Top 2nd-Quarter Trades of Lee Ainslie's Maverick Capital

- By Margaret Moran

Lee Ainslie (Trades, Portfolio), the founder and CEO of Maverick Capital, recently disclosed the firm's portfolio changes for the second quarter of 2020, which ended on June 20.

One of the "Tiger Cubs" mentored by legendary investor Julian Robertson (Trades, Portfolio) of Tiger Management, Ainslie founded Maverick Capital in 1993. The Dallas-based firm employs six industry heads for researching investment opportunities, each one an expert in their respective industry: consumer, health care, cyclical, retail, financial and telecommunications, media and technology. After consulting these experts, Ainslie makes the final call on any changes to the portfolio.

Maverick Capital's top buys for the second quarter were Facebook Inc. (NASDAQ:FB) and Dollar Tree Inc. (NASDAQ:DLTR), while its top sells were Fleetcor Technologies Inc. (NYSE:FLT) and Restaurant Brands International Inc. (NYSE:QSR).

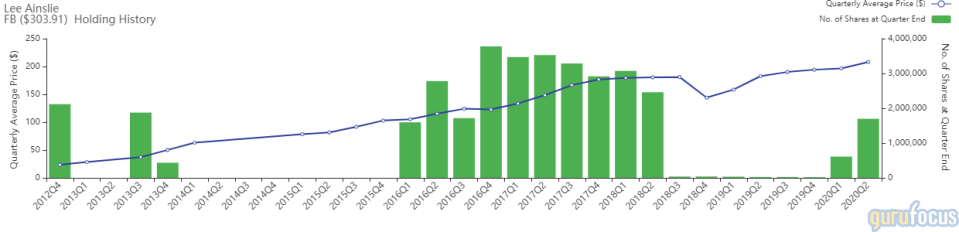

Maverick Capital upped its stake in Facebook by 1,085,179 shares, or 177.4%, for a total holding of 1,696,896 shares. The trade had a 5.18% impact on the equity portfolio. During the quarter, shares traded for an average price of $208.03.

Facebook is a social media giant based in Menlo Park, California. It was founded by Mark Zuckerberg and several fellow Harvard students. Since its launch in 2004, it has become an icon of the social media industry and expanded into news, advertising, business, data collection and other avenues.

