter.

The American economy has recovered from the sharp downturn caused by the arrival of the coronavirus and is chugging along just fine, at least for the moment. Yet the tech sector—the country’s most dynamic industry—has fallen into a kind of recession characterized by mass layoffs, pervasive hiring freezes, a bear market for tech stocks (their recent rebound notwithstanding), a collapse in initial public offerings, and a sharp drop in venture-capital funding.

For decades, the industry’s potential seemed boundless. So why has tech suffered so much more than its corporate peers have lately? That question has two answers: Federal Reserve Chair Jerome Powell’s effort to stamp out inflation, and the waning of a pandemic emergency during which many tech companies thrived.

The foremost issue for tech companies is interest rates, which Powell has been hiking sharply for the past year. Short-term borrowing costs were close to scratch for much of the 2010s and fell to scratch again when the pandemic hit, but they began rising precipitously in 2022 as the Federal Reserve has attempted to reduce inflation by slowing down parts of the economy. Pretty much all American businesses across all business sectors are reliant on borrowed cash in one way or another (as are most American consumers). But many tech companies were especially conditioned to very low interest rates: Uber, an enormous and long-established business, for instance, loses money on many rides, and thousands and thousands of start-ups accrue huge losses and rely on their financiers to foot their bills while they grow.

The interest-rate hike has hit the tech sector hard in another way: by helping crater crypto prices, thus erasing billions of dollars of paper wealth, disciplining any number of venture capitalists, and crashing any number of technology businesses, most spectacularly the Ponzi-like FTX. Indeed, the crypto winter has both directly hurt many technology companies that went all in on bitcoin or ether and indirectly made the financing climate harder for others. There aren’t a lot of bitcoin decamillionaires around to invest this year, and many VCs are deep in the red.

The second major factor is a reversion to the mean after the intense early years of the pandemic. That awful period was in some ways a good one for tech firms. People stopped going to theaters and started watching more movies and shows at home—hurting AMC and aiding Netflix and Hulu. Families stopped shopping as much in person and began buying more things online—depressing town centers and boosting Amazon and Uber Eats, and spurring many businesses to pour money into digital advertising. Companies quit hosting corporate retreats and started facilitating meetings online—depriving hotel chains of money and bolstering Zoom and Microsoft. Schools sent students home—hurting firms that provide services to school districts and leading to a surge in spending on computers, tablets, and virtual-classroom software.

Flush with new revenue and bolstered by low borrowing costs, tech companies expanded. They added thousands and thousands of new workers: Microsoft, for instance, went from a head count of 163,000 to 221,000, and Meta, Facebook’s parent company, from 45,000 to 72,000. Many firms also expanded their business operations; Meta, for instance, poured billions and billions of dollars into developing a virtual-reality social space (that, I would add, nobody likes and nobody is using).

Consumer spending has since normalized. Sales of smartphones, laptops, kitchen gadgets, and gym equipment have dropped, and Americans are spending a lot more cash in restaurants and movie theaters and on hotels and flights. As a result, many tech companies have seen revenues in parts of their businesses decline, and corporate officers are admitting that they expanded too quickly. “Our productivity as a whole is not where it needs to be for the head count we have,” Sundar Pichai, the head of Google’s parent company, told employees last year.

The net result is that tech companies whose prospects once seemed limitless now look a bit more like other old, lumbering corporate giants. There’s some good news for tech firms, though. Many are still wildly profitable. The Fed is likely to stop hiking interest rates soon. Artificial intelligence has started making amazing breakthroughs—ones that regular consumers can finally understand, see, and use. Maybe a tech summer is just around the corner.