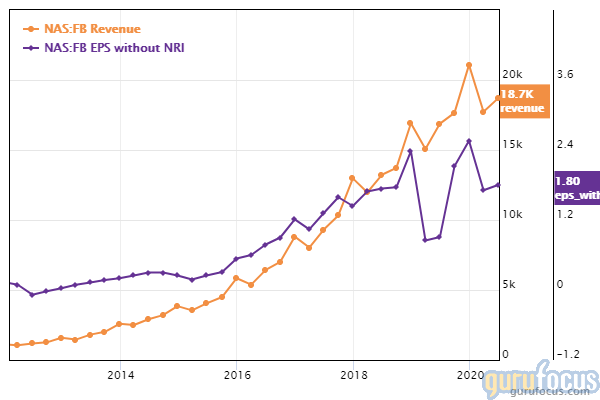

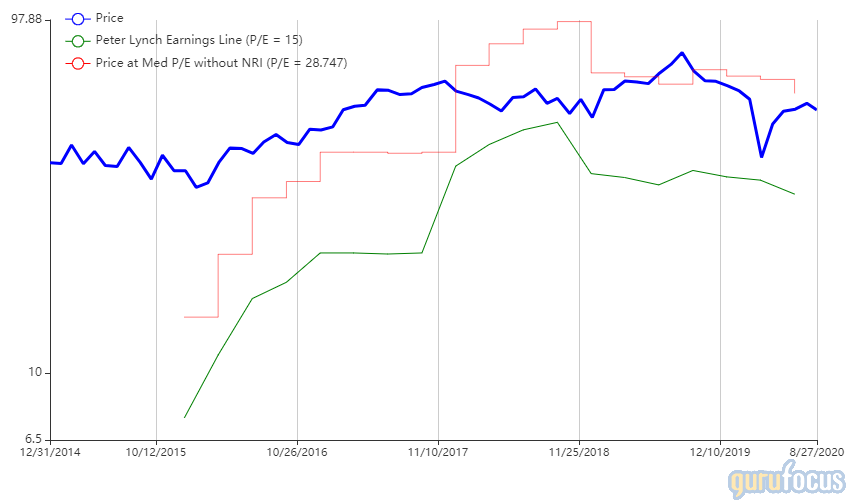

On Aug. 27, shares of Facebook traded around $295.43 for a market cap of $841.91 billion and a price-earnings ratio of 36.25. According to the Peter Lynch chart, the stock trades above its intrinsic value but below its median historical valuation.

GuruFocus gives the company a financial strength rating of 8 out of 10 and a profitability rating of 9 out of 10. The interest coverage ratio of 1,394.95 and Altman z-Score of 20.09 show that the company has high financial stability. The three-year revenue growth rate of 37.5% and three-year earnings per share without non-recurring items growth rate of 22.6% point to exceptional growth.

Dollar Tree

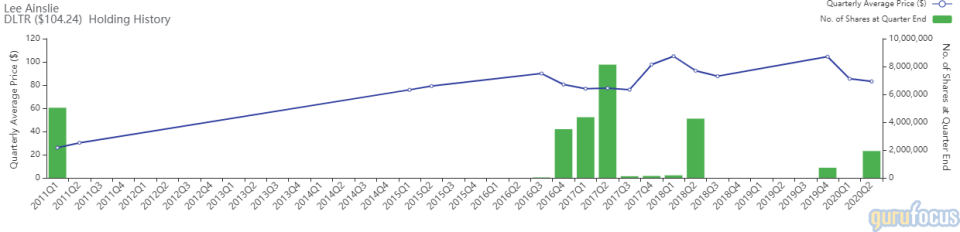

The firm also added 1,923,308 shares to its Dollar Tree investment, increasing the number of shares owned by 56401.99% for a total of 1,926,718 shares and impacting the equity portfolio by 3.75%. Shares traded for an average price of $83.15 during the quarter.

Dollar Tree is an American chain of discount variety stores based in Chesapeake, Virginia. It operates through the Dollar Tree, Family Dollar and Dollar Tree Canada brands, which altogether have more than 15,000 locations throughout 48 U.S. states and five Canadian provinces.

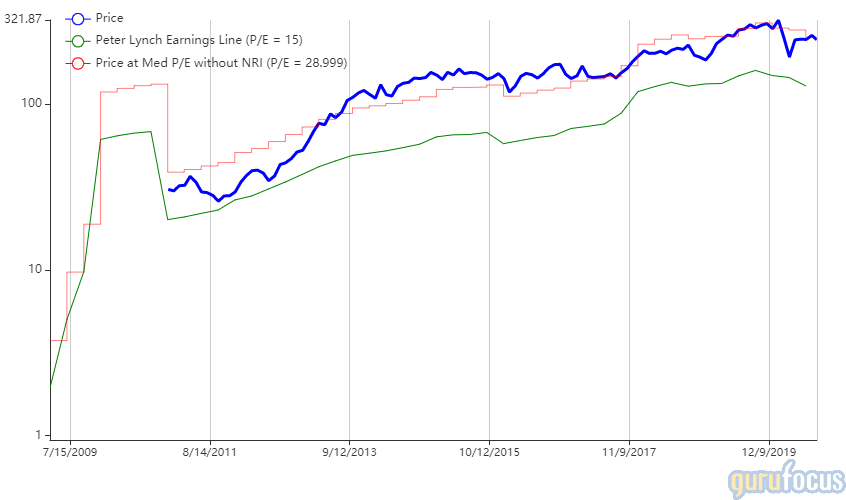

On Aug. 27, shares of Dollar Tree traded around $97.43 for a market cap of $23.21 billion and a price-earnings ratio of 30.66. According to the Peter Lynch chart, the stock may be overvalued based on recent earnings.

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 0.17 is lower than 69.34% of competitors, but the Altman Z-Score of 2.48 indicates that the company is not likely in danger of bankruptcy. The return on invested capital continues to exceed the weighted average cost of capital, meaning the company is creating value for shareholders.

Fleetcor Technologies

The firm cut its holding in Fleetcor Technologies by 1,017,928 shares, or 82.08%, for a remaining position of 222,217 shares. The trade impacted the equity portfolio by -4.01%. During the quarter, shares traded for an average price of $236.36.

Based in Atlanta, Fleetcor is a provider of fuel cards, radio-frequency identification (RFID) and other workforce payment products and services. The company specializes in securing and simplifying payment for fuel, general payables, toll and lodging expenses, with operations in over 80 countries.

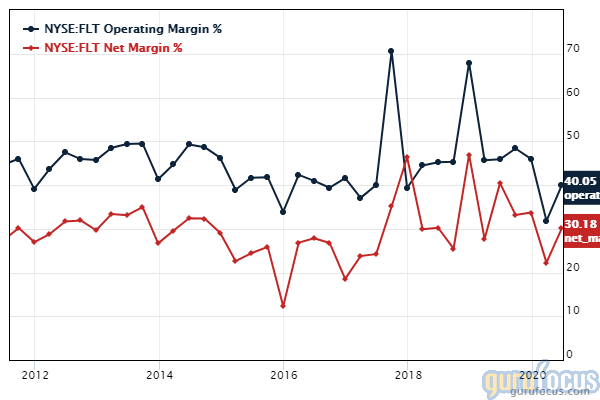

On Aug. 27, shares of Fleetcor traded around $246.58 for a market cap of $20.74 billion and a price-earnings ratio of 28.5. According to the Peter Lynch chart, the stock trades above its intrinsic value but in line with its median historical valuation.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 9 out of 10. The cash-debt ratio of 0.17 is lower than 88.33% of other companies in the software industry, but the Altman Z-Score of 2.84 indicates financial stability. The operating margin of 40.05% and net margin of 30.18% show high earnings compared to total revenue.

Restaurant Brands International

The firm sold all 4,612,010 of its shares of Restaurant Brands International, impacting the equity portfolio by -3.90%. Shares traded for an average price of $50.21 during the quarter.

Restaurant Brands International is a fast-food holding company that owns the Popeye's, Tim Hortons and Burger King brands. Based in Toronto, Canada, the company's 27,000 restaurants are located mainly in the U.S. and Canada, with a presence in more than 100 countries.

On Aug. 27, shares of Restaurant Brands traded around $54.74 for a market cap of $16.53 billion and a price-earnings ratio of 25.34. According to the Peter Lynch chart, the stock trades above its intrinsic value but near its median historical valuation.

GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 7 out of 10. The Altman Z-Score of 1.11 indicates the company may face liquidity issues in the next two years, though the current ratio of 1.73 shows that it can meet its short-term debt obligations. The company has a three-year revenue growth rate of 10.2% and a three-year EPS without NRI growth rate of 17.3%.

Portfolio overview

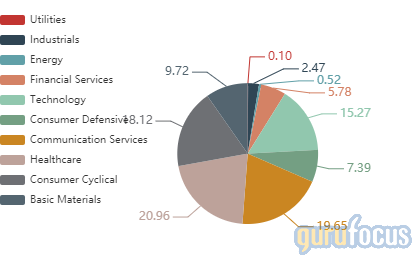

During the second quarter, Ainslie's firm established 265 new positions, sold out of 168 stocks and added to or reduced several other positions for a turnover ratio of 28%. As of the quarter's end, the firm held 563 common stock positions valued at a total of $4.76 billion.

The top holdings were Facebook with an 8.10% portfolio weight, Humana Inc. (NYSE:HUM) with 6.33% and Microsoft Corp. (NASDAQ:MSFT) with 6.22%. In terms of sector weighting, the firm was most invested in health care, communication services and consumer cyclical.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Julian Robertson's Top 2nd-Quarter Trades

Top 2nd-Quarter Buys of Steven Cohen's Firm

The Dow Gets a Facelift: Salesforce, Amgen and Honeywell to Join the Index

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.